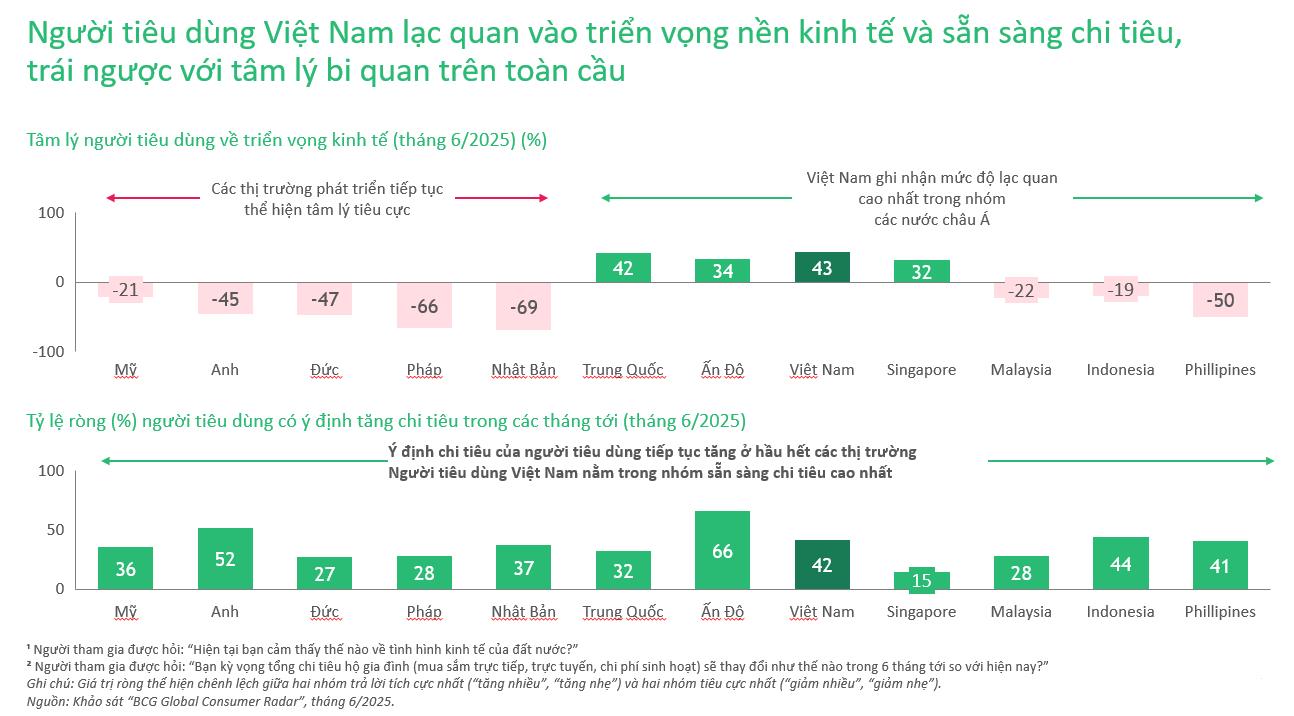

Unlike most global consumers, Vietnamese consumers exhibit a unique optimism about their country’s future. This optimism is translating into a robust spending momentum.

Compared to other Southeast Asian countries like Malaysia, Singapore, Indonesia, and the Philippines, Vietnamese consumers display a significantly higher level of optimism, with a 43% higher optimism score than pessimism, reflecting a strong collective confidence in the national economy.

Similarly, Vietnamese consumers’ willingness to spend is impressive, with 42% planning to increase their spending in the coming months, positioning Vietnam among the top 5 most optimistic countries in terms of consumption.

This surge in spending is not coincidental. Over the years, Vietnam has recorded remarkable economic growth, with a GDP increase of 7.1% in 2024 and a projected 6.6% in 2025.

This growth momentum continues strongly in 2025, with foreign direct investment (FDI) reaching its highest level in nearly a decade. In the first seven months of 2025, FDI increased by 8.4% compared to the same period last year, totaling $13.6 billion. This influx of capital is creating more job opportunities as FDI projects expand in manufacturing and services, providing workers with better access to employment and stable incomes. This income security bolsters consumer confidence and drives household spending.

This prosperity also opens new opportunities for Vietnam’s economy, which is on track to become a middle-high-income country by 2030. By then, 80% of the population is expected to belong to the middle or upper class. Urbanization rates are projected to rise from 45% in 2025 to 50% in 2030, fostering numerous business opportunities in growing cities and expanding the domestic consumer market.

