On November 1st, Sacombank Jewelry Company (SBJ) listed the buying price of silver bars at 1.881 million VND per tael and the selling price at 1.929 million VND per tael, a decrease of 6,000 VND per tael compared to the previous day.

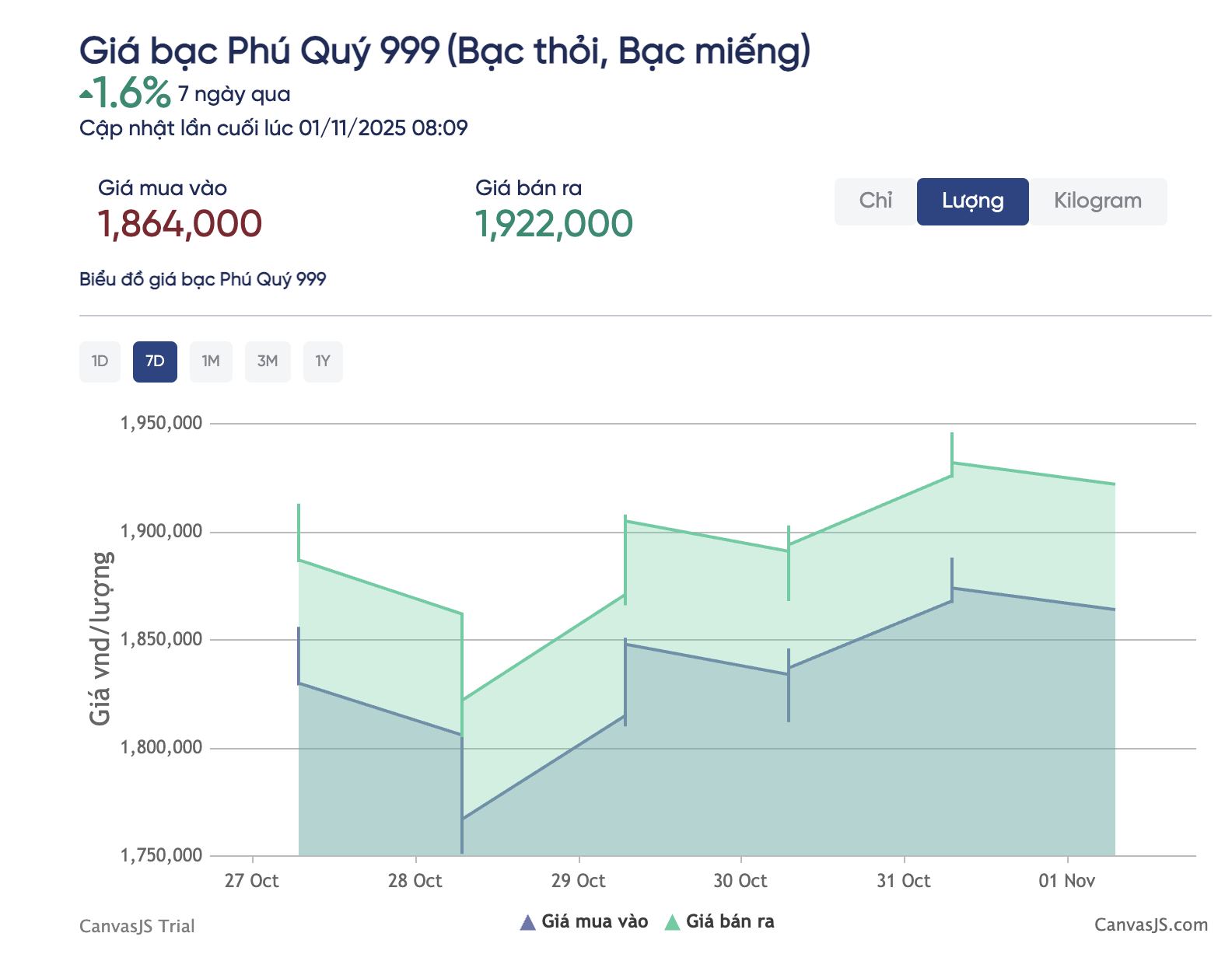

Phu Quy Group traded silver at 1.864 million VND for buying and 1.922 million VND per tael for selling, a drop of 24,000 VND per tael.

Other brands such as Ancarat and Golden Fun traded silver in the range of 1.914 – 1.92 million VND per tael (selling price).

In the international market, silver closed the last session of the week at $48.6 per ounce, down 0.49% from the previous session.

Silver prices have seen significant fluctuations in recent days.

From its peak of $54.4 per ounce, silver prices have fallen by about 12%, but still remain up approximately 68%, making it one of the most profitable investment channels.

According to experts, factors driving silver prices upward include high investment and industrial demand, particularly in renewable energy and semiconductor manufacturing, which give the metal a dual role.

However, in its latest commodity market forecast, the World Bank (WB) predicts that the average silver price in 2026 will be around $41 per ounce, significantly lower than current levels. The WB even forecasts that silver prices will continue to decline in 2027, ending the prolonged price surge, dropping to $37 per ounce.

Currently, the global silver price converted at the listed exchange rate is approximately 1.54 million VND per tael.

Notably, according to reports from *Bao Nguoi Lao Dong*, the silver price “fever” is cooling down, with fewer people queuing to buy silver or waiting long hours at counters compared to previous periods at some silver companies.

“When silver prices peaked at 2.14 million VND per tael, many people lined up early in the morning to buy. But now, the number of customers has significantly decreased,” said an employee at a silver company in Ho Chi Minh City.

Silver Prices Reverse Course, Falling After Sudden Surge

Today’s silver prices both domestically and globally have dipped, following a significant surge in yesterday’s trading session.