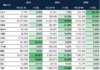

Vietnam’s stock market experienced a sharp decline towards the end of the November 3rd session, driven by heightened profit-taking pressures. Real estate stocks were not exempt, with notable names like CEO, HDC, TCH, NLG, and DXG even hitting the floor.

Real estate stocks plummeted on November 3rd.

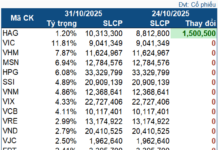

Against this backdrop, shares of Quoc Cuong Gia Lai Corporation (QCG) staged a remarkable rally, closing the session at a ceiling price of 14,150 VND per share. Trading volume surged, with nearly 1.5 million shares changing hands, exceeding the 20-day average. QCG’s market capitalization consequently rose to nearly 3.9 trillion VND.

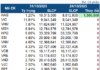

In related news, Quoc Cuong Gia Lai released its Q3/2025 financial report, revealing a 37% decline in revenue to 111 billion VND, primarily due to reduced apartment handovers. For the first nine months of the year, QCG recorded 354 billion VND in revenue (up 46%) and pre-tax profit of 46 billion VND (over four times higher than the same period last year and the highest since 2019). However, these figures fall significantly short of the company’s annual targets of 2 trillion VND in revenue and 300 billion VND in pre-tax profit.

As of September 30th, QCG’s total assets stood at 8.7 trillion VND, including 154 billion VND in cash and bank deposits, and 1.17 trillion VND in inventory.

On the liabilities side, total debt amounted to 4.15 trillion VND, with short-term financial debt at only 157 billion VND and long-term debt exceeding 200 billion VND.

Quoc Cuong Gia Lai’s most significant burden remains its obligations related to the Bac Phuoc Kien residential project. As of September 30, 2025, the outstanding payable to Sunny Island Investment Corporation for the Bac Phuoc Kien project had decreased to 1.983 trillion VND, indicating that QCG had paid 900 billion VND to Sunny Island in the first nine months of the year.

The company further disclosed that in late October, it made an additional payment of 200 billion VND, bringing the total amount paid to Truong My Lan to 1.1 trillion VND.

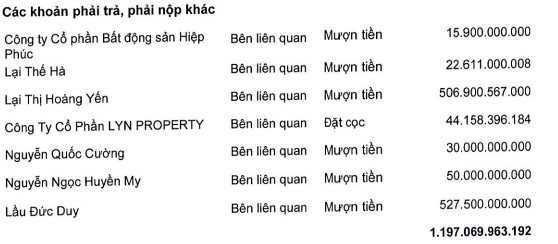

Alongside these substantial payments to settle project obligations, QCG has also significantly increased borrowing from related parties. By the end of Q3/2025, QCG had borrowed over 1.1 trillion VND from individuals, primarily from relatives of its leadership.

Source: QCG’s Q3/2025 Financial Report.

Specifically, the loan from Ms. Lai Thi Hoang Yen, daughter of Chairman Lai The Ha, totaled 507 billion VND, an increase of 400 billion VND compared to three months prior.

Similarly, the loan from Mr. Lau Duc Duy, brother-in-law of CEO Nguyen Quoc Cuong, stood at 527 billion VND, up 395 billion VND from Q2/2025.

Previously, according to the verdict in the Van Thinh Phat case, Quoc Cuong Gia Lai is required to repay 2.883 trillion VND to Sunny Island to regain control of the Bac Phuoc Kien project.

This project was transferred by QCG to Sunny Island between 2016 and 2017. Per the agreement, Sunny Island was to pay a total of 4.8 trillion VND in installments to acquire the land use rights. However, after disbursing 2.883 trillion VND, the partner halted payments, stalling the transaction.

Market Plunge Fears: Investors Brace for Further Losses

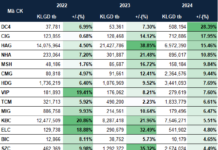

The VN-Index has plummeted for the third consecutive week, shedding nearly 150 points from its historic peak, leaving many investors grappling with significant losses.

Record Sell-Off by Foreign Investors Surpasses 100 Trillion VND: When Will the Pressure Ease?

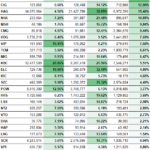

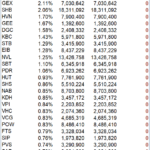

In the first ten months of 2025, foreign investors recorded a net sell-off exceeding 100 trillion VND on the Ho Chi Minh City Stock Exchange (HOSE), surpassing the entire year’s record of 2024 and placing significant pressure on the VN-Index. However, experts anticipate that this pressure will ease in the coming period.

Unveiling the Lender Behind Cuong ‘Do La’s Company’s Billion-Dollar Loan

Quoc Cuong Gia Lai JSC has secured significant financial support through loans from key individuals closely associated with the company. Specifically, the company borrowed 507 billion VND from Ms. Lai Thi Hoang Yen, the daughter of QCG’s Chairman, Mr. Lai The Ha. Additionally, Mr. Lau Duc Duy, the brother-in-law of Mr. Nguyen Quoc Cuong (known as Cuong ‘do la’) and the CEO of QCG, provided a loan exceeding 527 billion VND.