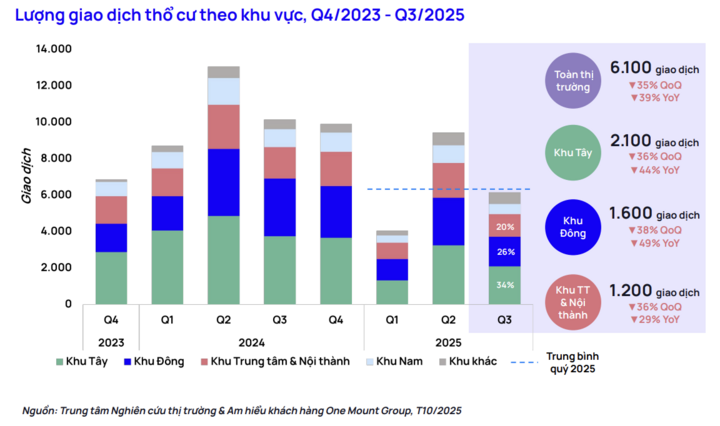

Specifically, in Q3/2025, land transactions saw a significant decline compared to the previous quarter, reaching nearly 6,100 transactions, a 35% quarterly decrease. The average quarterly transaction volume in 2025 has reverted to levels similar to those in 2023.

Annually, land transactions also plummeted by 39%. According to One Mount Group, this decline is primarily attributed to the continued rise in prices, with an average annual increase of 28% in 2025, making this property type increasingly inaccessible to buyers.

Notably, in Q3, the shift from land to apartments became more pronounced, driven by two main factors. First, this transition reflects a change in buyer preferences, particularly among younger homebuyers. The new generation prioritizes modern living spaces, integrated amenities, security, and professional management over land ownership, unlike previous generations.

Additionally, despite the significant increase in apartment prices (both primary and secondary) over the past year (approximately 20% annually), the total cost of a land property remains 2.1 times higher than that of an apartment.

Moreover, flexible financing packages from developers and banks have made it easier for buyers with limited capital to access this market segment, contributing to improved liquidity.

One Mount Group also highlights that the 12 wards with the highest land transaction volumes include 4 in East Hanoi, 3 in West Hanoi, and 5 in the city center and inner districts. These wards account for approximately 50% of Hanoi’s total transactions.

In the East, Bo De and Long Bien wards recorded the highest sales, with nearly 400 and 360 transactions, respectively, due to their direct benefits from infrastructure projects launched in Q3 and well-developed living amenities.

In the West, Yen Nghia and Ha Dong wards saw the most transactions, thanks to their reasonable prices and the advantages of local transportation development projects.

Central and inner-city wards also reported strong sales, driven by high demand for prime urban land ownership and genuine housing needs.

For the 2026 land market forecast, One Mount Group predicts a slight recovery in transactions, with a 9% increase compared to 2025.

Emerging Real Estate Satellite Hubs: A Vibrant Ring Around Ho Chi Minh City

The real estate market is buzzing with activity in the satellite regions surrounding Ho Chi Minh City, as anticipation builds ahead of the city’s expansion. Leading the charge is the former Binh Duong province, topping the charts with an impressive index of 100. Close behind are Dong Nai (38), Ba Ria – Vung Tau (34), and Long An (28), collectively forming a vibrant “satellite belt” around the bustling metropolis.

Ministry of Construction Addresses Solutions to Cool Down Housing Prices

The Ministry of Construction highlights that property prices in many areas do not accurately reflect true supply and demand dynamics. Instead, they are heavily influenced by speculation, opaque planning information, administrative boundary adjustments, and herd mentality. Consequently, there is a pressing need to regulate the real estate market, particularly through measures that balance housing product structures and control land and property transaction prices.

Affordable 1 Billion VND Homes in Dong Da: Why Buyers Are Walking Away Disappointed

Priced at just over 1 billion VND, a rarity for properties in Dong Da district, potential buyers often leave shaking their heads after viewing the property in person.

Affordable Housing: Testing the Restructuring Capabilities of Real Estate Enterprises

After the first nine months of the year, the supply of affordable and mid-range housing remains scarce, while property prices in major cities continue to soar. In response, the proposed development of reasonably priced commercial housing is anticipated to diversify the market, balance supply and demand, and stabilize prices. However, for this policy to be effective, experts emphasize the need to refine legal frameworks, offer investment incentives, and ensure viable profit margins for developers.