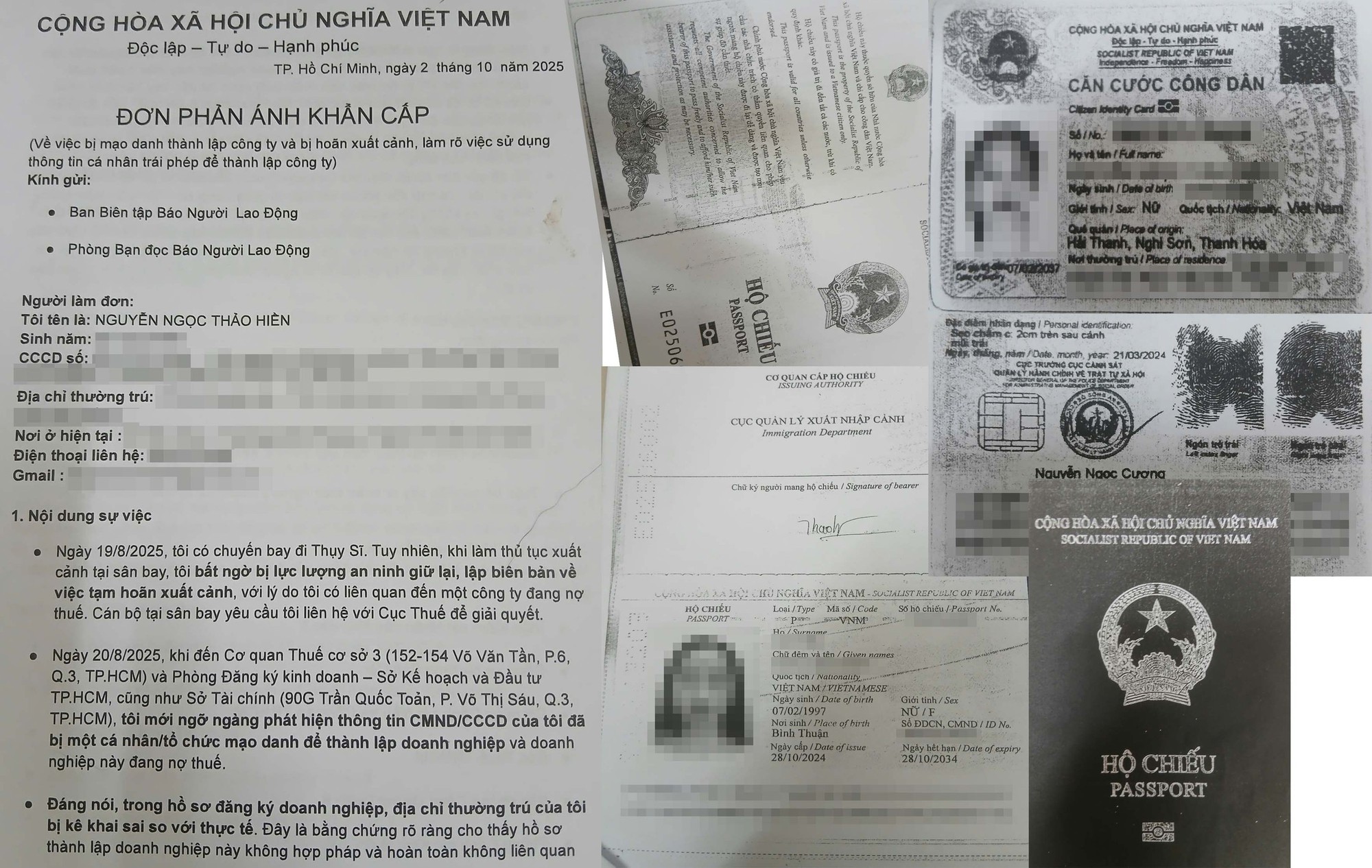

“I was completely taken aback when I was barred from leaving the country by the Tan Son Nhat International Airport Customs Police due to tax arrears,” shared Ms. Nguyen Ngoc Thao Hien (from Lam Dong Province) with the People’s Daily Newspaper.

Unwitting Debtor

Ms. Hien recounted that on August 19th, while processing her flight to Switzerland, she was issued a temporary travel ban by the Tan Son Nhat International Airport Customs Police due to a company’s tax liabilities. She was advised to contact the tax authorities for resolution.

Subsequently, Ms. Hien engaged with Tax Office 3 (under the Ho Chi Minh City Tax Department) and the Ho Chi Minh City Department of Finance to investigate the matter.

The head of Tax Office 3 revealed that Nhung Hinh Vuong Trading Co., Ltd. had outstanding tax debts exceeding 308 million VND. Based on the centralized tax management system linked with business registration authorities, in November 2024, the tax office sent a notice of coercive measures, including a temporary travel ban, to the address at 49 Da Tuong, Thanh Hai Ward, Phan Thiet City, Binh Thuan Province. This address was listed as the permanent residence of Ms. Nguyen Ngoc Thao Hien, the legal representative of Nhung Hinh Vuong Trading Co., Ltd.