Despite global economic challenges and tariff fluctuations, domestic consumer demand remains stable. Thanks to flexible monetary policies, such as low-interest rates and credit limit waivers, spending momentum is sustained, as evidenced by an 11.3% increase in total retail sales compared to the previous year.

“My World” Matters More Than “The World Out There”

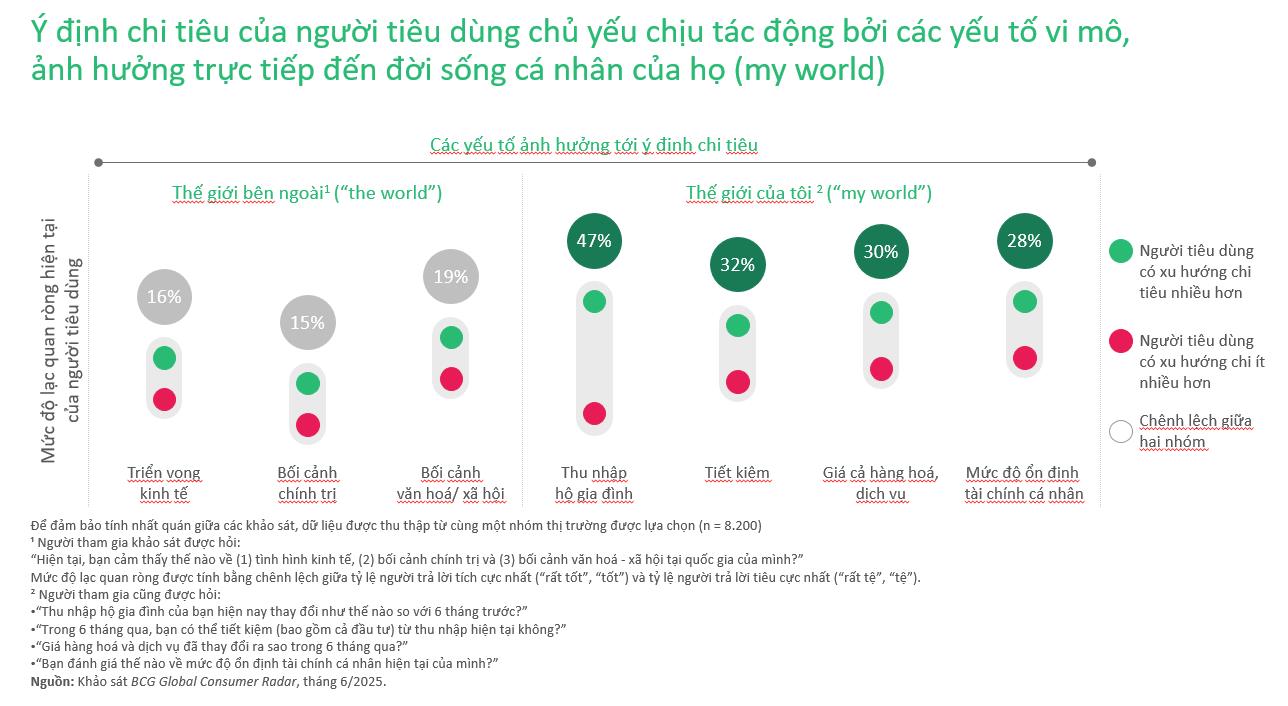

According to the Global Consumer Radar survey by Boston Consulting Group (BCG), global consumers are increasingly focusing on their personal finances—”my world”—when making spending decisions. Instead of being influenced by macroeconomic perceptions or “the world out there,” they adjust their shopping behaviors to align with their actual financial capabilities.

Vietnamese consumers strongly reflect this trend. For them, household income growth and stable savings are far more important than global interest rates or international trade policies. Only 36% of Vietnamese consumers believe tariffs could increase product prices, compared to 73% in Singapore, 67% in Malaysia, and 65% in the Philippines.

Globally, 65% of consumers worry about price increases due to import tariffs, and 75% plan to cut back on spending. However, in Vietnam, even with expected price rises, only 11.2% of consumers plan to adjust their shopping behavior, such as switching to cheaper brands, buying less, or seeking promotions for alcoholic beverages, snacks, and personal care products.

