|

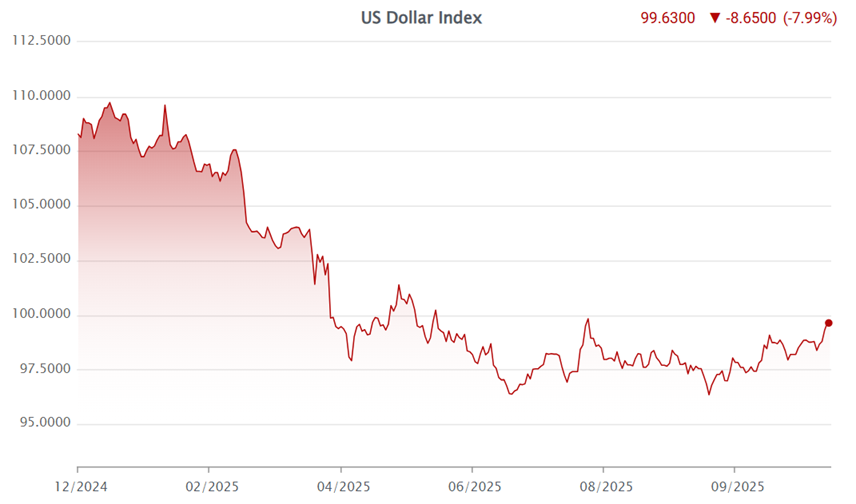

DXY Trends from the Start of 2025 to November 1st

Source: VietstockFinance

|

At the close of October 31st, the USD Index (DXY), which measures the greenback’s strength against a basket of six major currencies, reached 99.63 points, up 0.88 points from the previous week’s end.

Earlier, on October 30th (Vietnam time), the Fed announced its second consecutive rate cut, lowering the benchmark rate by 25 basis points to 3.75–4%, amidst economic data disruptions caused by the federal government shutdown. However, Powell’s hawkish statement suggesting no further cuts this year triggered a sharp rise in DXY.

The Fed’s smaller-than-expected cut kept USD yields high, attracting international capital back to the U.S. and boosting the greenback’s value.

Source: SBV

|

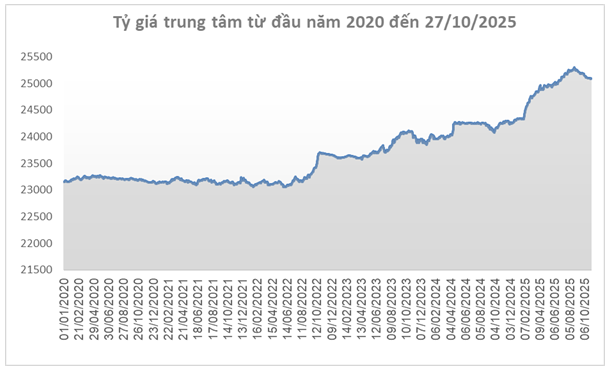

In Vietnam, the State Bank set the central exchange rate at 25,093 VND/USD on October 31st, a 5-dong decrease from the previous week—marking the fifth consecutive week of decline. With a ±5% band, commercial banks’ rates can fluctuate between 23,838 and 26,348 VND/USD.

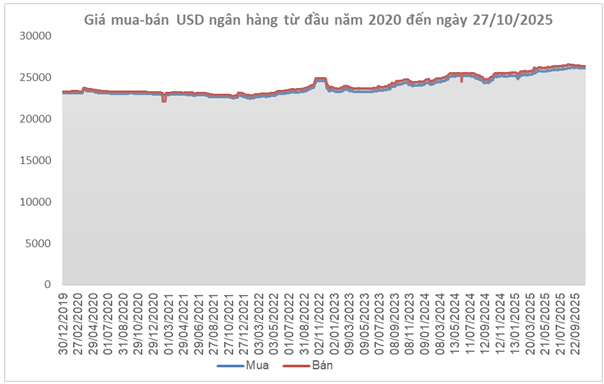

At the Foreign Exchange Reserve Management Department, the reference rate stood at 23,889–26,297 VND/USD (buy–sell), both down 5 dong from the prior week.

Source: VCB

|

Among banks, Vietcombank closed the week at 26,077–26,347 VND/USD, a 5-dong drop in both directions compared to the previous week.

Source: VietstockFinance

|

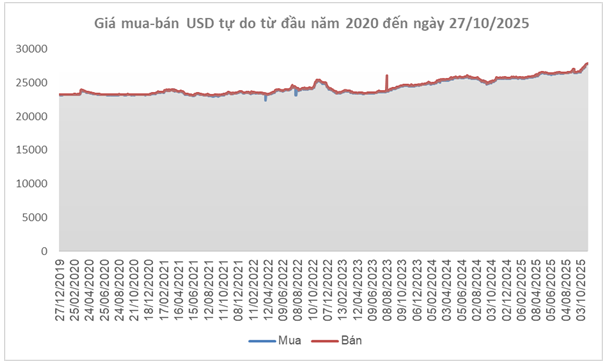

Conversely, the free market remained “hot,” with the USD/VND rate climbing to 27,800–27,850 VND/USD (buy–sell), up 150 dong from the previous week—marking the fourth consecutive week of strong gains.

– 17:45 02/11/2025

USD Sustains Its Safe-Haven Status

During the week of October 20–24, 2025, the USD rebounded in international markets, despite weaker-than-expected U.S. inflation data—a factor that bolstered expectations of a Federal Reserve rate cut at their upcoming meeting the following week.

Central Bank Reverses Course with Net Injection into Open Market

During the week of October 13–20, 2025, the State Bank of Vietnam (SBV) reversed its stance, resuming net injections into the open market after two consecutive weeks of net withdrawals. This shift occurred amid fluctuating liquidity in the banking system, as evidenced by a sharp rise in overnight interest rates.

USD Price Reverses Downward

During the week of October 13–17, 2025, the US dollar reversed its course and weakened in the international market as the United States signaled a softer stance in trade negotiations with China.