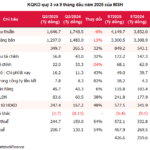

| Gilimex’s Quarterly Business Results for 2022-2025 |

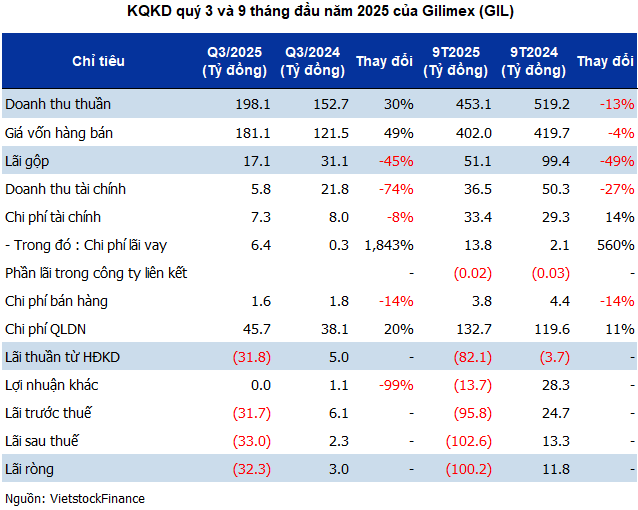

Following a staggering 71 billion VND loss in Q2, Gilimex reported a net loss of over 32 billion VND in Q3/2025. Despite the narrowed loss, this result marks a reversal from the modest 3 billion VND profit in the same period in 2024, pushing the total nine-month loss beyond 100 billion VND—the deepest since its inception.

However, the substantial loss has not significantly eroded retained earnings, with undistributed after-tax profits nearing 722 billion VND by the end of Q3 and equity capital exceeding 2.4 trillion VND. Nevertheless, the 150 billion VND profit target for this year appears unattainable.

|

Q3 revenue rose 30% year-over-year to over 198 billion VND, but nearly double cost of goods sold slashed gross profit margin by nearly 12 percentage points to 8.6%. For the first nine months, revenue totaled just over 453 billion VND, the lowest in 15 years and down 13% year-over-year.

Additionally, soaring expenses eroded profits, including 133 billion VND in management costs for the nine months, up 11% year-over-year. Financial expenses also climbed 14% to over 33 billion VND, with interest payments accounting for 41%—nearly seven times higher than the previous year.

Gilimex attributed this to its industrial park real estate segment, where accelerated infrastructure development to meet secondary investor deadlines led to a sharp rise in operating costs, significantly reducing consolidated profits.

On the HOSE exchange, GIL shares fell over 2% to 15,500 VND/share on November 3rd following the Q3 loss announcement. Over the past three months, the stock has lost 20% of its value and plummeted 73% from its April 2022 peak of over 57,000 VND/share.

| GIL Stock Price Trends Over the Past Year |

Deepening Negative Cash Flow from Operations

As of September, Gilimex held over 813 billion VND in bank deposits, up 10% year-to-date. Inventory rose 14% to over 1.881 trillion VND, primarily in three areas: Phu Bai Industrial Park (606 billion VND, 32%), finished goods (623 billion VND, 33%), and raw materials (333 billion VND, 18%). Nghia Hung Industrial Park project costs accounted for 8%.

Total debt surpassed 925 billion VND, 2.7 times higher than the start of the year, with over 33% in short-term loans. Surging inventory and receivables pushed net cash flow from operations to a negative 481 billion VND, far exceeding the 88 billion VND deficit earlier in the year.

Prolonged Fallout from Amazon Dispute

Gilimex’s decline began with its late 2022 dispute with Amazon. Quarterly revenue plummeted to 100-300 billion VND, far below the previous thousand-billion thresholds. Net profits remained low, with multiple quarters reporting losses.

At the September 2025 Extraordinary Shareholders’ Meeting, the company approved measures to protect its legal rights in the Amazon lawsuit. Shareholders questioned management about Amazon’s abrupt contract termination. Gilimex insisted it was a strategic shift by the partner, not due to personal conflicts.

The prolonged dispute with Amazon also impacted Garmex Saigon (GMC), Gilimex’s manufacturing partner. By Q3, Gilimex maintained a 64 billion VND securities portfolio at cost but faced an 80% unrealized loss, primarily from its 61 billion VND investment in Garmex, now down 84%. The company provisioned 51.4 billion VND for this loss.

– 15:28 03/11/2025

Phú Tài Records Highest Profit in 3 Years, Driven by Strong Growth in Wood and Stone Exports

Phú Tài Corporation (HOSE: PTB) reported a remarkable Q3 profit of VND 136 billion, the highest in three years. This exceptional performance is attributed to the rapid growth of its wood and stone export segments, coupled with an improved gross margin of 21.5% and financial revenue more than doubling year-over-year.

Trung An Breaks Five-Quarter Loss Streak, Yet Borrowing Costs Remain a Tight Squeeze

With a nearly 50% reduction in financial costs, Trung An High-Tech Agriculture Joint Stock Company (UPCoM: TAR) reported a positive turnaround in Q3 net profit after a prolonged period of losses. However, its outstanding debt of over VND 1,200 billion remains a significant constraint on the profitability of this leading rice exporter in the Western region.

Viet Tien Garment Reaches 7-Year Profit Peak Fueled by Financial Segment and Accelerating Affiliate Gains

Vietnam Garment Manufacturing Corporation (UPCoM: VGG) reported its highest quarterly profit since 2019 in Q3, driven by a 310% surge in financial revenue and a 50% increase in associate profits year-over-year. This stellar performance propelled the company’s nine-month results 18% above its annual target.