However, as the company had not fulfilled its tax obligations, Tax Office 3 requested the police to impose a temporary travel ban on the legal representative to recover the tax debt, as per legal provisions.

The Ho Chi Minh City Department of Finance also provided information that Nhung Hinh Vuong Trading Co., Ltd. was established in 2020 and has not been dissolved. During its operation, the company underwent four changes in information. In the fourth change (October 2023), the company registered its headquarters at 19 Cao Thang, Ward 12, District 3 (now Ban Co Ward), Ho Chi Minh City. Simultaneously, the company changed its owner from Mr. Dinh Duy Minh to Ms. Nguyen Ngoc Thao Hien, updating her as the director and legal representative with a permanent address at 49 Da Tuong, Thanh Hai Ward, Phan Thiet City, Binh Thuan Province.

Ms. Hien asserted that she did not establish the company, authorize anyone to register it, contribute capital, or manage its operations. She believed that her personal information and address were fraudulently used to register the company. Ms. Hien suspected that this might stem from the loss of her ID card years ago, which listed her permanent address in Thanh Hai Ward, Phan Thiet City, Binh Thuan Province.

Similarly, Mr. Ngo Hoang Vy (Ho Chi Minh City) stated that he did not authorize or sign any documents related to the establishment of Van Nien Construction and Transportation Co., Ltd. (located in the former District 7). Yet, in 2022, he discovered he was listed as the legal representative and faced a travel ban due to the company’s tax debts.

Ms. Nguyen Ngoc Thao Hien submits her complaint to the People’s Daily Newspaper

Tightening Loopholes, Erasing Unjust Debts

Mr. Nguyen Van Duoc, a member of the Ho Chi Minh City Tax Consultancy and Agency Association, attributed the loopholes in business registration and information changes to Decree 01/2021/NĐ-CP. This decree allows company founders to authorize others to handle registration without requiring notarized or certified authorization documents. After establishment, companies are not mandated to stamp documents for changes in information such as headquarters, legal representatives, or directors.

Additionally, Decree 01/2021/NĐ-CP stipulates that company founders self-declare registration information and are legally responsible for its legality, truthfulness, and accuracy. Business registration authorities are not liable for violations occurring before or after registration.

According to Mr. Duoc, exploiting these loopholes, fraudsters have long used others’ personal information to establish companies or alter details like headquarters, legal representatives, and directors. If such companies incur tax debts, the individuals whose information was falsified bear the consequences, including the tax liabilities.

“To address this, business registration authorities now upload company establishment documents to the VNeID system. This system requires founders to verify all related information through electronic identification. Consequently, fraudulent use of others’ information to establish companies or change legal representatives is now impossible,” Mr. Duoc explained.

Attorney Tran Xoa, Director of Minh Dang Quang Law LLC, advised that when citizens complain about identity fraud leading to tax debts and travel bans, business registration authorities should forward the case to the police for verification.

If the police confirm fraud, the registration authorities will nullify the victim’s information and notify the tax office to clear the debt. Subsequently, the tax office will request the Immigration Department to lift the travel ban on the individual.

Thorough Verification

Mr. Doan Minh Dung, Director of the Ho Chi Minh City Tax Department, stated that the department is scrutinizing the list of tax-indebted companies. Upon identifying inaccuracies in tax debt records, officers will reissue tax notices.

If taxpayers assert that tax debts resulted from identity fraud, the tax office will conduct thorough checks before applying coercive measures, including travel bans.

“The Ho Chi Minh City Tax Department has discussed with the city’s police leadership measures to prevent fraudulent company registrations and is ready to collaborate with relevant agencies to resolve cases of identity fraud leading to unjust tax debts and travel bans,” Mr. Dung added.

Over 31,000 Businesses in Ho Chi Minh City Owe More Than $1 Billion in Taxes: Which Major Players Top the List?

The Ho Chi Minh City Tax Department has recently released a list of tax defaulters, revealing a staggering total debt of over 25,356 billion VND. Notably, numerous real estate companies have been named and shamed for their substantial outstanding tax liabilities.

High-Speed Rail Link: Ho Chi Minh City Proposes Fastest Route Connecting Long Thanh to Tan Son Nhat

The Ho Chi Minh City People’s Committee has submitted a detailed proposal to Prime Minister Pham Minh Chinh and Deputy Prime Minister Tran Hong Ha regarding the development of a rail link connecting Tan Son Nhat and Long Thanh airports. This initiative aims to enhance transportation efficiency and reduce travel time between the two major aviation hubs in the region.

Latest Proposal on International Flight Operations at Tan Son Nhat and Long Thanh Airports

Facing mounting pressure from aircraft shortages and disrupted supply chains, Vietnam Airlines proposes a phased transition of international routes from Tan Son Nhat to Long Thanh Airport, rather than an immediate wholesale shift. This approach is seen as a balanced strategy, harmonizing infrastructure planning with the realities of market operations.