Circular No. 102/2025/TT-BTC enhances state management efficiency in securities and the stock market, ensuring transparency, market effectiveness, and protection of legal rights for all market participants.

Enhancing Financial Safety Metrics Framework

The Minister of Finance has signed and issued Circular No. 102/2025/TT-BTC, amending and supplementing Circular 91/2020/TT-BTC on financial safety indicators and measures for securities firms failing to meet regulations. The circular takes effect from December 15, 2025.

According to the Ministry of Finance, beyond adjustments for consistency with current laws (Law No. 56/2024/QH15 dated November 29, 2024, Decree No. 155/2020/NĐ-CP, Decree No. 245/2025/NĐ-CP, and related guidelines), Circular No. 102/2025/TT-BTC aims to calculate financial safety metrics comprehensively addressing risks in securities companies and fund management firms. This aligns with the rapid expansion and deepening of the stock market, particularly the recent surge in market capitalization.

The issuance of Circular No. 102/2025/TT-BTC enables securities firms to better manage risks, enhance capabilities, and improve service provision, attracting investors—especially foreign ones—as Vietnam’s stock market enters a new growth phase following its upgrade to secondary emerging market status by FTSE Russell.

Additionally, Circular No. 102/2025/TT-BTC strengthens state management of securities and the stock market, ensuring transparency, market efficiency, and protection of legal rights for all participants.

Circular No. 102/2025/TT-BTC amends 7 articles of Circular No. 91/2020/TT-BTC, replaces several appendices, and repeals certain provisions.

Adjusting Risk Coefficients and Available Capital

The Ministry of Finance highlights key amendments in Circular No. 102/2025/TT

Circular No. 102/2025/TT-BTC enhances state management efficiency in securities and the stock market, ensuring transparency, market effectiveness, and protection of legal rights for all market participants.

Refining Financial Safety Indicators Framework

The Minister of Finance has signed and issued Circular No. 102/2025/TT-BTC, amending and supplementing Circular 91/2020/TT-BTC on financial safety indicators and measures for securities firms failing to meet regulations. The circular takes effect from December 15, 2025.

According to the Ministry of Finance, beyond adjustments for consistency with current laws (Law No. 56/2024/QH15 dated November 29, 2024, Decree No. 155/2020/NĐ-CP, Decree No. 245/2025/NĐ-CP, and related guidelines), Circular No. 102/2025/TT-BTC aims to comprehensively calculate financial safety indicators, addressing risks in securities companies and fund management firms. This aligns with the rapid expansion and deepening of the stock market, particularly the recent surge in market capitalization.

The issuance of Circular No. 102/2025/TT-BTC empowers securities firms to better manage risks, enhance capabilities, and improve service delivery, attracting investors—especially foreign ones—as Vietnam’s stock market enters a new growth phase following its upgrade to secondary emerging market status by FTSE Russell.

Additionally, Circular No. 102/2025/TT-BTC strengthens state management of securities and the stock market, ensuring efficient, transparent operations and safeguarding the legal rights of all market participants.

Circular No. 102/2025/TT-BTC amends seven articles of Circular No. 91/2020/TT-BTC, replaces several appendices, and repeals certain provisions.

Adjusting Risk Coefficients and Available Capital

The Ministry of Finance highlights key amendments in Circular No. 102/2025/TT-BTC.

First, regarding available capital, the circular revises rules on undistributed profits to align with current accounting standards. It also adjusts items increasing or decreasing available capital for securities firms, ensuring consistency with Circular No. 91/2020/TT-BTC and reflecting recent operational realities.

Second, for market risk coefficients, the circular updates provisions on listed equity coefficients to align with stock transfer regulations (Decree No. 155/2020/NĐ-CP, Circular No. 57/2021/TT-BTC, Circular No. 69/2023/TT-BTC). It also incorporates non-cash expenses in calculating and measuring investment assets and securities firm activities.

Furthermore, the circular specifies market risk coefficients for rated corporate bonds, enabling risk calculation based on international credit rating standards. Securities firms may reference ratings from Standard & Poor’s, Fitch Rating, Moody’s, or domestically licensed independent rating agencies. The circular also outlines principles for handling multiple ratings or ratings over a year old.

