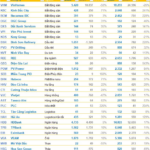

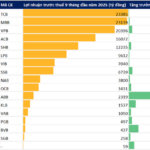

Bank stocks continued their gloomy streak in October. According to data from 27 listed banks, the total market capitalization of the sector as of October 31, 2025, reached over 2.68 million billion VND, a 3.61% decrease compared to the end of September. A total of 17 banks experienced a decline in market capitalization, while 9 banks saw an increase, and 1 bank remained unchanged.

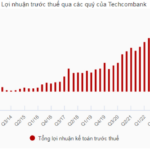

Among the top performers, Vietcombank maintained its leading position despite a 3.9% drop, with a market capitalization of nearly 498 trillion VND. VietinBank, although experiencing a 3.5% decrease, climbed one rank as BIDV suffered a significant 6.5% decline, dropping to third place. The two major private banks, Techcombank and VPBank, both lost over 7%, securing the fourth and fifth positions, respectively.

Another state-owned giant, MB, saw a substantial 10% decline in market capitalization, making it the second-largest loser in October.

Mid-sized banks experienced minor fluctuations, with LPBank rising by 2.4%, ACB remaining stable, and Sacombank and SHB declining by over 2%.

At the lower end, VIB and TPBank decreased by around 7%. SeABank and Eximbank continued to be among the biggest losers, with market capitalization drops of 8.3% and 14.8%, respectively.

A notable highlight in October was the growth of 9 banks, defying the overall trend. HDBank led the way with a 13.5% increase, pushing its market capitalization above 123 trillion VND and solidifying its ninth position. NCB and PG Bank surprised with gains of over 66%, climbing to 18th and 26th ranks, respectively.

Overall, the banking sector’s market capitalization decreased by more than 100 trillion VND in October, reflecting investors’ cautious sentiment following a period of significant adjustments.

Stock Market Week 27-31/10/2025: Clear Polarization

The VN-Index extended its decline in the final session of the week, capping off October with a third consecutive week of adjustments. Amid subdued liquidity, the market is likely to remain volatile, characterized by persistent tug-of-war dynamics and heightened divergence.

Where Does Vingroup Stand Among Southeast Asia’s Largest Conglomerates with a Market Cap of 850 Trillion VND?

Among Southeast Asia’s top 15 largest market capitalization giants, Vietnam boasts only one representative, Vingroup, while Thailand claims three, and both Singapore and Indonesia each contribute five names to the list.