Spending Behavior Varies by Income Level

While most Vietnamese consumers are optimistic about spending, there are clear differences in behavior across income groups.

Low- and middle-income households are more price-sensitive when buying alcoholic beverages and snacks but maintain stable spending on essentials like food, non-alcoholic drinks, and clothing. For these consumers, businesses should focus on “value and affordability,” ensuring core products remain accessible without compromising quality.

In contrast, high-income households have greater disposable income, leading to increased spending on entertainment, travel, automobiles, and household appliances—categories showing significant growth in spending intentions. These consumers prioritize quality, exclusivity, and convenience, offering businesses opportunities to develop new products or services.

Building Strategies from Insights

Positive consumer sentiment doesn’t guarantee spending behavior. Beyond surface-level optimism, businesses must understand how different income groups balance essential needs with aspirational desires.

Rapid urbanization and high digital connectivity in Vietnam make the consumer landscape more complex than ever. Brands need to know not just who is spending, but how and where they are spending.

Geographically, major cities like Hanoi, Ho Chi Minh City, and Da Nang, home to higher-income households, prioritize premium products emphasizing innovation, quality, and lifestyle value. In contrast, smaller cities and rural areas, with more limited household budgets, prefer competitively priced essentials for daily living.

In terms of promotions, blanket discount strategies may attract short-term attention but reduce profit margins and brand loyalty. Instead of relying on short-term discounts, businesses should focus on value-driven bundles, multi-buy deals, or personalized app-based offers. These approaches not only effectively retain price-sensitive customers but also build long-term brand relationships.

Businesses maintaining a balanced product portfolio of both affordable and premium options will have a long-term competitive advantage, even in a volatile global economy. By offering flexible choices—both budget-friendly and high-end—brands can meet diverse consumer needs, whether they aim to upgrade or cut back on spending as incomes fluctuate. This is key to sustaining stable and sustainable growth.

Vietnam is leading the region in digital engagement, with social commerce accounting for nearly 45% of total online sales. Livestreaming has become a primary channel for both product discovery and conversion. Brands combining entertainment with personalized offers are engaging Gen Z faster than traditional channels. BCG predicts Gen Z consumers will contribute up to 35% of national consumption growth by 2030.

Additionally, Vietnam presents a unique market blend of optimism and complexity, where strong economic prospects are driven by highly personalized spending habits. This intersection creates a powerful tailwind for future consumption. Businesses that accurately identify opportunities and strategize effectively will gain a leading position not only in Vietnam but also across the region.

As Vietnam approaches upper-middle-income status, Vietnamese consumers will shape Asia’s next development chapter—more confident, connected, and sophisticated than ever. For brands, the question is no longer “Should we enter the Vietnamese market?” but “How can we adapt quickly to its growing complexity?”

Thank you to Mr. Nguyen Ha Thanh Luan, Senior Project Director at Boston Consulting Group Vietnam, and Mr. Kwon Il-Dong, Managing Director and Partner at Boston Consulting Group Vietnam, for their contributions to this article.

Banks Focus on Supporting Businesses and Boosting Economic Growth in the Final Two Months of the Year

Implementing the 2025 monetary policy objectives outlined in Directive No. 01 from the State Bank of Vietnam (SBV), alongside local mandates, banking operations in Ho Chi Minh City and Dong Nai Province will focus on targeted solutions to support businesses and drive economic growth during the final two months of the year.

Vietnamese Citizens Deposit Over 8 Quadrillion Dong in Credit Institutions

According to the State Bank of Vietnam, deposits from residents in credit institutions have reached approximately 8 quadrillion VND since the beginning of the year, marking a nearly 13% increase compared to the same period last year. This substantial financial resource plays a crucial role in sustaining Vietnam’s high GDP growth momentum.

Elevating Vietnam’s Stock Market: A Golden Opportunity to Cement Its Global Financial Standing

Speaking at the Emerging Vietnam “Beyond the Upgrade” event hosted by SSI Securities, Ms. Wanming Du, Director of Asia-Pacific Policy at FTSE Russell, remarked that over the past decade, she has witnessed numerous markets transition from frontier to emerging status. However, no country compares to Vietnam in terms of the speed and scale of its reforms.

Pyn Elite Fund: Market Pullbacks Are Transient, Bullish Trend Remains Intact

According to Pyn Elite Fund, the upward trajectory of the stock market is underpinned by robust economic growth and substantial corporate profit expansion.