|

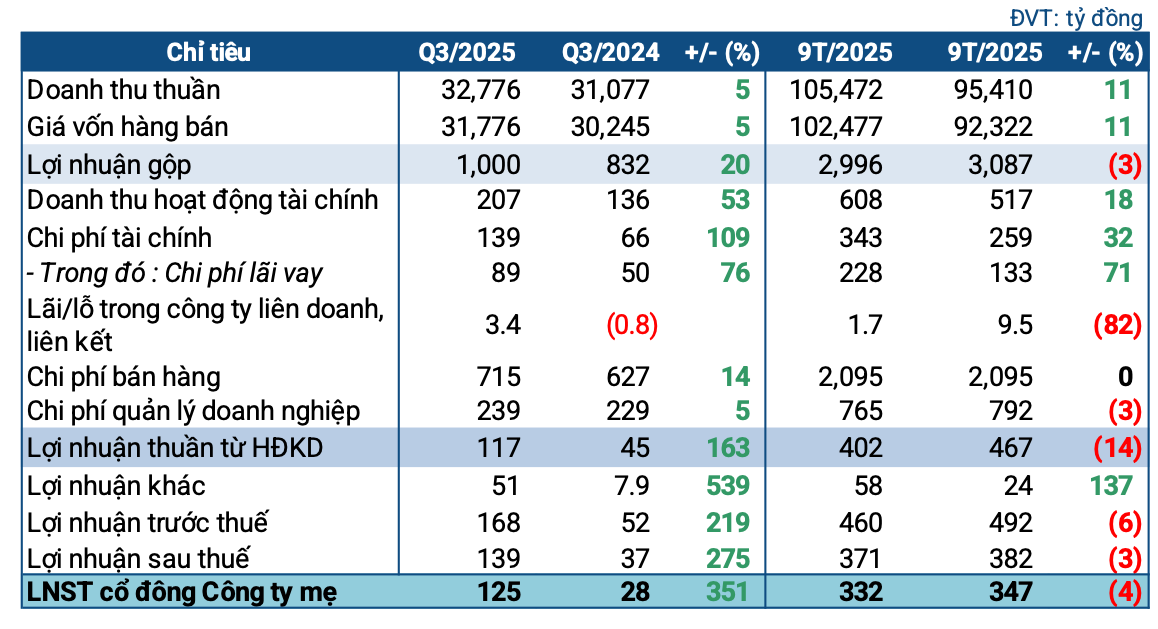

OIL’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, OIL reported net revenue of nearly VND 32.8 trillion, a 5% increase year-on-year. After deducting the cost of goods sold, the company’s gross profit reached nearly VND 1 trillion, up 20%.

Financial activity revenue surged by 53% to VND 207 billion, offsetting the rise in financial expenses to VND 139 billion, double the previous year. Both selling and administrative expenses increased significantly. Despite this, OIL recorded a net profit of VND 125 billion, a strong recovery from the VND 28 billion profit in the same period last year.

PVOIL explained that global and domestic oil prices in Q3/2025 remained stable with minimal fluctuations, compared to the sharp decline (15-19%) in Q3/2024. This stability contributed to the higher gross profit in Q3/2025. Additionally, the parent company’s financial activity income (revenue minus expenses) increased by 65%, primarily due to the reversal of financial investment provisions and higher interest income from deposits.

While Q3 saw significant gains, the cumulative net profit for the first nine months of the year decreased slightly by 4% year-on-year to VND 332 billion, despite an 11% rise in revenue to VND 105 trillion. The company exceeded its revenue target by 8% but achieved only 59% of the post-tax profit plan set by the 2025 Annual General Meeting.

Source: VietstockFinance

|

As of the end of Q3, OIL’s total assets stood at nearly VND 37.4 trillion, an 11% decrease from the beginning of the year, with VND 31 trillion in current assets, down 13%. Total cash (including cash, cash equivalents, and short-term financial investments) reached over VND 15.8 trillion, a 6% decline.

Short-term receivables decreased by 36% to over VND 10.5 trillion, primarily from receivables at BSR. Inventory increased by 13% to over VND 4 trillion.

In terms of capital, total liabilities decreased by 15% to over VND 25.7 trillion, mostly short-term debt. However, short-term loans increased by 26% to nearly VND 9.4 trillion.

– 08:21 03/11/2025

Notable Real Estate M&A Deals in Q3 2025

In Q3/2025, the real estate M&A market witnessed several notable transactions, including Vinaconex’s sale of the Cát Bà Amatina project, Hodeco’s withdrawal from the Đại Dương tourism complex, and DIC Corp’s transfer of the Lam Hạ Center Point project. These deals highlight the dynamic nature of Vietnam’s property sector during this period.

Vinasun’s Profit Decline: A Setback Amid Asset Liquidation

Net profit witnessed positive growth, even doubling year-over-year, yet Vietnam Taxi Corporation (Vinasun, HOSE: VNS) still reported a decline in net income for Q3 due to reduced proceeds from asset disposals.

Oil Prices Stabilize, Petrolimex Profits Surge Ninefold Year-on-Year

Petrolimex (HOSE: PLX), Vietnam’s leading petroleum conglomerate, has released its Q3/2025 consolidated financial report, showcasing a robust recovery compared to the same period last year. This significant turnaround is primarily attributed to the more stable global oil price trends observed during Q3/2025.