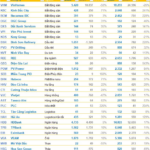

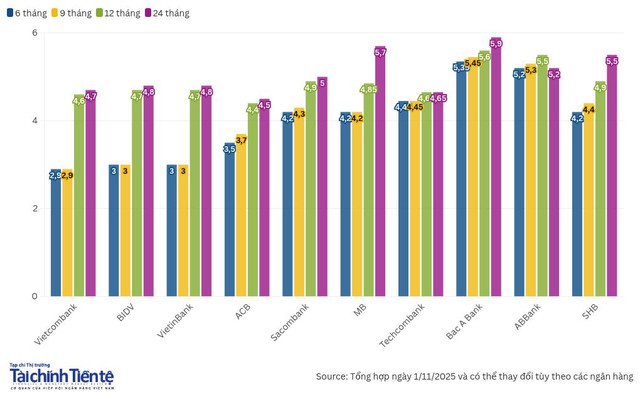

A quick review of deposit interest rates (mobilization rates) listed on bank websites such as Agribank, Vietcombank, BIDV, VietinBank, VPBank, Techcombank, MB, ACB, Sacombank, HDBank, SHB, VIB, SeABank, BacABank, TPBank, NCB, KienlongBank, Saigonbank, Vietbank, and others as of early November 2025 reveals that mobilization rates (for surveyed terms of 6, 9, 12, and 24 months) have been adjusted by some banks, though the overall trend remains stable.

Among state-owned commercial banks, deposit interest rates at the counter in early November 2025 remain unchanged compared to October 2025.

Specifically, Vietcombank’s rates remain consistent across all terms: 2.9%/year for 6 and 9 months, 4.6%/year for 12 months, and 4.7%/year for 24 months or more. The 4.7%/year rate is also the highest mobilization rate applied by Vietcombank for terms of 12 months or longer.

At BIDV, rates remain stable compared to the previous month: 3.0%/year for 6 and 9 months, 4.7%/year for 12 months, and 4.8%/year for 24 months.

VietinBank maintains rates of 3.0%/year for 6 and 9 months, 4.7%/year for 12 months, and 4.8%/year for 24 months.

Among private commercial banks, some have adjusted online deposit rates, while most have kept mobilization rates unchanged.

For instance, SHB increased rates by up to 0.6%/year. Online mobilization rates for 1-2 months rose by 0.6%/year to 4.1%/year; 3 months by 0.35%/year to 4.15%/year; 4-5 months by 0.45%/year to 4.25%/year; and 6 months by 0.3%/year to 5.2%/year.

For terms of 7-11 months, SHB increased rates by 0.3%/year to 5.3%/year; 12 months by 0.1%/year to 5.4%/year; and 13-24 months by 0.1%/year to 5.6%/year.

VIB also increased online mobilization rates across all terms: 0.1%/year for 1-2 months to 3.8%/year and 3.9%/year, respectively; 0.2%/year for 3-5 months to 4%/year. Terms of 6 months or more increased by 0.1%, resulting in 4.8%/year for 6-11 months, 5%/year for 12 months, 5.3%/year for 15-18 months, and 5.4%/year for 24-36 months.

Since early October, nine banks have slightly increased mobilization rates by 0.1-0.2%/year for short terms, including GPBank, NCB, Vikki Bank, Bac A Bank, VCBNeo, HDBank, Sacombank, VIB, and SHB.

To attract large capital from individuals and organizations with strong financial capabilities, some banks offer special rates, but these come with strict conditions on minimum deposit amounts and terms.

For example, ABBank offers 9.65%/year for new or renewed deposits of 1.5 trillion VND or more, with a 13-month term.

PVcomBank offers a special rate of 9%/year for 12-13 months for counter deposits, requiring a minimum balance of 2 trillion VND. HDBank offers 8.1%/year for 13 months and 7.7%/year for 12 months, with a minimum balance of 500 billion VND.

Vikki Bank offers 7.5%/year for terms of 13 months or more, with a minimum deposit of 999 billion VND. Bac A Bank offers up to 6.2%/year for 18-36 months on deposits over 1 billion VND. IVB offers 6.15%/year for 36 months, requiring a minimum deposit of 1.5 trillion VND.

Analysts predict that mobilization rates will slightly increase by the end of the year after remaining stable in Q3. However, the overall trend will remain low, aligning with monetary policy to support economic growth above 8% as set by the government.

KBSV Research experts suggest that private commercial banks may increase rates by 20-30 basis points for 6-12 month terms, while state-owned banks will remain stable, reflecting policy direction. Mobilization rates by year-end will stay low, similar to or lower than during the COVID period.

MSB Research agrees that mobilization rates may slightly increase at some private commercial banks to meet capital demands and manage systemic risks, but will remain low to support growth. Lending rates are expected to stabilize, continuing to support production, business, and priority sectors.

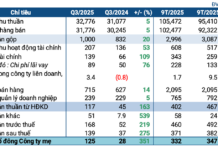

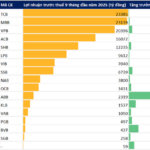

Q3/2025 Financial Reports Deadline: Vinhomes, HDBank, TPBank, Vietjet, BSR, and More Companies Announce Surprising Results by October 30th

Khang Điền (KDH) reported a staggering 783% surge in Q3/2025 net profit, reaching 654 billion VND. Similarly, Becamex IJC and Intresco saw remarkable growth, with net profits soaring by 203% and 308%, respectively.