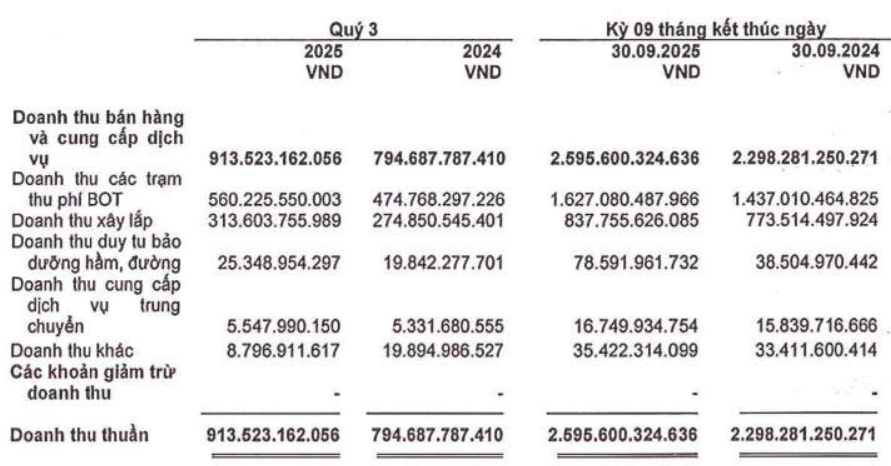

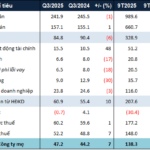

Growth momentum stems from the operation of BOT toll stations, surging by 18% and accounting for 61% of revenue, thanks to the stable toll collection from projects like Hai Van Tunnel, Deo Ca Pass, Cu Mong Pass, and Cam Lam – Vinh Hao Expressway.

|

Revenue structure of HHV in Q3/2025

Source: HHV

|

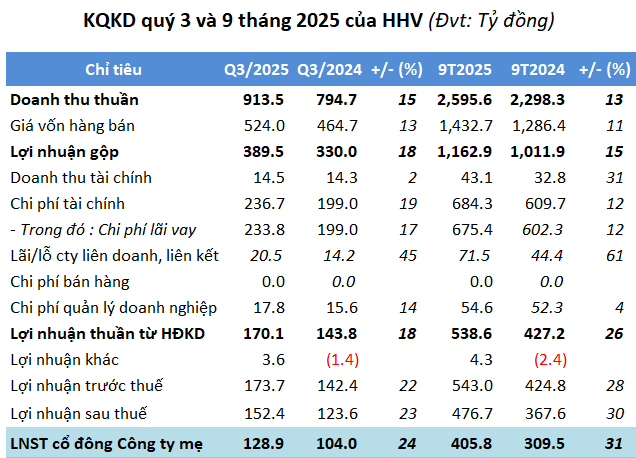

After nine months, net revenue reached nearly VND 2,596 billion, up 13%, and post-tax profit hit approximately VND 477 billion, a 30% increase. With these results, Deo Ca has achieved 72% and 86% of its annual targets, respectively.

Source: VietstockFinance

|

HHV announced that the company is currently focusing on executing several projects slated for completion by year-end, including the Dong Dang – Tra Linh Expressway Phase 1 (over VND 14,000 billion), spanning more than 93km with a contract execution rate of nearly 42%; Quang Ngai – Hoai Nhon Expressway (over VND 20,400 billion), 88km long with over 90% completion; and the Lien Chieu Port Coastal Road (over VND 1,203 billion), approximately 92% complete.

From 2026 to 2030, HHV is preparing resources to invest in the HCMC – Trung Luong – My Thuan Expressway Phase 2 (over VND 40,000 billion) and proposing the expansion of certain sections of the North-South Eastern Expressway (over 1,100km) under the PPP model. Notably, the Red River Scenic Boulevard project (approximately VND 300,000 billion) aims to break ground in Q1/2026. Additionally, the company is gearing up for the North-South High-Speed Railway and metro projects in Hanoi and HCMC.

As of the end of Q3, HHV‘s total assets exceeded VND 40 trillion, a 3% increase from the beginning of the year. The majority of capital is allocated to long-term assets, accounting for 96% at nearly VND 38.4 trillion. Liabilities remained relatively stable at nearly VND 28.1 trillion, primarily in long-term financial loans totaling nearly VND 17.5 trillion, down 3% year-to-date.

– 06:00 04/11/2025

Billion-Dollar Investment: CEO Pours Over $43 Million into Sonasea Vân Đồn Harbour City Project

Fueled by robust financial performance and significant cost-cutting measures, C.E.O Group Corporation (HNX: CEO) reported a 7% year-over-year increase in consolidated net profit for the third quarter.

Vietjet Reports Robust Q3 2025 Growth – Declares 20% Stock Dividend

Vietjet Aviation Joint Stock Company (HoSE: VJC) has announced its Q3/2025 business results, showcasing robust growth and achieving 97% of its annual plan. This performance underscores the airline’s strong recovery and development momentum in the post-pandemic era.