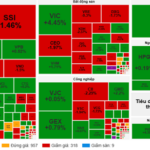

Last week, the VN-Index dropped by 43.53 points to close at 1,639.65. Trading liquidity continued to decline sharply, with the total market trading value reaching VND 137,596 billion, a nearly 27% decrease compared to the previous week. Similarly, the HNX-Index ended the week at 265.85 points, down 1.43 points from the prior week. Liquidity on the HNX reached VND 10,231 billion, a nearly 35% drop from the previous week.

On the HoSE, foreign investors net-sold for five consecutive sessions, with nearly 158 million units sold, totaling over VND 2,727 billion. On the HNX, foreign investors also net-sold for five sessions, with 13.33 million units sold, totaling over VND 363 billion.

On the Upcom market, foreign investors net-sold 0.74 million units but recorded a net purchase value of VND 18.4 billion. Overall, during the trading week from October 27 to 31, foreign investors net-sold over 172 million units across the market, with a total net selling value of more than VND 3,072 billion.

Billion-Dollar Capital Raise

Saigon-Hanoi Commercial Joint Stock Bank (stock code: SHB) has announced a plan to increase its charter capital by issuing 750 million shares. Of these, SHB plans to sell 200 million shares to professional investors. The proceeds from this issuance will be allocated for lending to supplement working capital, investing in fixed assets, and expanding business lending for project implementation.

SHB will increase its charter capital by issuing 750 million shares.

SHB will also issue over 459 million shares to existing shareholders at a ratio of 100:10, meaning shareholders holding 100 shares can purchase an additional 10 new shares. The offering price is VND 12,500 per share.

The total expected proceeds from this issuance are VND 5,742 billion. SHB will allocate VND 3,742 billion for business lending and project implementation, VND 1,500 billion to supplement working capital and fixed assets, and VND 500 billion for personal consumption loans and home purchases.

In addition to the two share offerings, SHB will issue nearly 91 million ESOP shares to employees at VND 10,000 per share. These ESOP shares will be restricted from transfer for 18 months. The expected proceeds of VND 906 billion will be used for credit activities to meet the capital needs of the economy.

Upon completion of the issuance, SHB’s charter capital will increase by VND 7,500 billion, reaching VND 53,442 billion. The implementation is expected to take place in Q4 2025 and 2026.

The Board of Directors of Saigon Commercial Bank (Saigonbank – stock code: SGB) has approved a plan to increase charter capital by issuing shares from retained earnings instead of using shareholders’ equity.

Accordingly, Saigonbank will issue over 22 million shares to existing shareholders at a 6.5% ratio, meaning shareholders holding 100 shares will receive 65 new shares. The issuance capital will be sourced from 2024 post-tax profits and retained earnings from previous years. Upon completion, Saigonbank’s charter capital will increase from VND 3,388 billion to VND 3,608 billion.

Saigonbank will issue over 22 million shares to existing shareholders at a 6.5% ratio.

Recently, several banks have increased capital through share issuances. For example, OCB Bank will issue over 197 million shares to raise its capital to over VND 26,630 billion. Nam A Bank will issue over 343 million shares to existing shareholders, and Vietbank will complete two issuances of 378 million shares, increasing its charter capital to nearly VND 10,920 billion. NCB will complete a private placement of 750 million shares, raising its charter capital to VND 19,280 billion—one year ahead of its restructuring schedule.

Major Shareholder Sells Vinasun Shares

Kim Ngưu Consulting LLC, a major shareholder of Vietnam Sunrise Joint Stock Company (Vinasun – stock code: VNS), has registered to sell 1 million VNS shares to restructure its investment portfolio. The transaction will take place from October 31 to November 28 via agreement or order matching.

If successful, Kim Ngưu Consulting will reduce its VNS holdings to over 7.6 million shares, equivalent to an 11.2% stake in Vinasun. Notably, Mr. Đặng Tiến Sỹ, a member of Vinasun’s Board of Directors, is the authorized representative of Kim Ngưu Consulting’s share capital.

Moc Chau Milk will allocate VND 110 billion for this dividend payment to shareholders.

Moc Chau Dairy Cattle Joint Stock Company (Moc Chau Milk – stock code: MCM) has announced that it will finalize the shareholder list on November 17, 2025, for the first dividend payment of the year. Moc Chau Milk will pay a cash dividend at a 10% rate, meaning shareholders holding 1 share will receive VND 1,000. The payment will be made on December 18.

With 110 million outstanding shares, Moc Chau Milk will allocate VND 110 billion for this dividend payment. Vietnam Livestock Corporation (Vilico – stock code: VLC), the parent company holding nearly 59.3% of MCM’s capital, will receive over VND 65 billion. Vietnam Dairy Products Joint Stock Company (Vinamilk – stock code: VNM), holding 8.85% of the capital, will receive over VND 9.7 billion in dividends.

At the 2025 Annual General Meeting, Moc Chau Milk approved a 20% dividend payout plan for the year. Therefore, MCM shareholders can expect at least one more dividend payment.

Vietstock Weekly 03-07/11/2025: Rising Risks?

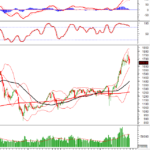

The VN-Index extended its decline for the third consecutive week, accompanied by trading volumes plunging further below the 20-week average. Risks are escalating as the MACD indicator has crossed below the Signal line, triggering a sell signal. Unless buying momentum rebounds swiftly, the index may retreat to test the Middle Band of the Bollinger Bands, aligning with the 1,580–1,600 point range.

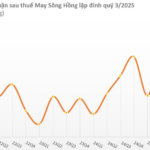

Textile Firm Reports Record-Breaking Q3 Profits, Stock Surges to All-Time High

As of September 30, 2025, cash, cash equivalents, and deposits surged to nearly 2.0 trillion VND, marking a remarkable 29% increase compared to the beginning of the year.