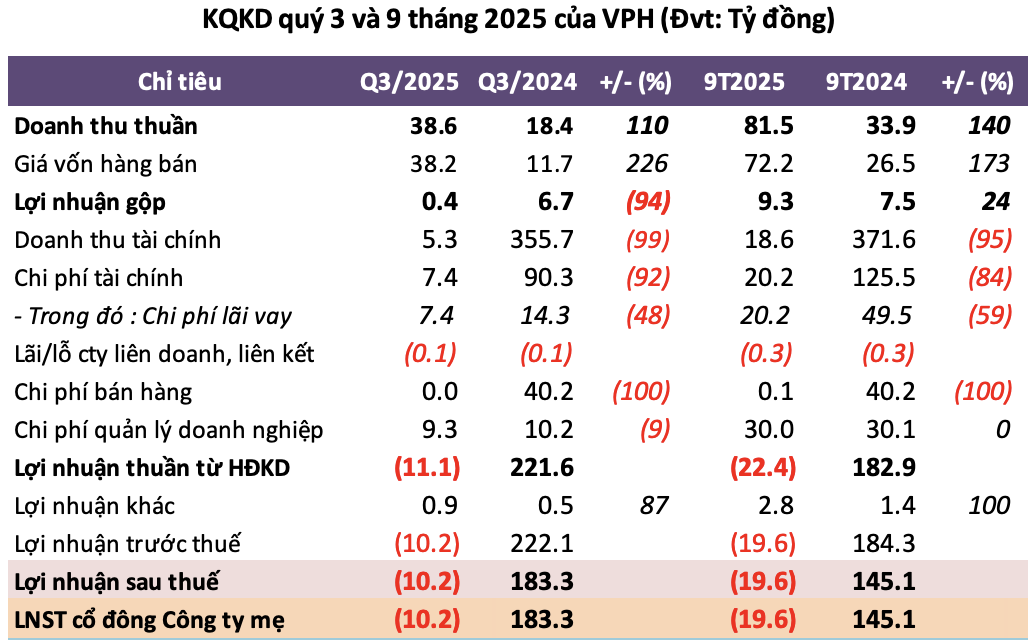

As the third quarter drew to a close, Van Phat Hung Corporation (HOSE: VPH) reported a net revenue of nearly VND 39 billion, more than double the same period last year. However, due to a significant increase in cost of goods sold, gross profit plummeted by 94% to just under VND 400 million. Gross profit margin shrank dramatically from 36% to a mere 1%.

Financial revenue also saw a sharp decline of 99%, dropping to over VND 5 billion. This contrasts sharply with the previous year’s exceptional performance, which included nearly VND 350 billion from the transfer of subsidiary shares.

Despite an 88% reduction in financial, selling, and administrative expenses, totaling VND 17 billion, VPH could not avoid its fourth consecutive quarterly loss. The company recorded a loss of over VND 10 billion, compared to a profit of VND 183 billion in the same period last year.

| VPH Extends Losing Streak to Fourth Consecutive Quarter |

Van Phat Hung attributed this performance to the absence of real estate transactions during the period. Additionally, construction revenue failed to generate profits, as third-party contractors were designated to execute the projects.

Over the first nine months, net revenue reached nearly VND 82 billion, 2.4 times higher than the same period last year. However, the company incurred a net loss of nearly VND 20 billion. Beyond the continued losses, VPH also reported a negative operating cash flow of over VND 480 billion, primarily due to a VND 415 billion increase in receivables.

Source: VietstockFinance

|

As of September 30, VPH’s short-term receivables rose by 37% year-to-date to over VND 745 billion. Notably, a VND 412 billion receivable from margin deposits emerged. Total assets stood at VND 1,873 billion, down 3% from the beginning of the year, with cash balances plummeting 85% to VND 27 billion. Inventory slightly decreased to VND 195 billion. Total liabilities edged up to nearly VND 845 billion, with financial debt of VND 450 billion—a 4% increase, accounting for 53% of total liabilities.

– 08:10 03/11/2025

Revealed: Real Estate Giant Pays Employees Nearly $1,700 Monthly Salaries

The average monthly income of employees in several real estate companies ranges from 13 to nearly 37 million Vietnamese dong.

Vietnam Airlines Surges Ahead with Impressive Q3 2025 Performance

On October 30, Vietnam Airlines Corporation (stock code: HVN) released its Q3 2025 financial report, showcasing remarkable growth. Key metrics including output, revenue, and profit not only met but exceeded targets, underscoring robust financial stability and laying a solid foundation for its 2026-2030 development strategy.

Văn Phú Surpasses 75% of 2025 Profit Target, Sets Sights on Dominating Southern Market

Văn Phú announced a strong Q3-2025 performance, achieving revenues of VND 395 billion, primarily driven by its flagship projects, The Terra – Bắc Giang and Vlasta – Sầm Sơn.