On October 31, FPTS announced plans to sell nearly 1.2 million shares of MSH between November 6 and December 5. The purpose is to execute proprietary trading, aiming to reduce its holdings from approximately 13.2 million shares (11.728%) to 12 million shares (10.665%) if the transaction is successful.

This volume mirrors a previous sale attempt by FPTS, scheduled for August 18 to September 16, which failed due to unfavorable market prices.

Earlier this year, the company executed two successful sales of MSH shares. The first, registered from June 3 to July 2, resulted in the sale of 672,400 shares out of the targeted 1.2 million. The second, from July 9 to August 7, fully disposed of the remaining 520,000 shares.

FPTS’s divestment moves follow a robust recovery in MSH share prices, which rebounded to historical highs after a tariff shock. As of the November 3 close, MSH shares traded at VND 39,000, marking a nearly 50% surge since the April low.

|

FPTS Continues to Offload MSH Shares Post-Recovery

Source: VietstockFinance

|

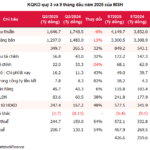

FPTS’s investment in MSH has significantly influenced its quarterly earnings. In Q3, the company reported pre-tax profits of VND 134 billion, a 30% year-on-year increase. However, realized and unrealized gains diverged sharply.

Unrealized losses reached nearly VND 79 billion, up significantly from VND 10 billion in the same period last year, primarily due to MSH share revaluation. Conversely, realized profits surged 48% to VND 167 billion, driven by VND 45 billion in gains from FVTPL financial assets, largely from selling nearly 1.2 million shares and fund certificates—nearly matching total MSH shares sold in the quarter.

FPTS’s MSH investment has long been labeled as highly profitable. As of Q3 2025, its listed equity investments totaled nearly VND 457 billion, with MSH alone accounting for over VND 455 billion—38 times the purchase price.

Meanwhile, MSH, a textile firm, reported record Q3 net profits of nearly VND 201 billion, up 54% year-on-year. For the first nine months of 2025, net profits reached nearly VND 427 billion, a 64% increase and surpassing the full-year 2024 figure of VND 413 billion.

– 16:28 03/11/2025

Red River Garment Smashes Quarterly Profit Record, Invests Nearly VND 1.6 Trillion in Bonds

Record-breaking Q3 profits for Hong Ha Garment Joint Stock Company (HOSE: MSH) as the company continues to maintain a substantial financial investment portfolio, with nearly one-third of its assets in bonds, while simultaneously ramping up production and overseas investments.

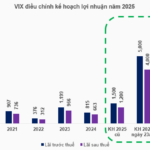

VIX Enhances Business Plan Once More, Outlines Capital Raising Strategy for Crypto Asset Firm

VIX Securities Corporation (HOSE: VIX) is set to elevate its 2025 pre-tax and post-tax profit targets to VND 6,500 billion and VND 5,200 billion, respectively, replacing the plan announced in late September. Additionally, the company plans to issue nearly 920 million shares at VND 12,000 per share to raise capital for proprietary trading, margin lending, and a crypto asset platform.