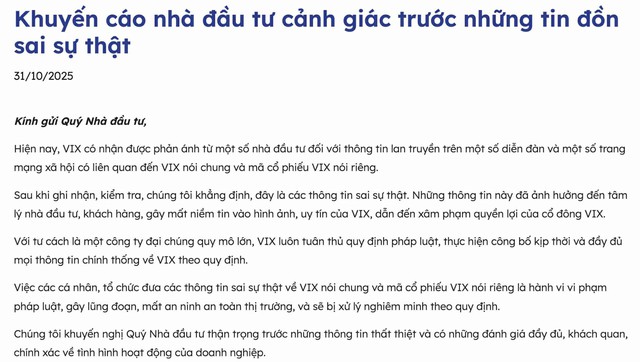

According to the company’s representative, these claims are entirely false and have “negatively impacted investor and customer sentiment, undermining trust in VIX’s reputation and shareholder interests.”

VIX asserts that, as a large-scale public company, it “strictly adheres to legal regulations, ensuring timely and comprehensive disclosure of all official information as required by law.”

The representative emphasized that individuals or entities spreading misinformation about the company or its VIX stock code are engaging in “illegal activities that disrupt market security and integrity, and will face severe penalties under current regulations.”

The company advises investors to exercise caution regarding rumors and to “objectively assess the company’s operational performance.” Official updates are available on VIX’s corporate website.

In its statement, VIX also highlighted its growth trajectory, reaffirming its commitment to “optimizing resources, strategic planning, vision, and governance to maximize shareholder value.”

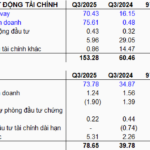

In Q3 2025, VIX reported total operating revenue of VND 3,222 billion, a 482% increase year-over-year. Pre-tax profit reached VND 3,048 billion, over 9 times higher than the VND 325 billion recorded in Q3 2024.

This marks the highest quarterly profit since VIX’s inception. The primary growth driver was proprietary trading activities, with fair value gains through profit/loss (FVTPL) totaling VND 2,751 billion, accounting for 85% of total revenue.

Insider sources attribute these results to profit realization from stocks such as VSC, BSR, HAH, and PC1 within the company’s portfolio.

For the first nine months of 2025, VIX recorded a pre-tax profit of VND 5,116 billion, positioning itself among the top performers in the securities industry.

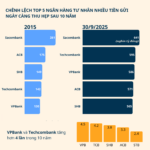

Unprecedented Surge in Extraordinary Shareholder Meetings Convened by Leading Securities Firms

MBS and Vina Securities have jointly finalized the list of shareholders eligible to attend the Extraordinary General Meeting of Shareholders in 2025, scheduled for November 19th.

VIB Surpasses VND 7.04 Trillion in Pre-Tax Profit After 9 Months, Up 7% Year-on-Year, Completes 21% Dividend Payout for 2025

International Bank (VIB) has announced its business results for the first nine months of 2025, reporting pre-tax profits exceeding 7.04 trillion VND, a 7% increase compared to the same period in 2024. Credit growth and mobilization rose by 15% and 11%, respectively. Asset quality continues to improve, with safety management maintained at optimal levels.

After Selling Can Gio Land to GELEX for Over 600 Billion VND, Vietnam’s Largest Auto Distributor’s Stock Surges 80% Following Nine Consecutive Circuit-Breaker Sessions

Since early October, SVC stock has surged over 80%, reaching its highest level in nearly three years following a remarkable nine consecutive sessions of hitting the upper limit.