In Q3/2025, several companies executed real estate project transfers, significantly boosting their financial reports.

Hodeco Exits Ocean Tourism Project

According to the Q3/2025 consolidated financial report, Ba Ria – Vung Tau Housing Development JSC (Hodeco, ticker: HDC, HoSE) recorded a remarkable financial revenue of VND 700 billion. This surge was primarily driven by a VND 696 billion profit from the sale of shares in Ocean Entertainment Investment and Construction JSC in Vung Tau.

Ocean Entertainment Investment and Construction JSC is the developer of the Ocean Tourism Project (commercially known as Antares), spanning 19.6 hectares with a total investment of nearly VND 8.5 trillion.

Hodeco initiated this transaction in 2022, but it was only finalized recently. The company reported investing VND 570 billion to acquire a 42.72% stake in the project (27.55 million shares). On July 1, 2025, Hodeco transferred 27.55 million shares of Ocean Entertainment Investment and Construction JSC for VND 1.639 trillion.

Amid a sharp decline in real estate revenue, this divestment became the primary driver of Hodeco’s profit for the period. Consequently, HDC reported a record after-tax profit of nearly VND 539 billion in Q3/2025, compared to just over VND 13 billion in the same period last year.

While the identity of the transferee remains undisclosed, as of September 30, 2025, Hodeco recorded a short-term receivable of nearly VND 336 billion from Success Real Estate LLC, arising from the sale of shares in Ocean Entertainment Investment and Construction JSC.

This receivable is secured by a deposit of over VND 44 billion from Tan Cuong Investment Consulting and Trading JSC, along with a payment guarantee letter worth over VND 291 billion issued by MB Bank on June 27, 2025.

DIG Transfers Lam Ha Center Point Residential Area

Similar to Hodeco, DIC Corporation (DIG, HoSE) reported significant profits from the transfer of the Lam Ha Center Point residential area in Lam Ha Ward, Phu Ly City, Ha Nam Province (now Ha Nam 1 Ward, Ninh Binh Province) for VND 1.327 trillion, excluding VAT.

Rendering of the Lam Ha Center Point residential project

As a result, DIC Corp recorded a net revenue of over VND 1.339 trillion, 28.3 times higher than the same period last year. After deducting taxes and fees, DIG reported a net profit of over VND 193 billion, 17.3 times higher than the same period last year.

Savico Sells Long Hoa – Can Gio High-End Residential Area

During this period, Saigon General Service Corporation – Savico (SVC) recorded financial income of nearly VND 669 billion, a 3,200% increase year-over-year, primarily from a VND 537 billion profit from the sale of investments. Savico attributed this income to the transfer of real estate project capital during the period.

It is likely that this revenue stems from Savico’s completion of the transfer of its capital in the Long Hoa – Can Gio high-end residential project, earning over VND 619 billion through a public auction. The transferee is Gelex Infrastructure JSC.

The project covers nearly 30 hectares in Long Hoa Commune, Can Gio District (formerly), planned as a high-end residential area for approximately 4,000 residents. Savico partnered with HCMC Foreign Trade and Investment Development JSC (Fideco, FDC) on this project since 2002, with a 50-50 capital contribution ratio.

The project was allocated land by the HCMC People’s Committee in 2005 but has been largely stalled due to legal issues, according to Fideco’s 2024 annual report.

Vinaconex Exits Cat Ba Amatina Project

Another notable transaction in the quarter was Vietnam Construction and Import-Export Corporation (Vinaconex, VCG) exiting the Cat Ba Amatina project.

According to Vinaconex’s Q3/2025 financial report, on August 1, 2025, the company completed the transfer of its entire 107.1 million shares (equivalent to 51% of the charter capital) in Vinaconex Tourism Investment and Development JSC (Vinaconex ITC), the developer of the Cat Ba Amatina project. The project covers 172.37 hectares with a total investment of nearly VND 11 trillion in Cat Ba, Hai Phong City.

This transaction contributed to a financial revenue of VND 3.186 trillion, 87 times higher than the same period last year. Profits from the transfer of subsidiaries and associates amounted to over VND 3.060 trillion. As a result, Vinaconex reported an after-tax profit of VND 3.304 trillion, a 2,140% increase compared to Q3/2024.

Prime Minister’s Mandate for a $500 Billion GDP Impact Model Launching in November

Introducing the first-of-its-kind model in Vietnam, a groundbreaking innovation that sets a new standard in the industry.

Vinasun’s Profit Decline: A Setback Amid Asset Liquidation

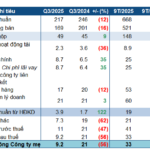

Net profit witnessed positive growth, even doubling year-over-year, yet Vietnam Taxi Corporation (Vinasun, HOSE: VNS) still reported a decline in net income for Q3 due to reduced proceeds from asset disposals.