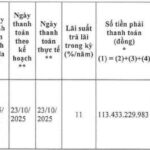

According to a report submitted to the Hanoi Stock Exchange (HNX) on October 30, 2025, Saigon – Lam Dong Tourism and Investment Joint Stock Company is obligated to pay over VND 319 billion in interest for the bond series SLTCH2328001.

However, the company has not made the payment on time due to a third extension on the interest payment deadline for the second installment of the bond.

As per the company’s report on October 28, 2025, Saigon – Lam Dong Tourism and Investment and the investor representing 100% of the bondholders have agreed to extend the payment deadline for the second installment of the SLTCH2328001 bond series to December 30, 2025, with no additional charges beyond the bond interest.

The SLTCH2328001 bond series, issued in December 2023, has a face value of VND 1,607 billion, an annual interest rate of 12%, and a 5-year term. The bondholder is PetroVietnam Securities Joint Stock Company. This is the only bond series currently issued by Saigon – Lam Dong Tourism and Investment.

Established in 2005, Saigon – Lam Dong Tourism and Investment primarily operates in the hotel, guesthouse, and resort services sector. The company is the developer of the Saigon – Da Lat Tourism, Resort, and Outdoor Entertainment Complex, spanning 153 hectares.

Rendering of the Saigon – Da Lat Tourism, Resort, and Outdoor Entertainment Complex. Image: Saigontel

As of a September 2018 registration change, the company’s charter capital stands at VND 200 billion, with the following shareholders: Saigon Investment Joint Stock Company (40%), Ms. Le Thi Anh (40%), and Mr. Dang Thanh Tam (20%).

Mr. Dang Thanh Tam is also the Chairman of the Board of Directors at Kinh Bac City Development Shareholding Corporation (KBC) and Saigon Telecommunications and Technologies Joint Stock Company (Saigontel, SGT).

After several adjustments, by December 2023, Saigon – Lam Dong Tourism and Investment’s charter capital had increased to VND 620 billion. During this period, Mr. Nguyen Hoang Ky Lan replaced Ms. Nguyen Cam Phuong as the company’s General Director and legal representative.

According to Saigontel’s 2025 semi-annual governance report, Ms. Cam Phuong remains affiliated with Saigon – Lam Dong Tourism and Investment as a Board member. She also serves as a Board member and General Director at Saigontel, where Mr. Dang Thanh Tam is the Chairman.

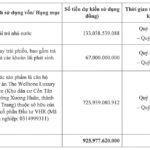

In February 2024, Saigon – Lam Dong Tourism and Investment pledged its entire capital contribution in 3H Vietnam Investment and Construction LLC, valued at VND 945 billion, and its capital contribution in A&E Logistics LLC, valued at VND 965 billion, as collateral at Vietnam Public Bank – Hanoi Branch.

Financially, as of June 30, 2025, the company’s equity has significantly decreased to nearly VND 99 billion, compared to over VND 534 billion in the same period the previous year.

In the first half of 2025, Saigon – Lam Dong Tourism and Investment reported a net loss of over VND 142 billion, compared to a net loss of over VND 8 billion in the same period in 2024. Accumulated losses as of June 30, 2025, reached nearly VND 537 billion.

Total liabilities amount to VND 2,769 billion, 28.02 times the equity. Long-term debt constitutes the majority at nearly VND 2,418 billion, including VND 1,606 billion in long-term loans and finance leases from the SLTCH2328001 bond series, and VND 399 billion in deferred income tax liabilities.

Additionally, the company has short-term liabilities of nearly VND 351 billion, primarily consisting of short-term payables (nearly VND 296 billion).

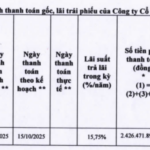

PetroVietnam Auctions Stakes in GID and PVTS

PetroVietnam is auctioning off its entire stake of 8.7 million shares in GID and 10.5 million shares in PVTS, with the strategic goal of divesting from these two enterprises.