Services

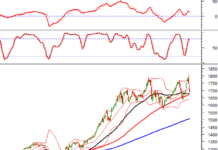

| BIG Stock Surges in Late October Trading Week |

Strong Rally Fueled by Positive Indicators

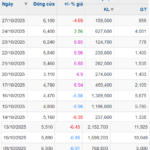

According to the company, the upward trend is not solely driven by technical factors but also supported by a series of updates on business operations and strategic development initiatives.

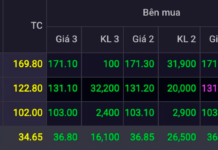

Specifically, Q3 2025 profits reversed to positive after a sluggish 2024, setting the stage for full-year 2025 earnings to double year-over-year. Plans to issue shares to existing shareholders at 10,000 VND per share aim to boost equity, expand scale, and strengthen financial capabilities. Additionally, the company targets an uplisting to the Ho Chi Minh City Stock Exchange (HOSE) in 2026, enhancing transparency and liquidity for BIG shares.

Recently, Chairman Võ Phi Nhật Huy registered to purchase 1 million BIG shares, demonstrating strong confidence in the company’s growth prospects.

BIG Leadership Inaugurates Big Expo Subsidiary Office in China

|

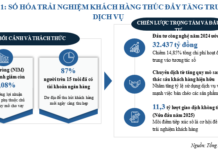

Q3 Profit Reversal Marks Financial Resilience Turning Point

According to the Q3 2025 report, BIG recorded robust consolidated revenue and profit growth compared to the same period in 2024, shifting from loss to profit. This turnaround is underpinned by four key subsidiaries: Big Hotel, with an average occupancy rate of 80%, provides stable revenue; Big Expo saw over 60% growth in coffee exports to China; Big CT and Big Bro, new subsidiaries in construction and real estate brokerage, began generating revenue, diversifying the profit structure.

Experts view the Q3 profit reversal as a sign that Big Group has completed its restructuring phase and entered a sustainable profitability cycle, laying the foundation for 2025 profits to double the previous year.

Capital Strategy and Exchange Uplisting Attract Investors

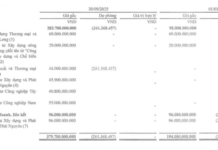

BIG announced plans to issue shares to existing shareholders at 10,000 VND per share, aiming to repay bank debt, reduce financial pressure, and expand resources for 2026 business activities.

This move, coupled with the Chairman’s registration to purchase 1 million shares, underscores management’s confidence in BIG’s intrinsic value and growth potential.

Additionally, the planned 2026 uplisting to HOSE is a strategic milestone, elevating the brand, expanding access to institutional investors, and increasing market liquidity.

BIG: A Resurgent Midcap Stock with Potential

With a market price below its book value of 10,400 VND per share, an attractive P/E ratio, and profit recovery potential, BIG stands out as a notable Midcap stock on UPCoM.

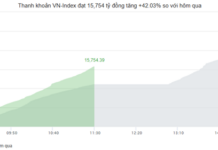

The recent 20% rally reflects not only technical momentum but also market confidence in BIG’s long-term vision as a diversified, multi-pillar conglomerate committed to transparency and sustainable growth.

– 06:58 03/11/2025

Two Major Shareholders Emerge Amidst TNI’s Turbulent Shifts

Amidst the market downturn in early October, two new individual shareholders invested a combined total of over 6.5 billion VND in shares of Thanh Nam Group Corporation (HOSE: TNI). This move preceded a remarkable five-session consecutive surge in the stock price, prompting the company to issue an official explanation regarding the price volatility.

Chairman Vo Phi Nhat Huy Registers to Purchase 1 Million BIG Shares

According to the Hanoi Stock Exchange (HNX), Mr. Vo Phi Nhat Huy, Chairman of the Board of Directors of Big Group Holdings Joint Stock Company (UPCoM: BIG), has registered to purchase 1 million shares of BIG through both negotiated and order-matching methods. The anticipated transaction period is from October 24 to November 21, 2025.

TCBS (TCX) Announces 2024 Dividend Plan: 5% Cash – 20% Stock

TCBS Securities (HOSE: TCX) has proposed its 2024 dividend distribution plan, offering a 5% cash dividend and a 20% stock dividend. The final registration date for shareholders to submit their written opinions is set for October 30, 2025.