Strong Selling Continues in October, Highlighting Major Players

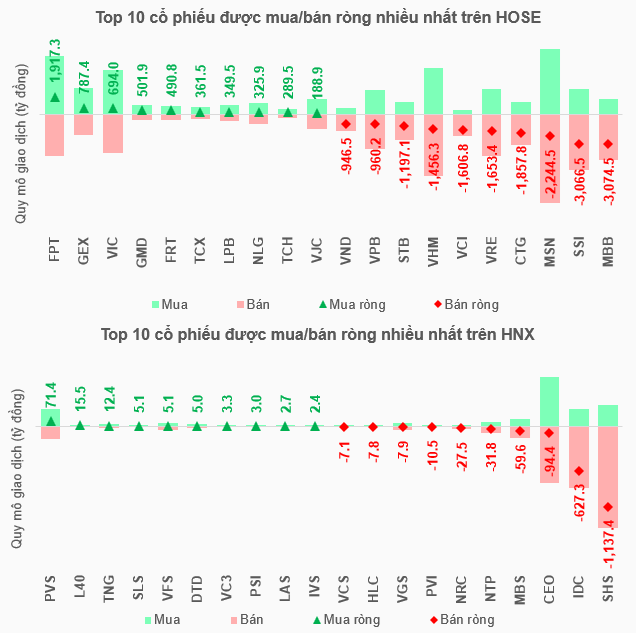

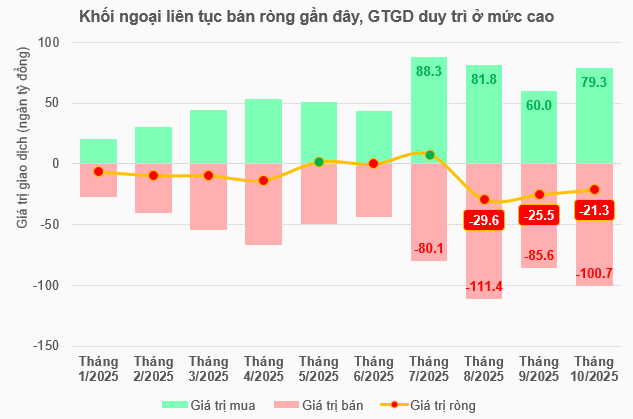

According to VietstockFinance, foreign investors remained highly active on HOSE in October, with purchases totaling over 79 trillion VND and sales nearing 101 trillion VND, resulting in a net sell-off of more than 21 trillion VND.

Throughout the month’s 23 trading sessions, foreign investors executed net selling in 19 sessions, most of which involved transactions worth thousands of billions. The remaining 4 net buying sessions were insufficient to improve the overall outlook.

Eight stocks recorded net selling of thousands of billions, led by MBB and SSI, both exceeding 3 trillion VND. Following closely were MSN, CTG, VRE, VCI, VHM, and STB.

On the buying side, FPT led with over 1.9 trillion VND, becoming the only stock with net buying in the thousands of billions, far ahead of others like GEX, VIC, GMD, and FRT.

On HNX, foreign investors net sold over 1.9 trillion VND, widening the year-to-date deficit to more than 3.3 trillion VND. SHS saw the heaviest net selling at over 1.1 trillion VND, followed by IDC with over 627 billion VND.

The pressure was evident as even a modest net buying value of over 71 billion VND was enough to make PVS the most net-bought stock of the month.

Source: VietstockFinance

|

10 Months Surpass 2024’s Record

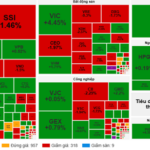

October marked the third consecutive month of net selling by foreign investors on HOSE. In recent months, buying values consistently hovered around 80 trillion VND/month, while selling twice surpassed 100 trillion VND (in August and October). Amid heightened market liquidity, foreign investors significantly increased their trading volume compared to the first half of the year.

