I. MARKET TRENDS IN WARRANTS

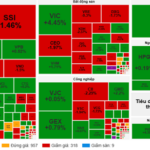

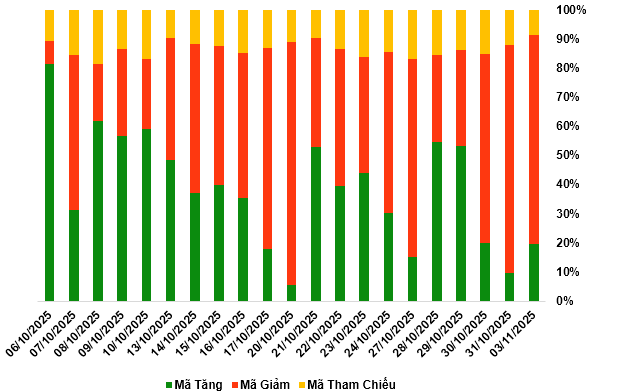

By the close of trading on November 3, 2025, the market recorded 47 gainers, 173 decliners, and 21 unchanged stocks.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

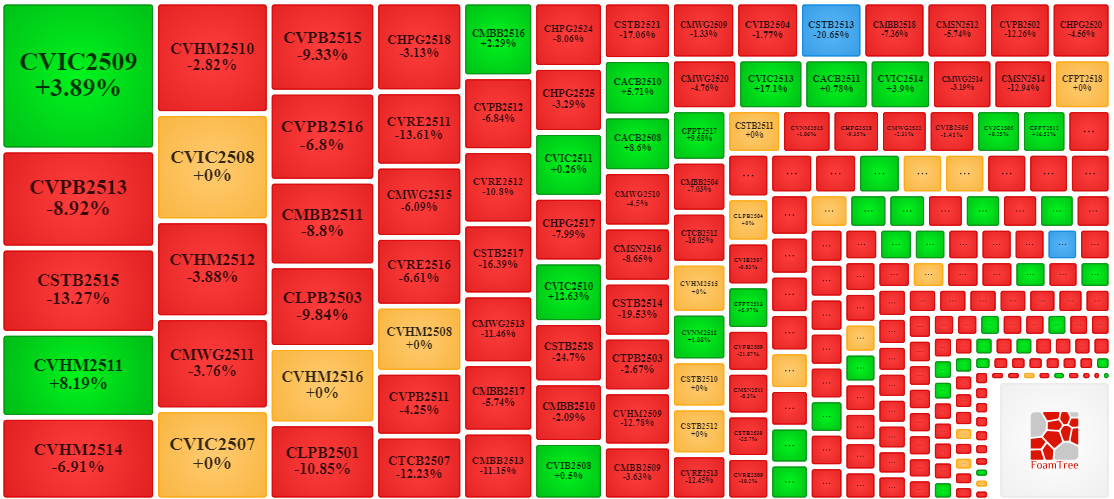

Source: VietstockFinance

During the November 3, 2025 session, sellers dominated the market, causing most warrant prices to decline. Notable decliners included CVPB2513, CSTB2515, CVHM2514, CVHM2510, and CMWG2511.

Source: VietstockFinance

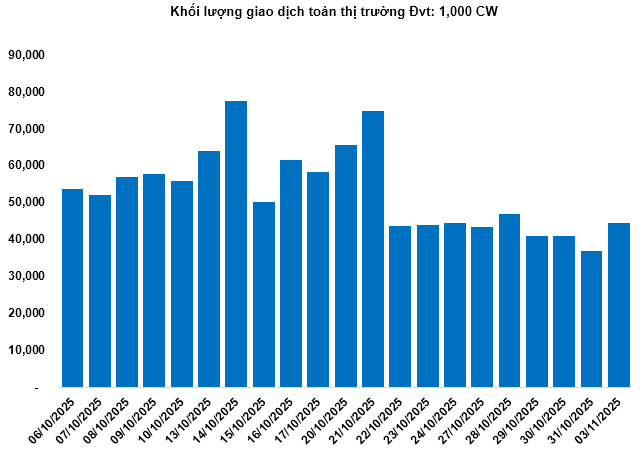

Total market volume on November 3 reached 44.46 million warrants, up 20.28%, while trading value fell 6.88% to VND 86.31 billion compared to October 31. CFPT2512 led in volume with 2.67 million warrants, and CMWG2510 topped trading value at VND 5.62 billion.

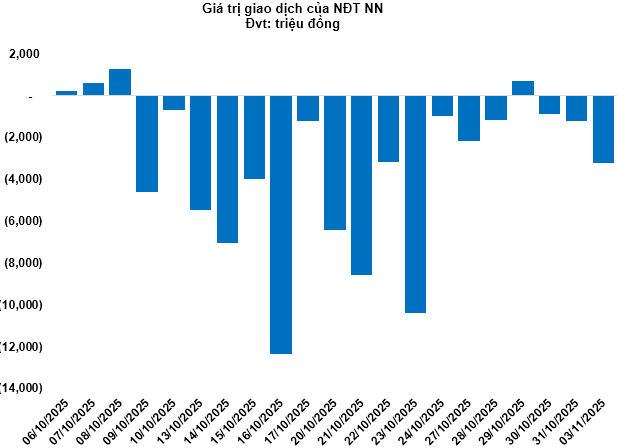

Foreign investors continued net selling on November 3, totaling VND 3.24 billion. CVNM2521 and CSTB2522 saw the highest net outflows.

