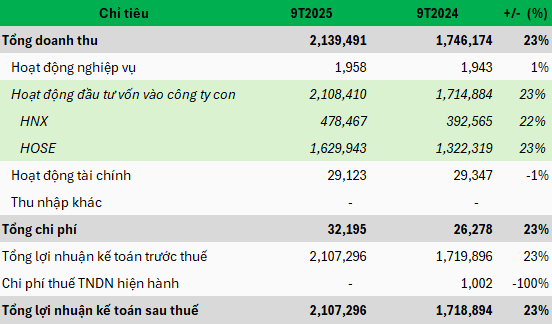

Specifically, the Exchange recorded a total revenue of over VND 2.139 trillion in the first nine months of the year, a 23% increase compared to the same period last year. The primary contribution came from capital investment activities in subsidiary companies, reaching more than VND 2.108 trillion, up by 23%.

Among the subsidiaries, the Ho Chi Minh City Stock Exchange (HOSE) contributed nearly VND 1.630 trillion to VNX, a 23% increase; while the Hanoi Stock Exchange (HNX) contributed over VND 478 billion, up by 22%.

After deducting all expenses, the Exchange retained a profit of more than VND 2.107 trillion, a 23% increase. This profit level corresponds to an average monthly earnings of over VND 234 billion.

Notably, the Exchange generated nearly VND 1.111 trillion in total revenue and approximately VND 1.101 trillion in after-tax profit in Q3 alone, surpassing the combined figures of the first two quarters, which were nearly VND 1.029 trillion in total revenue and around VND 1.007 trillion in after-tax profit. These results reflect the highly positive developments in the Vietnamese stock market during the period, significantly boosting revenue for members HOSE and HNX.

|

VNX’s Business Results for the First 9 Months of 2025

Unit: Million VND

Source: VietstockFinance

|

This year, VNX aims to achieve a total revenue of over VND 2.430 trillion and an after-tax profit of nearly VND 2.355 trillion. With the results accomplished in the first nine months, the Exchange has fulfilled nearly 90% of its revenue and profit targets.

Being just 10% away from the goal with Q4 still ahead, it is highly feasible for the Exchange to meet, or even exceed, its 2025 plan.

– 3:39 PM, November 3, 2025

Van Phat Hung Reports Fourth Consecutive Quarterly Loss Despite Doubling Revenue Year-Over-Year

Van Phat Hung’s Q3/2025 revenue soared 110% driven by construction contracts, yet the majority outsourced to third parties resulted in a net loss exceeding 10 billion VND, marking the fourth consecutive quarterly deficit.

Vietnam’s Pioneer in Frozen Agricultural Exports to Europe, US, Japan: Record 9-Month Profit, Stock Hits All-Time High

With nearly 50 years of expertise, Antesco (ANT), Vietnam’s pioneer in frozen vegetable exports, has released its Q3 2025 financial report.