Circular 19/2025/TT-BTC and the amended Securities Law of 2024 stipulate that to qualify as a public company, enterprises must have a minimum charter capital and equity of VND 30 billion. Additionally, at least 10% of voting shares must be held by a minimum of 100 minority investors, excluding major shareholders.

Due to these regulations, several companies have been delisted for failing to meet the criteria, particularly regarding shareholder structure. In the first half of 2025, at least four companies were delisted: NQT, HCB, SCY, and CC4. Specifically, NQT had only 9% of its charter capital held by minority shareholders; HCB had 9.73%; CC4 had 7.5%; and SCY had less than 2.4%.

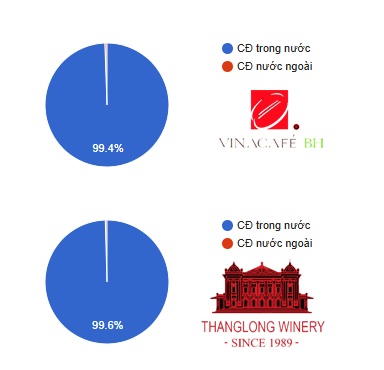

In the following months, more companies faced delisting for similar reasons. For instance, VCF (Vinacafe Bien Hoa) lost its public company status after nearly 99% of its shares were acquired by Masan (HOSE: MSN). Similarly, HIG and TEL passed resolutions to revoke their public company status, though no specific reasons were provided. Both had highly concentrated ownership structures, with the majority of shares held by major shareholders.

Likewise, VTL (Vang Thang Long) left UPCoM after over 20 years, failing to meet public company requirements in both shareholder structure and charter capital. Recently, SSH also announced its non-public shareholder structure, with one major shareholder holding 99.96% of the charter capital as of October 20, 2025. The company pledged to fulfill its obligations until the State Securities Commission officially revokes its public company status.

Concentrated shareholder structures of VCF and VTL

|

While these delistings were approved by shareholders, they were ultimately a result of failing to meet capital structure requirements.

Interestingly, some companies with market capitalizations in the billions of USD still have non-public shareholder structures, with major shareholders holding over 90% of shares.

Regulatory Relief

Currently, there are at least 15 companies with market capitalizations exceeding hundreds of trillions of VND, yet major shareholders hold over 90% of their charter capital. All of these are state-owned enterprises.

BIDV (HOSE: BID), with a market capitalization of over VND 265 trillion, is majority-owned by the State Bank of Vietnam (SBV, nearly 81%) and KEB Hana Bank (15%). PetroVietnam’s subsidiaries, including PV GAS (HOSE: GAS) and BSR, are over 90% owned by PetroVietnam. The Ministry of Finance holds nearly 97% of GVR, 99% of ACV, and over 99% of MVN. Other examples include VGI (over 99% owned by Viettel) and FOX (over 50% owned by the Ministry of Public Security after acquiring shares from SCIC, with FPT holding nearly 46%).

With such concentrated ownership, these companies clearly fail to meet the public company criteria under Circular 19/2025/TT-BTC and the amended Securities Law of 2024. If the regulations were uniformly applied, they would face delisting. Given their significant influence on market indices, their delisting could negatively impact investor sentiment.

However, Law No. 56/2024/QH15, Decree No. 245/NĐ-CP, and Circular No. 19/2025/TT-BTC introduced new regulations addressing this issue. Specifically, Law No. 68/2025/QH15 on state capital management and investment in enterprises (Clause 7, Article 58) states that public companies converted from 100% state-owned enterprises, currently listed or traded but not meeting shareholder structure requirements, will not lose their public company status.

Before these regulations were enacted, delisting concerns arose at several annual shareholder meetings of these companies. BSR’s leadership suggested that PetroVietnam consider partial divestment while the company seeks strategic partners.

However, rapid divestment to meet regulatory deadlines is challenging, given PetroVietnam’s ownership of 2.8 billion BSR shares. The exemption allows for a phased, long-term divestment strategy, ensuring an orderly approach.

– 08:10 03/11/2025

“From Joy to Despair: Hanoi Vodka Company Plunges Back into Losses”

In the first nine months of 2025, net revenue reached VND 87.9 billion, a 10% increase compared to the same period last year. However, the company still reported a post-tax loss of VND 3.8 billion.