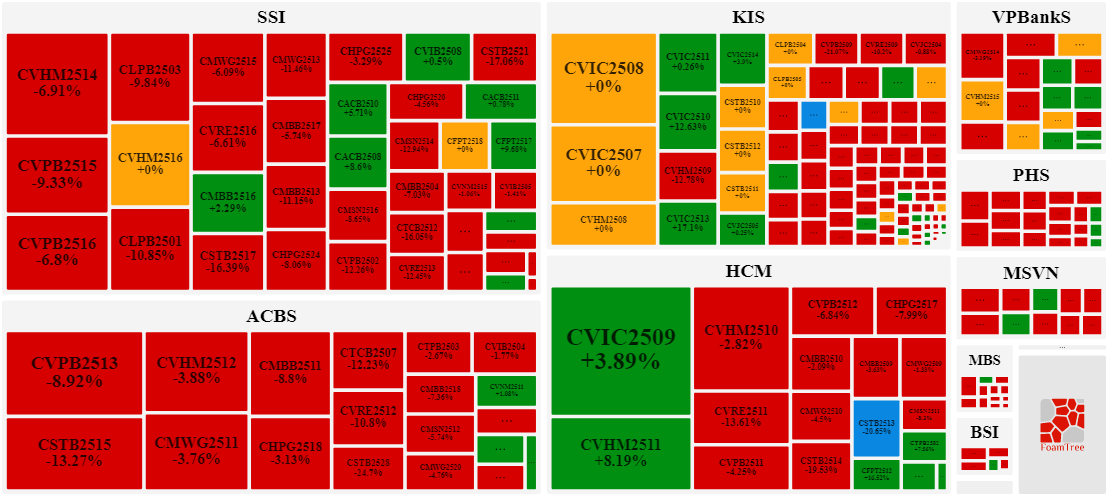

Securities firms SSI, ACBS, KIS, and HCM are the leading issuers of warrants in the market.

Source: VietstockFinance

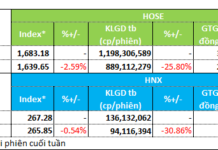

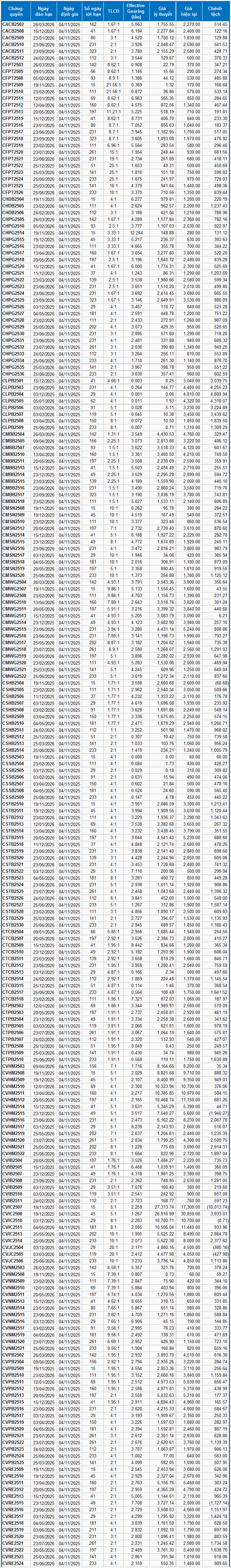

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from November 4, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturity.

According to this valuation, CVIC2507 and CVHM2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CHPG2514 and CFPT2515 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 November 3, 2025

Vietstock Daily 04/11/2025: Shadows Cast by Gathering Storm Clouds

The VN-Index plummeted for the third consecutive session, forming a bearish Three Black Crows candlestick pattern. Sentiment could turn even more pessimistic if the August 2025 low (around 1,605-1,630 points) is breached in upcoming sessions. Further compounding concerns, both the Stochastic Oscillator and MACD indicators continue to weaken following sell signals, suggesting a lackluster short-term outlook.

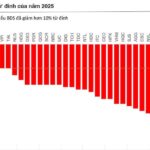

Record Sell-Off by Foreign Investors Surpasses 100 Trillion VND: When Will the Pressure Ease?

In the first ten months of 2025, foreign investors recorded a net sell-off exceeding 100 trillion VND on the Ho Chi Minh City Stock Exchange (HOSE), surpassing the entire year’s record of 2024 and placing significant pressure on the VN-Index. However, experts anticipate that this pressure will ease in the coming period.

Market Pulse 03/11: Blue-Chip Stocks Rebound, VN-Index Regains Green Territory

A robust recovery signal emerged during the final moments of the morning session, propelling the VN-Index to swiftly rebound and reclaim positive territory. At the midday break, the VN-Index surged by over 12 points (+0.74%), reaching a strong 1,651.76 points. Meanwhile, the HNX-Index lagged, closing at 264.15 points, down 0.64%. Market breadth remained balanced, with 317 gainers, 327 decliners, and 957 unchanged stocks.