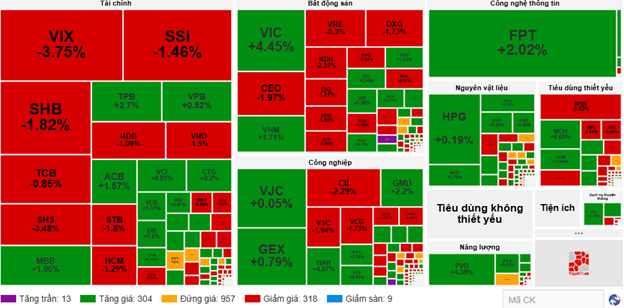

In terms of impact, the top 10 positively influencing codes contributed a total of 14.3 points to the VN-Index, with VIC leading the way at 7.73 points. Additionally, VHM and VCB collectively added 2.73 points to the index. Conversely, TCB and STB were the most negatively influential codes this morning, but they only deducted less than 1 point from the overall index.

Market polarization continued to dominate industry groups. The real estate sector temporarily led the market with a 2.1% increase, driven by strong performances from stocks like VIC (+4.45%), VHM (+1.71%), KBC (+1.29%), IDC (+2.36%), DXS (+2.38%), and RGG and QCG hitting their upper limits. However, several stocks remained in the red, including KDH (-2.37%), PDR (-1.55%), NLG (-2.26%), DXG (-1.73%), TCH (-1.15%), and CEO (-1.97%).

Two major capitalization groups, finance and industry, also saw several stocks attracting positive demand, such as MBB (+1.06%), TPB (+2.7%), ACB (+1.57%), VCB (+1.01%), LPB (+2.76%), GMD (+2.2%), PC1 (+3.36%), HAH (+4.07%), CDC (+5.04%), and VGC (+1.17%). Nevertheless, many stocks were significantly affected by negative adjustments, including VIX (-3.75%), SSI (-1.46%), SHB (-1.82%), SHS (-3.48%), HDB (-1.09%), CII (-2.29%), VSC (-1.94%), VCG (-1.73%), CTD (-1.93%), and HVN (-1.74%).

On the other hand, non-essential consumer goods temporarily lagged the market with a slight 0.22% decrease, as selling pressure concentrated on leading stocks like VPL (-0.52%), MWG (-0.12%), PNJ (-0.63%), and FRT (-0.94%).

Source: VietstockFinance

|

Foreign investors continued to net sell over 180 billion VND across all three exchanges, with selling pressure concentrated on VIX at 82.65 billion VND. Meanwhile, FPT led the net buying list with a value of 126.45 billion VND.

| Top 10 Stocks with Highest Foreign Net Buying and Selling on the Morning of 03/11/2025 |

10:30 AM: Selling Pressure Continues to Rise

Pessimistic sentiment persisted, causing major indices to decline. As of 10:30 AM, the VN-Index fell by more than 13 points, trading around 1,625 points. The HNX-Index dropped nearly 3 points, trading around 262 points.

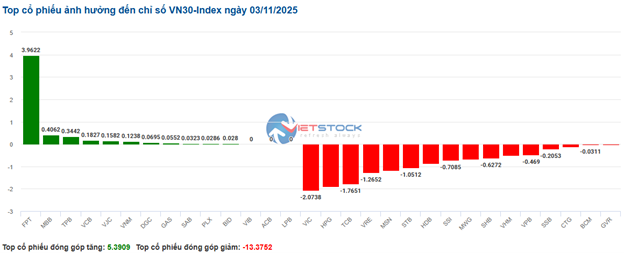

Stocks in the VN30 basket faced strong selling pressure, deducting over 13 points from the overall index. Notable decliners included VIC, HPG, TCB, and VRE, with respective impacts of 2.07 points, 1.88 points, 1.77 points, and 1.27 points. Other significant losers were MSN, STB, and HDB. On the positive side, FPT contributed nearly 4 points to the VN30-Index.