Third, regarding risk valuation, the circular updates asset pricing principles for securities firms, aligning with practices at stock exchanges (including listed equities, listed bonds, and unlisted bonds).

Additionally, Circular No. 102/2025/TT-BTC updates reporting templates for fund management and securities firms to ensure compliance with new regulations.

A six-month transition period is provided for securities firms to adjust operations and meet new financial safety requirements without abrupt market impacts.

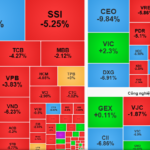

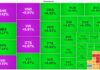

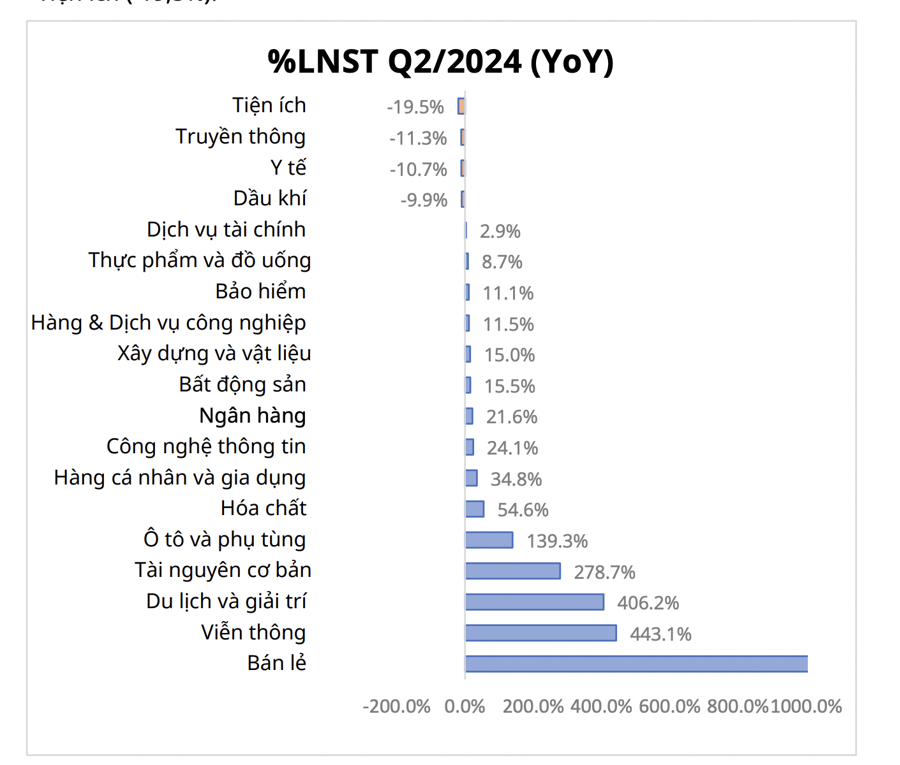

Liquidity Weakens as Capital Flows Out of Multiple Sectors

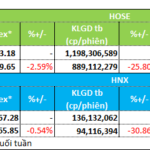

Market activity remained subdued during the trading week of October 27–31, with significant capital outflows observed across multiple sectors.

Vietstock Daily 04/11/2025: Shadows Cast by Gathering Storm Clouds

The VN-Index plummeted for the third consecutive session, forming a bearish Three Black Crows candlestick pattern. Sentiment could turn even more pessimistic if the August 2025 low (around 1,605-1,630 points) is breached in upcoming sessions. Further compounding concerns, both the Stochastic Oscillator and MACD indicators continue to weaken following sell signals, suggesting a lackluster short-term outlook.

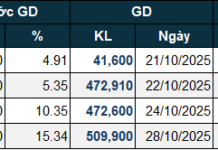

Mysterious Force Unleashes $48 Billion Buying Spree on Vietnamese Stocks in Final Session of October 31st Week

Proprietary trading firms unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase value of VND 1.107 trillion.