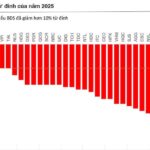

While the first nine months of 2025 have painted a bright picture of profitability and growth for some, many businesses continue to grapple with significant challenges, reporting substantial losses.

Leading the pack in pre-tax losses for the first nine months is Novaland Group, with a pre-tax loss of 1.043 trillion VND. This marks a significant improvement from the 3.104 trillion VND loss recorded previously. A sharp decline in financial revenue and foreign exchange losses contributed to Novaland’s 782 billion VND pre-tax loss in Q3 2025.

Beyond Novaland, three other real estate companies feature prominently.

In second place is Pomina Steel, with a recorded loss of 511 billion VND. In Q3, Pomina lost nearly 183 billion VND, marking its 14th consecutive quarter of losses and the 13th consecutive quarter with losses exceeding 100 billion VND. As of September 30, 2025, Pomina’s accumulated losses surpassed 3 trillion VND, with negative equity of 187 billion VND.

NSH Petro ranks third with a loss of 473 billion VND. In the first nine months of 2025, NSH Petro generated a mere 15 billion VND in net revenue (compared to nearly 619 billion VND in the same period last year). In Q3, the company reported zero revenue while still incurring management and interest expenses.

Other companies reporting losses exceeding 200 billion VND in the first nine months of 2025 include Phuoc An Port (379 billion VND), Hoang Anh Gia Lai Agriculture (HAGL Agrico – HNG) (375 billion VND), Vinaincon (255 billion VND), and Cao Bang Steel (CBI) (200 billion VND).

Several companies have also shifted from profitability to losses. For instance, International Dairy LOF (IDP) plummeted from a 1.031 trillion VND profit in the first nine months of 2025 to a 100 billion VND loss. Similarly, Dong Duong Imex (DDG) went from an 8 billion VND profit to a 192 billion VND loss, Viet Phat (VPG) from a 23 billion VND profit to a 158 billion VND loss, and SMC Steel from a 32 billion VND profit to a 140 billion VND loss. Gilimex, Thai Nguyen Hospital, Dai Thien Loc, and Phu Tho Tourism Services also joined the ranks of companies transitioning from profit to loss.

Analyzing industry sectors, real estate emerges as the most represented group in the top losers, with four companies. The steel sector follows with three representatives: Pomina, Cao Bang Steel, and Dai Thien Loc. The logistics sector (shipping and ports) contributes two names: Phuoc An Port (PAP) and Nosco (NOS). The food and beverage (F&B) sector also features two companies: International Dairy LOF and Chuong Duong Beco.

Real Estate Expert: The Era of ‘Flip-and-Sell’ Investing is Over

According to experts, the real estate market is shifting towards sustainable development, transitioning from short-term speculation to long-term investment.