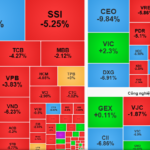

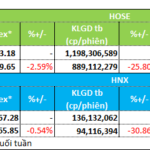

Today’s trading session (November 3rd) concluded with the VN-Index dropping 22.65 points (1.38%) to 1,617 points, while the VN30-Index fell 27.72 points (1.47%) to 1,857.64 points. On the Hanoi Stock Exchange, the HNX-Index decreased by 6.67 points (2.51%) to 259.18 points, whereas the UPCoM-Index bucked the trend, rising 1.17 points (1.03%) to 114.63 points.

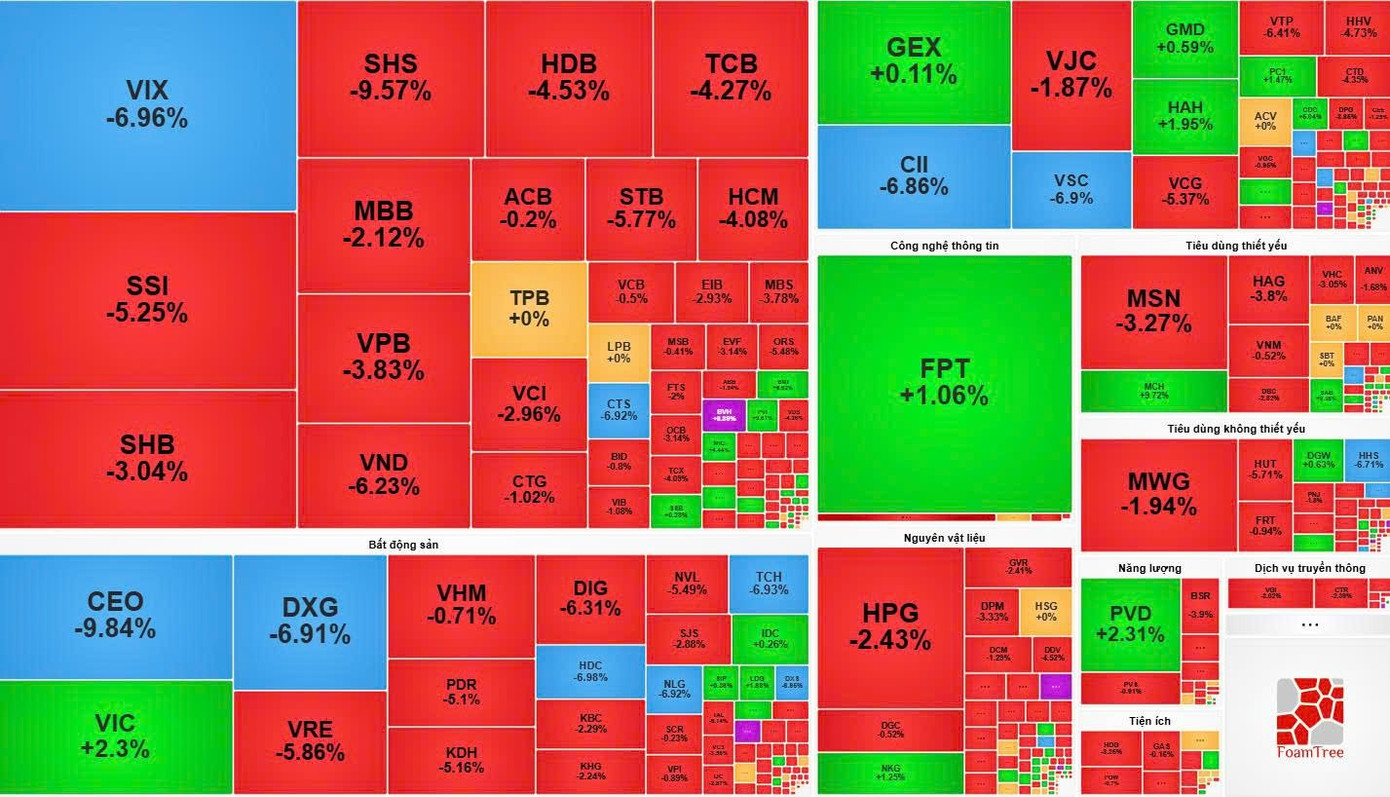

The most significant downward pressure came from the banking sector, causing market volatility throughout the session. Notable decliners included TCB (-4.27%), STB (-5.77%), VPB (-3.83%), HDB (-4.53%), MBB (-2.12%), and SHB (-3.04%), contributing to a 12-point loss in the VN-Index.

Red dominates today’s stock market session.

In the securities group, VIX was the most bearish stock, nearing its floor price; other stocks like SSI and VND also retreated to session lows, signaling potential risks if they break further. Alongside Gelex, GEX fell over 2%, setting a new low.

Conversely, the insurance sector emerged as a market highlight. PVI surged to its upper limit, surpassing its historical peak after reporting Q3 after-tax profits up 2.6 times year-on-year to 420 billion VND. BVH also hit its ceiling, thanks to a 42% rise in Q3 profits to 797.7 billion VND. Additionally, stocks like VIC, FPT, KDC, GMD, and BMP helped curb the index’s decline, with FPT being one of the few VN30 stocks to maintain positive territory.

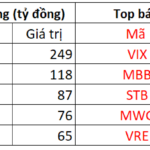

Total market liquidity reached nearly 33.1 trillion VND, with HoSE accounting for over 29.48 trillion VND. The market saw 240 decliners and only 88 advancers. Foreign investors net sold over 160 billion VND, marking their fourth consecutive session of capital withdrawal, primarily from VIX, MBB, STB, and VRE.

Experts advise investors to remain cautious and avoid bottom-fishing, awaiting clearer market equilibrium before opening new positions.

In the short term, the market is testing the resilience of key sectors. If banking, securities, and Vin-related stocks do not break further lows, this could signal a positive recovery trend. Statistics show that Vin-related stocks alone caused the index to lose over 40 points last week.

Stock Market Update November 4: Heavy Supply Pressure on Stocks, Investors Advised to Proceed with Caution

The trading session on November 3rd highlighted the mounting pressure from stock supply. Will this trend persist into the November 4th session?

MBB: Surging Prices Yet Remains a Long-Term Attractive Investment (Part 2)

Military Commercial Joint Stock Bank (HOSE: MBB) consistently demonstrates strong operational efficiency and profitability, ranking among the top performers in the banking sector. Current valuation metrics indicate that MBB shares are attractively priced, presenting a compelling opportunity for long-term investment.