|

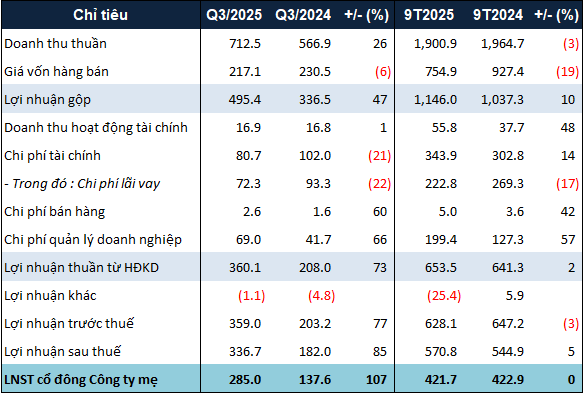

HDG’s Business Results for the First 9 Months of 2025. Unit: Billion VND

Source: VietstockFinance

|

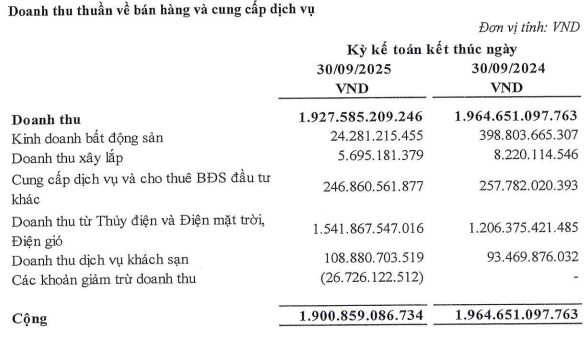

HDG reported that the revenue increase was primarily driven by the energy sector, notably the strong performance of hydropower projects, while other operations remained stable.

During the period, HDG reduced interest expenses by 22% to nearly 81 billion VND. However, selling expenses and management costs rose by 60% and 66%, reaching nearly 3 billion VND and 69 billion VND, respectively.

Despite these increases, the company achieved a net profit of 285 billion VND, nearly 2.1 times higher than the same period last year. However, the net profit for the first 9 months was approximately 422 billion VND, flat compared to the same period, as HDG incurred a loss of nearly 25 billion VND in Q2. Against the 2025 consolidated after-tax profit target of 1,057 billion VND, HDG has achieved 54%.

|

Revenue Structure of HDG in the First 9 Months of 2025

Source: Q3/2025 Consolidated Financial Statements

|

On the balance sheet, HDG‘s total assets as of September 30, 2025, stood at nearly 14.5 trillion VND, a 5% increase from the beginning of the year. Short-term cash holdings and trading securities rose by 14% and 13%, respectively, to over 626 billion VND and 584 billion VND. The trading securities portfolio includes only bonds and deposit certificates, with no stocks.

Notably, construction in progress costs doubled from the end of last year to nearly 1.7 trillion VND, due to an additional 797 billion VND from the Truong Thinh hydropower project.

Meanwhile, total liabilities remained largely unchanged at over 6.4 trillion VND. Outstanding loans also saw no significant change, at nearly 4.9 trillion VND. Construction costs and land use rights payable decreased by over 17% to more than 704 billion VND. Conversely, other short-term payables increased by 65% to over 280 billion VND. Notably, short-term provisions payable decreased by 43%, from 209 billion VND to 118 billion VND.

– 11:28 04/11/2025

EVNGENCO3 Surpasses Expectations with Nearly 31 Trillion VND in Revenue for the First Nine Months

According to the consolidated Q3/2025 financial report, Electricity Generation Corporation 3 – JSC (HOSE: PGV) recorded a net revenue of nearly VND 31 trillion in the first nine months of the year.

Unveiling Vingroup’s $43 Billion Empire: $5.3B in Under-Construction Real Estate, $760M in VinFast Projects, and $147M Invested in VinEnergo & VinSpeed

Vingroup (VIC) has achieved a monumental milestone, surpassing the 1 quadrillion VND asset threshold as revealed in its Q3/2025 financial report. The conglomerate is strategically channeling its substantial capital into key sectors, including real estate, the VinFast ecosystem, and emerging industrial pillars.

Safoco Vegetable Noodle Brand Reports Q3 Net Profit of VND 13 Billion

Despite a decline in net revenue, CTCP Lương thực Thực phẩm Safoco (HNX: SAF) maintained its profitability in Q3/2025, demonstrating resilience in a challenging market.