On November 3rd, Coolmate announced the successful closure of its Series C funding round. Led by Vertex Growth Fund (backed by Temasek), the investment also saw participation from Cool Japan Fund (supported by the Japanese Government), Youngone CVC (an investment arm of South Korea’s top 3 apparel conglomerate), and existing investors Vertex Ventures SEA & India and Kairous Capital.

While the investment amount remains undisclosed, Coolmate stated that the funds will be allocated to three strategic priorities:

– Expanding into the Women’s Market (Go Women).

In March 2025, Coolmate launched its first sportswear line for women, marking its initial foray into this new market segment. The company aims for female customers to contribute approximately 40% of its revenue by 2030.

– Developing Direct Sales Channels (Go Offline).

Alongside its online model, Coolmate plans to open its first physical store by the end of 2025. This move aims to enhance customer reach and provide an in-store shopping experience. The company expects retail to account for around 40% of its revenue by 2030.

– Expanding into International Markets.

Building on the success of its sports socks, which achieved “Best Seller” status on Amazon US, Coolmate aims to deepen its international presence, focusing on Southeast Asia. The goal is for international sales to constitute about 50% of total revenue by 2030.

Phan Chi Nhu, CEO and Founder of Coolmate, expressed that this investment lays the foundation for a new growth phase, enabling the company to expand globally. He aspires to establish Coolmate as a regionally influential Vietnamese fashion brand.

Coolmate’s 3 Co-founders

Previously, in May 2022, Coolmate secured a $2 million Series A investment led by Access Ventures, with participation from Do Ventures, CyberAgent Capital, and DSG Consumer Partners.

By November 2024, the company completed its Series B round, raising an additional $6 million from Vertex Ventures SEA & India and Kairous Capital.

Founded in 2019 by Phan Chi Nhu, Nguyen Van Hiep, and Nguyen Hoai Xuan Lan, Coolmate operates on a D2C model, selling directly to consumers online. Its 60-day return policy quickly attracted customers, generating $1.6 million in revenue within the first year.

A turning point came in 2021 when the startup appeared on Shark Tank Vietnam Season 4, securing a $500,000 investment from Shark Nguyen Hoa Binh. Subsequently, Coolmate expanded production by partnering with factories in Northern Vietnam and Ho Chi Minh City, adopting “green manufacturing” practices using organic cotton and recycled plastics.

By 2022, Coolmate’s revenue reached $12.5 million, doubling since its Shark Tank appearance. In 2024-2025, the company established two hubs in Hanoi and Ho Chi Minh City, totaling 32,000 sq ft, with over 100 employees, including offices, warehouses, and a large-scale operations center.

After six years, Coolmate has served over 5 million orders. The company initially targeted an IPO in Vietnam by 2025, later revised to 2026.

Launched on Vietnamese Entrepreneurs’ Day, October 13th, 2025, Next Gen CEO is a special initiative by CafeBiz and its partners. It aims to identify and honor the Next Generation of CEOs, fostering a strong community of Vietnamese leaders where generations connect, succeed, and amplify shared values.

Beyond celebrating CEOs, Next Gen CEO strives to build a robust entrepreneurial community, linking Vietnam’s business generations. Here, predecessors guide successors, and collective value is amplified.

https://cafebiz.vn/ceo-circle.chn

Vinamilk’s Q3 Consolidated Revenue Surges Close to 17 Trillion VND Milestone

Vinamilk reported a consolidated revenue of VND 16,968 billion in Q3, marking a 9.1% year-over-year increase. Consequently, the nine-month cumulative consolidated revenue reached VND 46,678 billion, up 0.7% compared to the same period last year. Vietnam’s leading dairy company saw growth in both domestic and international business segments relative to the previous quarter.

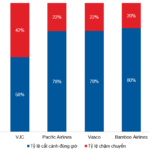

Soaring High with VJC: The Aviation Industry’s Rising Star (Part 2)

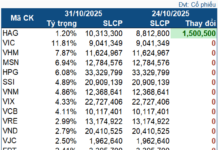

Despite lingering challenges that require attention in the coming period, Vietjet Aviation Joint Stock Company (HOSE: VJC) continues to captivate the investment community with its strong appeal. According to valuation model results, VJC’s stock price remains attractive for long-term investment opportunities.

Construction Giant Coteccons Explains Billion-Dollar Revenue with Slim Profit Margins

Coteccons, the construction titan, boasts an annual revenue of 25,000–30,000 billion VND, yet its profit margins linger at a mere 2% of total sales.