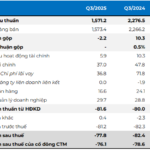

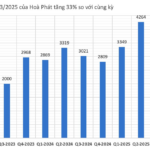

Hoa Phat Group (HPG), chaired by billionaire Tran Dinh Long, has released its Q3/2025 and 9-month 2025 business report. Specifically, in Q3/2025, Hoa Phat Group recorded VND 36,794 billion in revenue and VND 4,012 billion in post-tax profit, up 7% and 33% respectively compared to the same period in 2024.

For the first 9 months, the group achieved VND 111,031 billion in revenue, a 5% increase, and VND 11,626 billion in post-tax profit, a 26% increase compared to the same period last year.

In 2025, Hoa Phat set a business plan of VND 170,000 billion in revenue and VND 15,000 billion in post-tax profit. With these results, the Group has completed 65% of its revenue and 78% of its post-tax profit after 9 months.

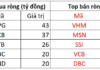

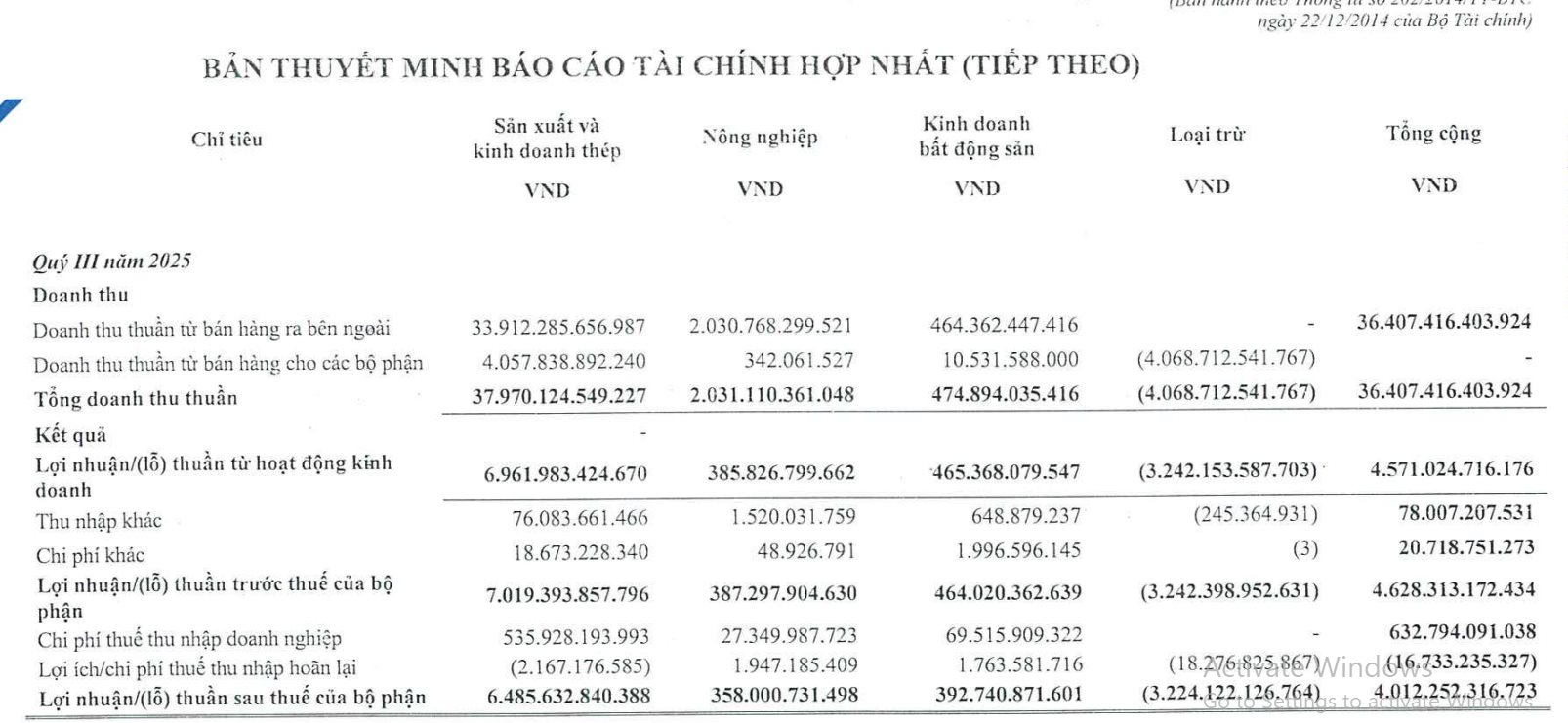

Hoa Phat Group is the largest steel producer in Southeast Asia and among the top 30 largest steel companies globally. Therefore, steel and related products are the main contributors to the group’s business results, accounting for 93% of revenue and 83% of post-tax profit.

