|

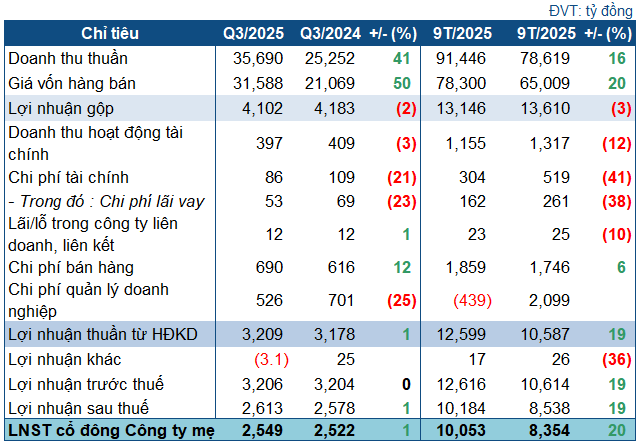

PV GAS’s Q3/2025 Business Targets

Source: VietstockFinance

|

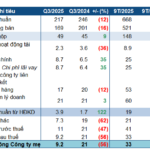

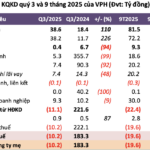

In Q3, PV GAS reported a net revenue of nearly VND 35.7 trillion, a robust 41% increase compared to the same period last year. However, the cost of goods sold surged by 50%, resulting in a slight decline in gross profit to over VND 4.1 trillion.

Despite this, GAS maintained its net profit at over VND 2.5 trillion, thanks to a 21% reduction in financial expenses (down to VND 86 billion) and a 25% decrease in management costs (down to VND 526 billion).

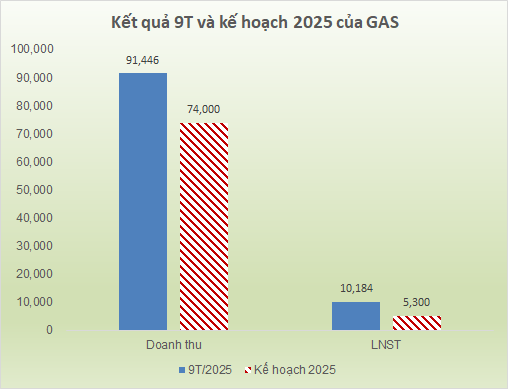

For the first nine months of the year, GAS achieved a revenue of over VND 91.4 trillion, a 16% year-on-year increase, with a net profit of over VND 10 trillion, up 20%. This performance nearly matches the full-year 2024 results (approximately VND 10.4 trillion), surpassing both revenue and post-tax profit targets set by the 2025 Annual General Meeting (exceeding by 24% and 92%, respectively).

Source: VietstockFinance

|

By the end of Q3, GAS’s total assets reached nearly VND 94 trillion, a 15% increase from the beginning of the year, with current assets accounting for VND 70.2 trillion, up 23%. Cash and short-term financial investments (term deposits) stood at over VND 44 trillion, a 34% increase, representing 47% of total assets. These deposits generated nearly VND 947 billion in interest income in the first nine months. However, inventory decreased significantly by 48%, to nearly VND 2.4 trillion.

In terms of long-term assets, construction in progress rose by 37% to nearly VND 2.4 trillion, primarily due to the B-O Mon gas pipeline project.

On the liabilities side, total debt reached nearly VND 27.5 trillion, a 35% increase from the beginning of the year. Short-term debt saw a sharp rise, mainly due to a 72% increase in “Accounts Payable – Short-Term” (up to nearly VND 10.4 trillion) and the emergence of VND 3.9 trillion in dividend payments under “Other Short-Term Payables.” Total loans (short and long-term) amounted to over VND 3.3 trillion, constituting only 3.5% of total capital.

– 09:38 03/11/2025

Vietnam Stock Exchanges Report Record Q3 Revenue, Surpassing Combined Earnings of First Two Quarters

In the first nine months of 2025, the Vietnam Stock Exchange (VNX) reported an after-tax profit of over 2.107 trillion VND. Notably, in Q3 alone, the exchange generated nearly 1.101 trillion VND in profit, surpassing the combined earnings of the first two quarters.

An Binh Securities Appoints New CEO

An Binh Securities has appointed Mr. Nguyen Quang Dat as its Chief Executive Officer for a two-year term, effective November 1, 2025.