Illustrative Image

Founded in 1975 as the An Giang Agricultural Supplies Company, Antesco has evolved into a leading agricultural processing enterprise in the Mekong Delta. It holds the distinction of being Vietnam’s first company to export frozen agricultural products globally.

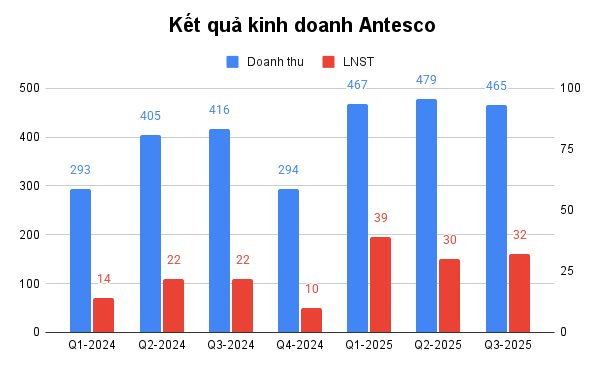

In Q3 2025, Antesco reported net revenue of VND 465 billion, an 11.7% increase year-over-year. Despite a 4.7% rise in cost of goods sold, gross profit surged by 37.7% to VND 121 billion. Gross margin improved from 21.1% to 26%.

Antesco’s Quarterly Business Results

During the quarter, financial expenses rose 12% to VND 18.2 billion, selling expenses increased 51% to VND 54.3 billion, and administrative expenses grew 18% to VND 20.2 billion. Consolidated net profit for Q3 reached VND 32.4 billion, up 48.5% year-over-year.

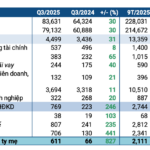

For the first nine months of 2025, Antesco recorded net revenue of VND 1,451 billion and net profit of VND 100.2 billion, marking 30.3% and 64% increases, respectively, compared to the same period in 2024.

In 2025, Antesco set a revenue target of VND 1,550 billion and a net profit goal of VND 85 billion. By the end of Q3, the company had achieved 94% of its revenue target and surpassed its profit goal by 118%. These nine-month results also exceeded the full-year 2024 performance (VND 1,405 billion in revenue and VND 74 billion in profit).

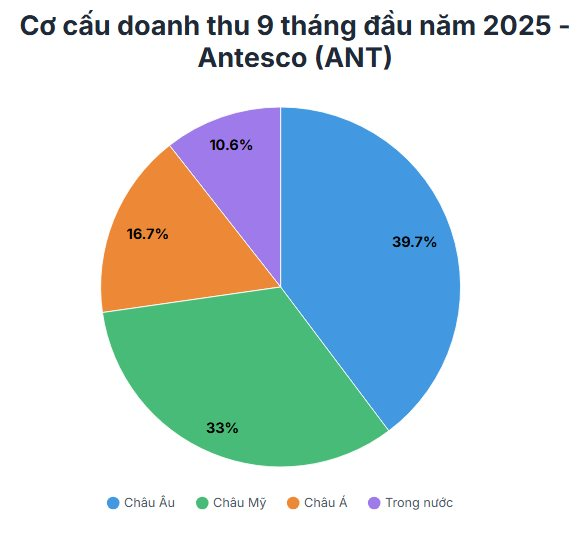

Antesco’s Revenue Breakdown by Market

Europe was the largest revenue contributor in the first nine months, generating VND 576.5 billion. This was followed by the Americas (VND 478.7 billion), Asia (VND 242 billion), and the domestic market (VND 153.6 billion).

As of September 30, 2025, Antesco’s total assets reached VND 1,405 billion, a 15% increase year-to-date. Cash and cash equivalents surged 352% to VND 259 billion, while short-term financial investments (term deposits) rose 82.5% to VND 262 billion. Combined cash and deposits totaled VND 521 billion, accounting for 37% of total assets.

Conversely, inventory decreased 30.5% to VND 224.5 billion, and short-term receivables dropped 29.5% to VND 150 billion. Total liabilities stood at VND 1,001 billion, up 8.6% year-to-date. Financial debt (short and long-term) totaled VND 863.8 billion, representing 61.5% of total capital.

Private Placement Completion and HOSE Listing Preparations

Antesco’s Factory. Photo: Antesco

Alongside its robust financial performance, Antesco is advancing its plans to list on the Ho Chi Minh City Stock Exchange (HOSE), advised by MB Securities (MBS).

Recently, the company privately placed 3.5 million shares to strategic investor Ylang Holdings at VND 12,900 per share, raising approximately VND 45 billion to repay VietinBank debt. Post-transaction, Ylang Holdings holds 8.1 million shares, or 33.8% of the new charter capital.

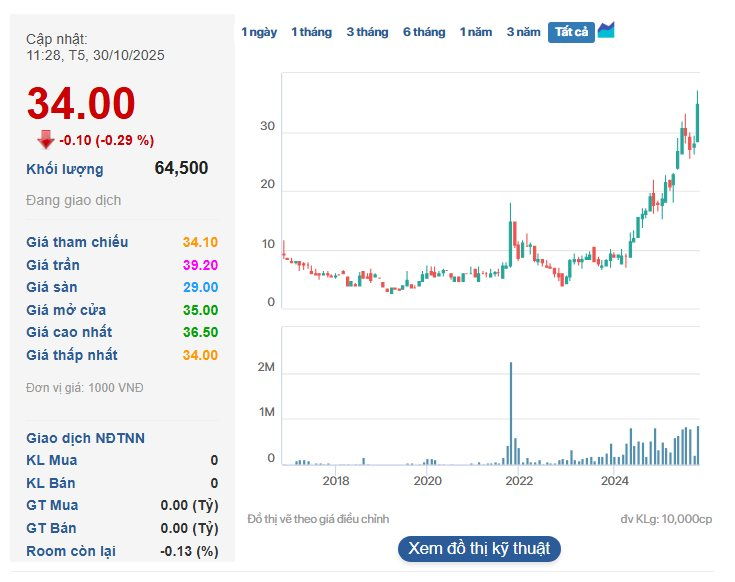

On October 30, 2025, ANT shares traded between VND 34,000 and VND 36,500, near historic highs. Compared to a year ago, the stock price has nearly doubled and increased eightfold since late 2022.

Oil Prices Stabilize, Petrolimex Profits Surge Ninefold Year-on-Year

Petrolimex (HOSE: PLX), Vietnam’s leading petroleum conglomerate, has released its Q3/2025 consolidated financial report, showcasing a robust recovery compared to the same period last year. This significant turnaround is primarily attributed to the more stable global oil price trends observed during Q3/2025.

Vietjet Reports Robust Q3 2025 Growth – Declares 20% Stock Dividend

Vietjet Aviation Joint Stock Company (HoSE: VJC) has announced its Q3/2025 business results, showcasing robust growth and achieving 97% of its annual plan. This performance underscores the airline’s strong recovery and development momentum in the post-pandemic era.

Real Estate Businesses Reap Massive Profits

In just nine months this year, TTC Land has surpassed 25% of its pre-tax profit target for 2025. Meanwhile, Thuduc House achieved a net profit of over 103 billion VND, exceeding its annual plan by 56%. Other real estate leaders such as Dat Xanh, Nha Khang Dien, Nam Long, CEO, and Phat Dat are also on the brink of meeting their sales targets.

Vietnam Airlines Reports Record Profits: Over 600 Billion VND in Q3 Net Income

As of the end of Q3, Vietnam Airlines held a total of nearly VND 18.2 trillion in cash, cash equivalents, and term deposits, accounting for approximately 25% of its total assets.