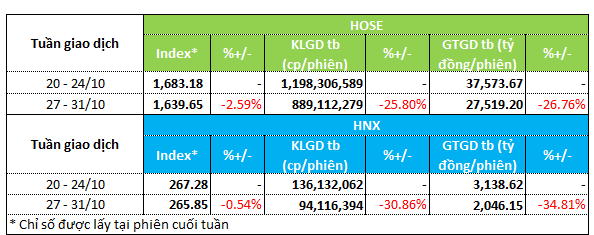

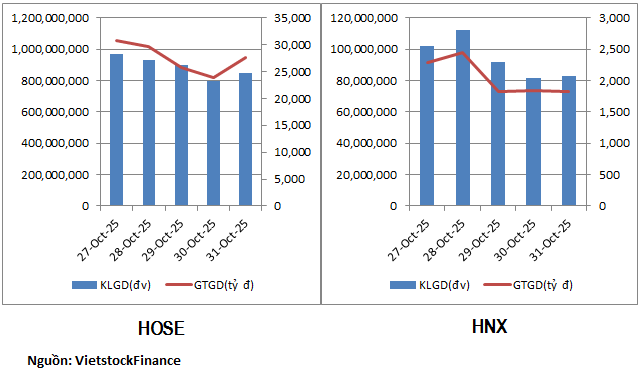

The stock market entered a subdued trading week in late October. Both indices and liquidity declined across the two listed exchanges. On the Ho Chi Minh Stock Exchange (HOSE), the VN-Index fell by 2.6% to nearly 1,640 points. The Hanoi Stock Exchange (HNX-Index) saw a 0.5% decrease, closing at 265.85 points.

Liquidity on both exchanges dropped by 25-35%. On HOSE, trading volume fell by 26%, losing the 1 billion unit/session mark. Average trading value decreased by nearly 27% to over 27.5 trillion VND/session.

On the HNX, trading volume plummeted by 30% to 94.1 million units/session, while trading value dropped by 35% to over 2 trillion VND/session.

|

Overview of Liquidity for the Week of October 27 – 31

|

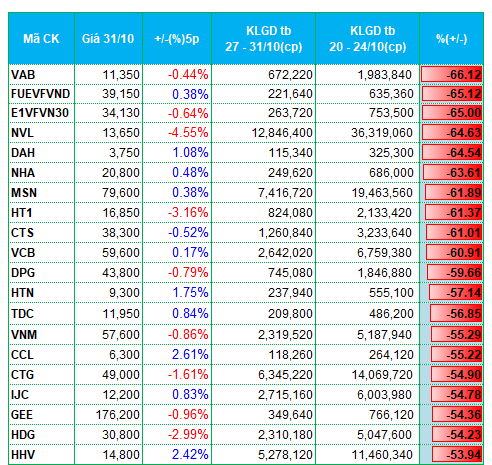

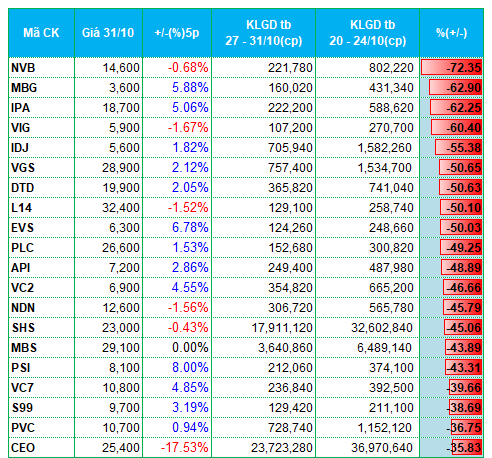

Capital outflow was prominent in sectors such as securities, banking, real estate, and construction, with liquidity declines ranging from 30% to 66%. The banking sector saw significant drops, with VAB falling 66% to 672 thousand units/session, VCB down 61% to 2.6 million units/session, and CTG decreasing by nearly 55% to 6.3 million units/session. On the HNX, NVB stood out with a 70% decline, recording liquidity of nearly 222 thousand units/session.

Several securities firms also experienced sharp liquidity drops, including CTS, VIG, EVS, SHS, MBS, and PSI, with trading volumes decreasing by 40-60% compared to the previous week.

Similarly, the construction sector saw numerous stocks with significant liquidity declines, such as DPG, HTN, TDC, VC7, and S99, dropping by 40-60%. The real estate sector also featured several representatives like NVL, NHA, CCL, IJC, HDG, DTD, L14, API, NDN, and CEO.

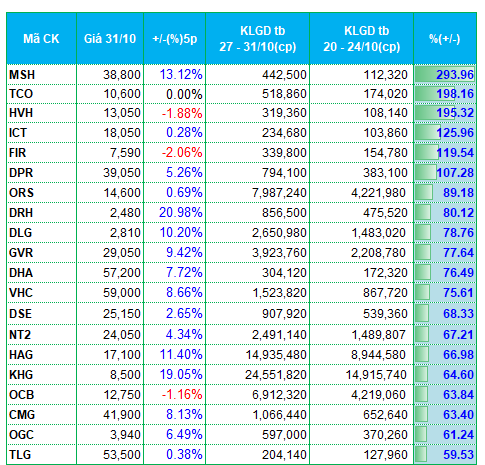

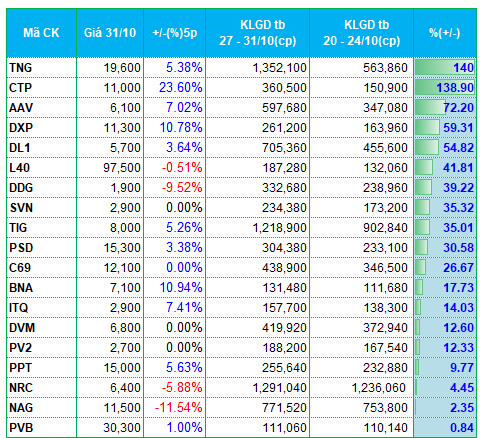

In contrast, capital inflows were dispersed across individual stocks. The textile and garment sector, represented by MSH, TNG, and SVN, and the telecommunications technology sector, including ICT and CMG, saw notable increases in liquidity.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX

|

The list of stocks with the highest increases and decreases in liquidity is based on average trading volumes exceeding 100,000 units/session.

– 19:28 03/11/2025

Will the Stock Market Regain Momentum After Three Weeks of Turbulence?

The VN-Index has endured three consecutive weeks of steep declines, shedding nearly 160 points from its peak of 1,800. Liquidity has also contracted, as a cautious sentiment grips the market. Analysts anticipate a period of divergence, with short-term risks stemming from the market entering an information vacuum following the third-quarter earnings season.

Market Pulse 03/11: Red Wave Sweeps Across, VN-Index Plunges Over 22 Points

At the close of trading, the VN-Index dropped 22.65 points (-1.38%), settling at 1,617 points, while the HNX-Index fell 6.67 points (-2.51%), closing at 259.18 points. Market breadth was overwhelmingly negative, with 468 decliners outpacing 229 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 4 advanced, and 3 remained unchanged.