The Minister of Finance has issued Circular No. 102/2025/TT-BTC, amending and supplementing certain provisions of Circular No. 91/2020/TT-BTC, which outlines financial safety indicators and measures to address securities firms failing to meet these standards (Circular No. 102/2025/TT-BTC). This circular takes effect from December 15, 2025.

Circular No. 102/2025/TT-BTC includes adjustments to align with current legal frameworks, including Law No. 56/2024/QH15 dated November 29, 2024, Decree No. 155/2020/NĐ-CP, Decree No. 245/2025/NĐ-CP, and related implementing documents.

The circular amends seven articles of Circular No. 91/2020/TT-BTC, replaces several appended annexes, and repeals certain provisions. Key amendments in Circular No. 102/2025/TT-BTC include:

Available Capital: Revised rules on undistributed profits for calculating available capital to align with current accounting standards. Adjustments to additions and deductions in calculating available capital for securities firms ensure consistency with Circular No. 91/2020/TT-BTC and reflect recent operational realities.

Circular No. 102/2025/TT-BTC amends Circular No. 91/2020/TT-BTC, effective from December 15, 2025, updating financial safety indicators and measures for securities firms.

Market Risk Coefficients: Updated rules for listed stocks to align with stock transfer regulations under Decree No. 155/2020/NĐ-CP, Circular No. 57/2021/TT-BTC, and Circular No. 69/2023/TT-BTC. The circular also introduces non-cash expense considerations in calculating and measuring investment assets and securities firm activities.

Additionally, the circular specifies market risk coefficients for corporate bonds with credit ratings, enabling risk calculation based on international credit rating standards. This supports the implementation of Law No. 56/2024/QH15, which mandates credit ratings in bond issuance and investment.

Securities firms may reference credit ratings from three international agencies—Standard & Poor’s, Fitch Rating, and Moody’s—and other independent agencies certified by the Ministry of Finance. The circular also outlines principles for handling multiple ratings or ratings over a year old.

Risk Pricing: Revised valuation principles for securities and other assets to align with listing and trading practices at stock exchanges, including registered stocks, listed bonds, and unlisted bonds.

Reporting Templates: Updated reporting templates for fund management and securities companies to reflect the above amendments.

Transition Provisions: A six-month adjustment period for securities firms to comply with new risk measures and maintain financial safety ratios, minimizing disruption.

Circular No. 102/2025/TT-BTC aims to comprehensively address risks in securities firms’ operations, reflecting the rapid growth and deepening of Vietnam’s stock market, particularly its market capitalization expansion.

This circular enhances risk management, service capabilities, and investor attraction, especially from foreign investors, as Vietnam’s stock market enters a new development phase following its upgrade to secondary emerging market status by FTSE Russell.

Furthermore, the circular strengthens state management of securities and the stock market, ensuring efficient, transparent operations and protecting market participants’ rights and interests.

Mysterious Force Unleashes $48 Billion Buying Spree on Vietnamese Stocks in Final Session of October 31st Week

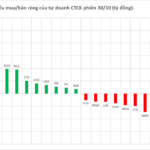

Proprietary trading firms unexpectedly turned net buyers on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase value of VND 1.107 trillion.

Blue-Chip Stock Code Witnessed Abnormal Accumulation of Over 100 Billion VND by Securities Company’s Proprietary Trading Desk on October 30th Session

Proprietary trading firms have resumed net buying on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase of VND 82 billion. This marks a significant shift in market sentiment, as these firms leverage their expertise to capitalize on emerging opportunities within Vietnam’s dynamic equity landscape.

VN-Index Projected to Hit 1,800 by 2026: Three Key Drivers Fueling a New Growth Cycle

According to experts, three key factors—market upgrades, a wave of large-scale IPOs, and the influx of foreign capital—will converge to create significant opportunities for Vietnam’s stock market. For 2026, a target of 1,800 points is deemed appropriate, paving the way for a long-term ascent toward the 2,000 mark.