Caution persists in the stock market as the new month begins, with significant volatility marking the first trading session. The VN-Index closed the session down 22.65 points (-1.38%) at 1,617 points. Trading liquidity remained low, with transaction values on HOSE exceeding 29.4 trillion VND.

Foreign trading activity was a notable downside, with net selling reaching 185 billion VND, though the selling pressure has eased compared to previous sessions.

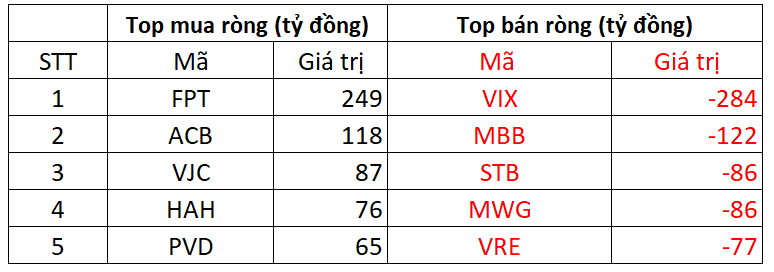

On HOSE, foreign investors net sold 137 billion VND

On the buying side, FPT was the most purchased stock by foreign investors on HOSE, with a value of over 249 billion VND. ACB followed closely, with 118 billion VND in purchases. Additionally, VJC and HAH were bought for 87 billion VND and 76 billion VND, respectively.

Conversely, VIX led the foreign sell-off with 284 billion VND. MBB and STB also faced significant selling pressure, with 122 billion VND and 86 billion VND sold, respectively.

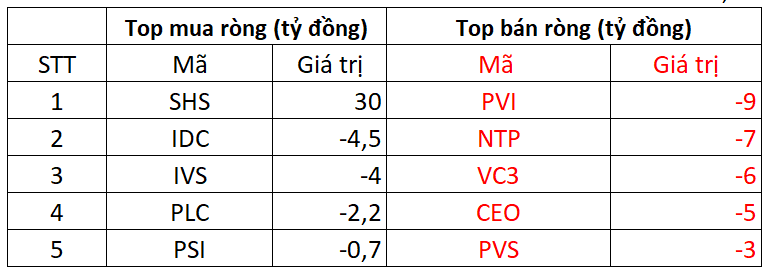

On HNX, foreign investors net sold 1 billion VND

SHS was the most bought stock on HNX, with a net purchase value of 39 billion VND. IDC followed with 5 billion VND in net purchases. Foreign investors also allocated a few billion VND to buy IVS, PLC, and PSI.

On the selling side, PVI faced the most significant foreign selling pressure, with nearly 9 billion VND sold. NTP followed with 7 billion VND sold, and VC3, CEO, and PVS were also sold for a few billion VND each.

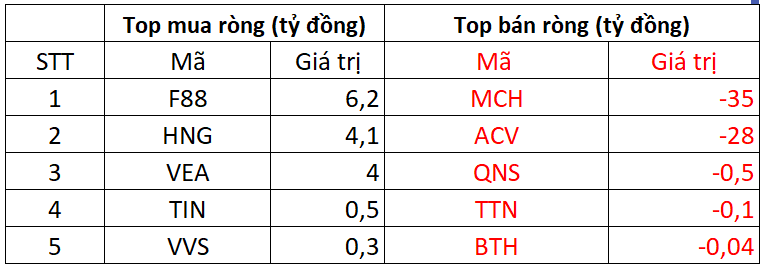

On UPCOM, foreign investors net sold 48 billion VND

F88 was the most purchased stock on UPCOM, with foreign investors buying 6 billion VND. HNG and VEA also saw net purchases of a few billion VND each.

Conversely, MCH faced the most significant foreign selling pressure, with 35 billion VND sold. Foreign investors also net sold ACV, QNS, and others.

Will the Stock Market Regain Momentum After Three Weeks of Turbulence?

The VN-Index has endured three consecutive weeks of steep declines, shedding nearly 160 points from its peak of 1,800. Liquidity has also contracted, as a cautious sentiment grips the market. Analysts anticipate a period of divergence, with short-term risks stemming from the market entering an information vacuum following the third-quarter earnings season.