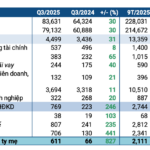

In Q1 of fiscal year 2026, Coteccons reported net revenue of VND 7,452 billion, a 56.6% increase year-over-year. Gross profit reached VND 322 billion—the highest since 2020—marking a 56.7% surge compared to the same period last year. Consequently, the gross profit margin stood at 4.32%, consistent with the previous year.

These positive results underscore Coteccons’ robust cost management and operational optimization capabilities, particularly amid ongoing industry challenges such as rising material costs, labor pressures, and intense competition within the construction sector.

Notably, net profit after tax soared to VND 294 billion, a remarkable 216.7% increase year-over-year. The net profit margin reached 3.95%, the highest in the last 21 quarters.

By the end of Q1 2026, new contract value totaled VND 19,300 billion, elevating Coteccons’ backlog to a historic high of VND 51,600 billion—surpassing the record set in fiscal year 2025. This not only provides a solid foundation for the 2026 business plan but also ensures a robust pipeline of projects for the coming years.

According to Coteccons representatives, 95.3% of tendered project revenue originated from traditional clients, reinforcing the company’s reputation for superior and consistent quality. The project portfolio continues to expand with key developments from esteemed clients such as Sun Group, Masterise Homes, Vinhomes, Ecopark, and TTC Land.

During the current quarter (Q2 of fiscal year 2026 – Q4/2025), Coteccons is collaborating with JS Group (Infinity Group) on the Jade Square project—a luxury residential complex comprising three towers located in Hanoi’s West Lake area. Coteccons is responsible for constructing the structural frame and exterior finishes, bringing the total number of active projects in the West Lake region and its vicinity to five. This further solidifies Coteccons’ leadership in shaping Hanoi’s urban landscape.

Coteccons representatives emphasized that the Q1 2026 financial results signify a strong start to the new fiscal year. With a record backlog, efficient operations, and a clear long-term growth strategy, the company is poised to enter a new growth phase, reaffirming its position as Vietnam’s leading construction firm in delivering iconic, era-defining projects.

Vietnam’s Pioneer in Frozen Agricultural Exports to Europe, US, Japan: Record 9-Month Profit, Stock Hits All-Time High

With nearly 50 years of expertise, Antesco (ANT), Vietnam’s pioneer in frozen vegetable exports, has released its Q3 2025 financial report.

Oil Prices Stabilize, Petrolimex Profits Surge Ninefold Year-on-Year

Petrolimex (HOSE: PLX), Vietnam’s leading petroleum conglomerate, has released its Q3/2025 consolidated financial report, showcasing a robust recovery compared to the same period last year. This significant turnaround is primarily attributed to the more stable global oil price trends observed during Q3/2025.

Real Estate Businesses Reap Massive Profits

In just nine months this year, TTC Land has surpassed 25% of its pre-tax profit target for 2025. Meanwhile, Thuduc House achieved a net profit of over 103 billion VND, exceeding its annual plan by 56%. Other real estate leaders such as Dat Xanh, Nha Khang Dien, Nam Long, CEO, and Phat Dat are also on the brink of meeting their sales targets.

Surge in Q3 Profits as NRC Leverages Contingency Integration

With a remarkable surge in net revenue and a significant reduction in management expenses, NRC Group Corporation (HNX: NRC) reported a consolidated net profit of nearly VND 24 billion in Q3/2025, a stark contrast to the VND 6 billion loss incurred in the same period last year.