Notably, agriculture is emerging as a strong sector, significantly contributing to Hoa Phat’s revenue and profit.

According to Hoa Phat Group’s Q3/2025 consolidated financial report, the agriculture sector, including animal feed production and livestock farming (pigs, cattle, and egg-laying chickens), continued its strong growth in Q3/2025.

During this period, external sales revenue reached VND 2,031 billion, with pre-tax profit recorded at VND 387.3 billion, accounting for approximately 8.4% of the group’s total pre-tax profit.

Compared to the first two quarters, Q3/2025 profit was slightly adjusted from VND 447 billion (Q1) and VND 578 billion (Q2). However, this result still far exceeds that of 2023, indicating that the agriculture sector remains a stable and effective “bright spot” in Hoa Phat’s business structure.

In the first 9 months of 2025, the agriculture sector achieved VND 6,259 billion in revenue and VND 1,297 billion in post-tax profit, up 28% and 88% respectively compared to the same period in 2024. This sector is the second-largest contributor, accounting for 6% and 11% of the group’s consolidated revenue and post-tax profit.

Hoa Phat attributes these positive results to high pork prices due to reduced supply caused by diseases, natural disasters, and stricter regulations under the 2025 Livestock Law, which forced many small-scale farmers to cease operations. Meanwhile, the group’s Australian cattle and egg production remained stable.

In addition to favorable market conditions, Hoa Phat’s proactive sourcing of raw materials for animal feed production helped control costs, improve profit margins, and enhance the efficiency of its agriculture sector.

Hoa Phat entered the agriculture sector in March 2015 with the establishment of Hoa Phat Hung Yen Animal Feed Company. Subsequently, in February 2016, Hoa Phat Agriculture Development JSC was founded to coordinate all agriculture-related enterprises within the group.

Currently, Hoa Phat Agriculture JSC (HPA) oversees the entire agriculture sector.

After 10 years of development, Hoa Phat’s agriculture sector ranks among the top in pig breeding and animal feed production, leads in supplying whole Australian cattle in Vietnam, and dominates the Northern clean egg market with an annual output of 336 million eggs.

In mid-September, HPA submitted its IPO application to the State Securities Commission. HPA plans to list on the HoSE in December 2025 under the ticker HPA, offering up to 30 million shares to investors. Based on the financial report as of June 30, 2025, HPA’s book value is VND 11,887 per share.

The capital raised from the IPO will be used to expand production, optimize the supply chain, and invest in the Central and Southern regions.

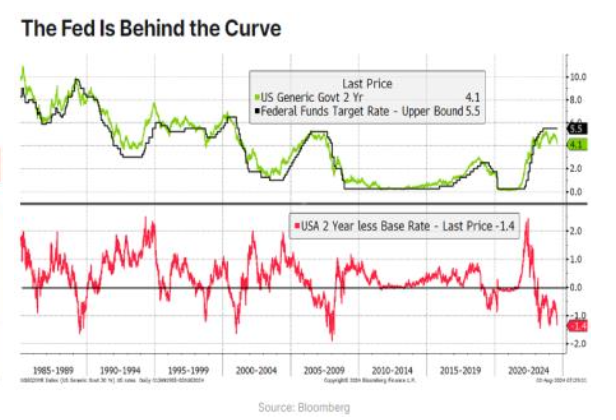

Hoa Phat’s Near 100 Trillion VND Debt and Soaring Interest Expenses: Unveiling the Unique Reason Behind the Surge

Hòa Phát’s debt has risen primarily due to the disbursement of medium and long-term loans, which are financing ongoing investment projects. Notably, the majority of this increase is attributed to the Hòa Phát Dung Quất 2 Steel Complex project.