Becamex IJC (Infrastructure Development Investment Joint Stock Company, stock code: IJC, listed on HoSE) has announced a resolution regarding the approval of the results of its additional public offering of shares to existing shareholders and the handling of unsold shares.

Following the subscription and payment period for the share purchase (from September 24, 2025, to October 23, 2025), existing shareholders of Becamex IJC subscribed to over 243.4 million shares out of the total 251.8 million shares offered, leaving approximately 8.4 million shares unsold.

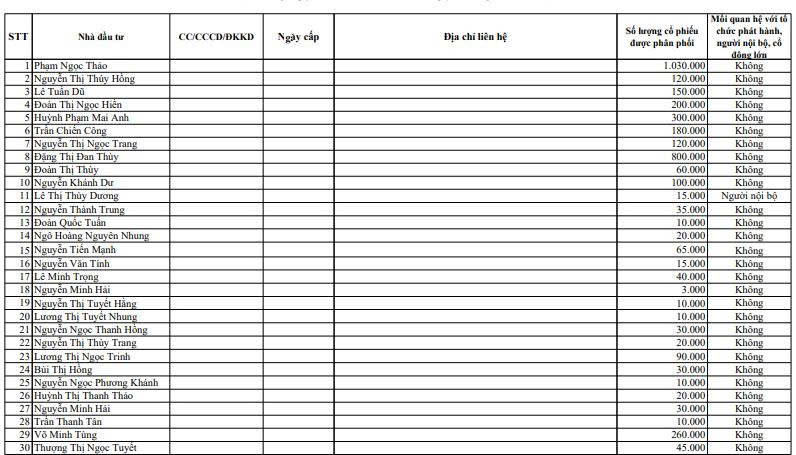

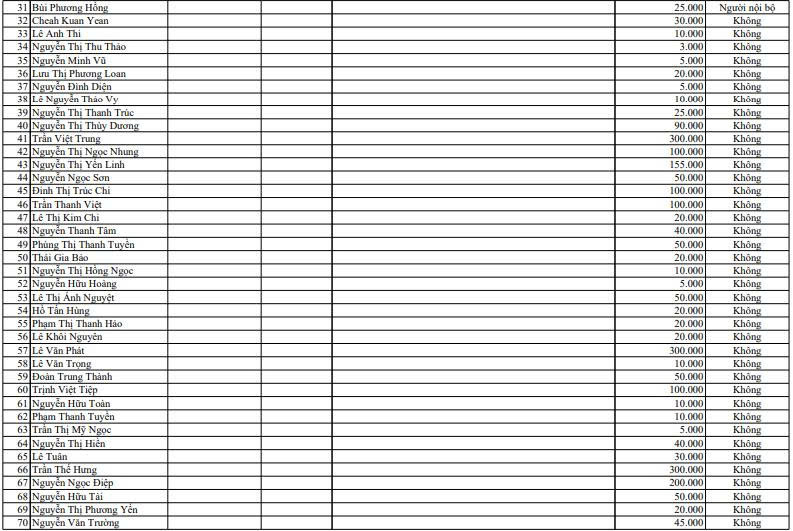

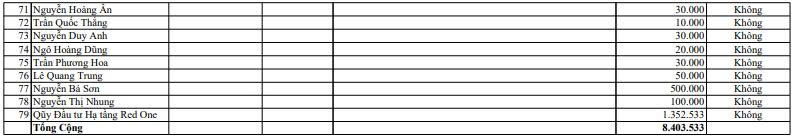

The Board of Directors of Becamex IJC has decided to offer the remaining unsold shares to 79 investors at a price of 10,000 VND per share. The subscription and payment period for this offer will be from November 5, 2025, to November 7, 2025.

Source: IJC

According to the accompanying list, the Red One Infrastructure Investment Fund is expected to receive the largest allocation, with over 1.35 million shares, followed by individual investor Phạm Ngọc Thảo, who is set to receive 1.03 million shares.

In related share trading news, on October 22, 2025, Becamex Group (Industrial Investment and Development Corporation, stock code: BCM, listed on HoSE) successfully purchased over 125.3 million shares in Becamex IJC’s offering of 251.8 million shares.

At an issuance price of 10,000 VND per share, it is estimated that Becamex Group spent nearly 1,253.2 billion VND to acquire these shares.

Following this successful transaction, Becamex Group increased its ownership in IJC from nearly 188 million shares to approximately 313.3 million shares, representing a 49.76% stake in Becamex IJC.

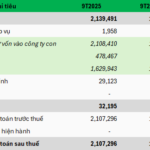

Regarding business performance, according to the consolidated financial report for Q3/2025, Becamex IJC recorded net revenue of nearly 671.6 billion VND, 3.5 times higher than the same period last year. After deducting taxes and fees, the company reported a net profit of nearly 254.4 billion VND, 2.9 times higher than the same period.

For the first nine months of 2025, the company generated net revenue of over 996.6 billion VND, a 39.5% increase compared to the first nine months of 2024; post-tax profit reached 397.3 billion VND, up 99.3%.

For 2025, Becamex IJC has set a business plan with an expected post-tax profit of 429 billion VND, a 21% increase compared to the profit achieved in 2024.

Thus, by the end of the first three quarters, the company has completed 92.6% of its planned post-tax profit target.

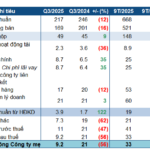

PV GAS’ 9-Month Profit Nearly Matches Full-Year 2024 Earnings

In Q3/2025, PV GAS (Vietnam Gas Corporation, HOSE: GAS) saw a modest increase in net profit compared to the same period last year. Despite this slight growth, the company achieved a remarkable feat by nearly matching its entire 2024 profit within just the first nine months of the year.