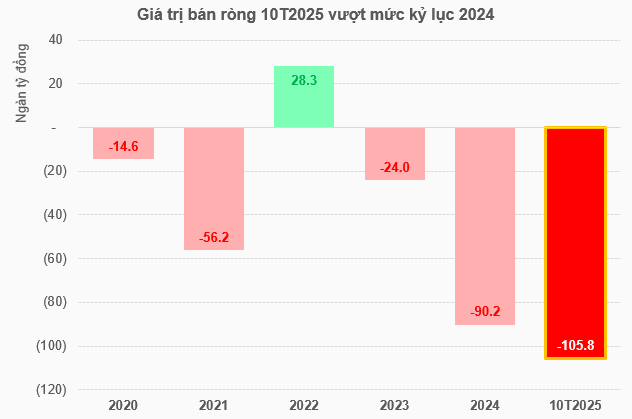

Despite two months remaining in 2025, foreign investors have already net sold over 100 trillion VND, surpassing the 2024 record of 90 trillion VND. This trend has challenged the VN-Index, causing it to trade sideways since mid-August.

Source: VietstockFinance

|

Will the Net Selling Cycle End Soon?

Speaking at the Market Flow program organized by VPBank Securities (VPBankS) on October 30, Mr. Trần Hoàng Sơn, Director of Market Strategy at VPBankS, noted that the outflow of international capital from Vietnam reflects a broader trend across Asia.

As of October 24, capital withdrawal continued in markets like South Korea, Taiwan, Vietnam, the Philippines, and Malaysia. Conversely, Japan maintained active net buying, while Thailand and Indonesia saw a return to net buying.

However, exchange rates are stabilizing, particularly interbank rates. The U.S. Federal Reserve’s (Fed) rate cut is expected to ease selling pressure.

“When the Fed cuts rates, the global environment becomes more favorable. Lower USD rates reduce capital outflows from emerging markets like Vietnam back to the U.S., positively impacting both capital and global asset markets,” Mr. Sơn predicted.

In reality, net selling slowed in the final week of October, with reduced pressure on stocks like SSI, CTG, VCI, and VHM. Conversely, significant net buying was observed in FPT, VPB, HDB, and VRE.

Taking a longer-term view, at the “Market Upgrade – Unlocking Investment Opportunities” seminar on October 31, Mr. Nguyễn Sang Lộc, Portfolio Management Director at Dragon Capital, highlighted factors such as market upgrades and IPO waves that will attract foreign capital.

Foreign investors may halt net selling by 2026, driven by market upgrades, and resume net buying in the following 1-2 years.

However, market upgrades are just the beginning of a long journey. Regulators will continue improving legal frameworks, trading infrastructure, transparency, and liquidity, enabling larger institutions to participate more deeply in Vietnam’s market. Beyond FTSE Russell, Vietnam aims for MSCI, a more ambitious target with higher standards and greater capital attraction potential.

Dragon Capital’s expert also noted that market upgrades will facilitate IPOs of major companies. Approximately 47.5 billion USD in IPO value is expected over the next three years across sectors like consumer goods, financial services, hospitality, entertainment, and IT. This diversification will attract large investment funds, ranging from tens to hundreds of billion USD.

– 12:00 03/11/2025

Market Pulse 03/11: Blue-Chip Stocks Rebound, VN-Index Regains Green Territory

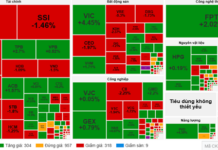

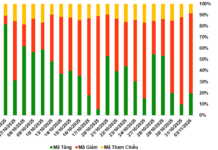

A robust recovery signal emerged during the final moments of the morning session, propelling the VN-Index to swiftly rebound and reclaim positive territory. At the midday break, the VN-Index surged by over 12 points (+0.74%), reaching a strong 1,651.76 points. Meanwhile, the HNX-Index lagged, closing at 264.15 points, down 0.64%. Market breadth remained balanced, with 317 gainers, 327 decliners, and 957 unchanged stocks.

Mysterious Force Unleashes $48 Million Buying Spree on Vietnamese Stocks in Final Session of October 31st

Proprietary trading firms unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase of VND 1.107 trillion.