Source: VietstockFinance

|

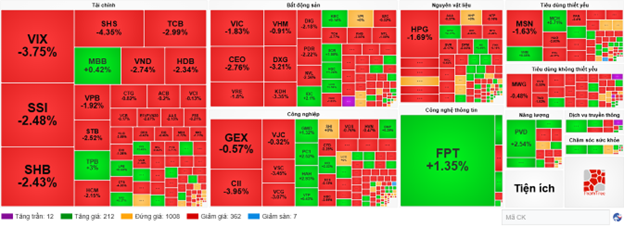

Money continued to flow out of the financial sector, causing most stocks in this industry to decline. Specifically, strong selling pressure was observed in VIX (-4.11%), SSI (-2.48%), and SHB (-2.13%). Additionally, HDB (-2.34%), VND (-2.74%), SHS (-4.78%), and TCB (-2.42%) also experienced declines.

The real estate sector was also heavily polarized, with selling pressure dominating stocks like CEO (-3.54%), VIC (-2.2%), VRE (-3.45%), and VHM (-1.41%). In contrast, only a few stocks like IDC, HQC, and VPI showed modest gains.

The industrial and materials sectors also faced widespread selling pressure, with declines in major capitalization stocks such as GEX (-0.79%), CII (-4.16%), VSC (-3.66%), HPG (-1.5%), GVR (-0.34%), and DPM (-0.83%).

Compared to the opening session, the market remained highly polarized, with over 1,000 referenced stocks and sellers maintaining the upper hand. There were 362 declining stocks and 212 advancing stocks.

Source: VietstockFinance

|

Opening: Market Starts Positively, Energy Sector Continues to Shine

At the opening session on 03/11, as of 9:30 AM, the market gradually became polarized, with buyers gaining a slight advantage. The VN-Index rose by more than 5 points to 1,645 points. The HNX-Index also increased slightly above the reference level, reaching 266 points.

Green dominated the morning session, with several energy stocks performing well from the start, including PVD (+1.85%), PVS (+0.3%), PVB (+1.32%), and PLX (+1.01%).

OPEC+ Agrees to Pause Production Increases in Q1 2026

Major stocks like VIC, VHM, HPG, and LPB led the VN30-Index with a combined increase of over 7.3 points. Conversely, VJC, STB, FPT, and SHB weighed on the market, but their impact was minimal.

Financial stocks were polarized at the start of the session. Some stocks faced early selling pressure, such as VIX (-0.18%), SSI (-1.17%), SHB (-0.91%), and HDB (-0.78%). Others performed well, including TPB (+1.8%), MBB (+0.64%), and PVI (+6.77%).

– 12:00 PM, 03/11/2025

Unveiling the Lender Behind Cuong ‘Do La’s Company’s Billion-Dollar Loan

Quoc Cuong Gia Lai JSC has secured significant financial support through loans from key individuals closely associated with the company. Specifically, the company borrowed 507 billion VND from Ms. Lai Thi Hoang Yen, the daughter of QCG’s Chairman, Mr. Lai The Ha. Additionally, Mr. Lau Duc Duy, the brother-in-law of Mr. Nguyen Quoc Cuong (known as Cuong ‘do la’) and the CEO of QCG, provided a loan exceeding 527 billion VND.

Market Warrant Week 03-07/11/2025: Fiery Rally Mirrors Underlying Market Momentum

As the trading session closed on October 31, 2025, the market witnessed a mixed performance with 24 stocks advancing, 198 declining, and 31 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 1.21 billion worth of shares.

Vietstock Weekly 03-07/11/2025: Rising Risks?

The VN-Index extended its decline for the third consecutive week, accompanied by trading volumes plunging further below the 20-week average. Risks are escalating as the MACD indicator has crossed below the Signal line, triggering a sell signal. Unless buying momentum rebounds swiftly, the index may retreat to test the Middle Band of the Bollinger Bands, aligning with the 1,580–1,600 point range.