Illustrative Image

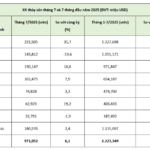

The year 2025 marks a significant recovery for the global surimi industry, driven by robust growth in key markets across the Asia-Pacific region. Amid this resurgence, Vietnam has emerged as a standout exporter. According to data from the Vietnam Association of Seafood Exporters and Producers (VASEP), the export value of fish cakes and surimi reached over $257 million in the first nine months of the year, a 26.1% increase compared to the same period in 2024.

Asian markets remain the industry’s cornerstone, with South Korea and Thailand leading the way, accounting for 25% and 23% of Vietnam’s total export turnover, respectively. Both markets recorded double-digit growth—17% in South Korea and 24% in Thailand.

Exports to countries participating in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also show promising growth, with double-digit increases. The China & Hong Kong market expanded by 45%, reaching nearly $36 million. Notably, the European Union (EU) saw a remarkable 79% surge, fueled by rebounding demand in Lithuania and Spain.

Another highlight is Malaysia’s explosive growth, with a 44% increase in the first nine months, signaling Southeast Asia’s emergence as a new potential market for Vietnamese surimi products.

In 2025, global surimi prices have stabilized after hitting a low point in late 2023, driven by renewed demand, particularly for convenience and ready-to-eat seafood products like crab sticks, fish cakes, and seafood snacks.

Major producers in Thailand, China, and Vietnam are investing heavily in advanced processing lines to enhance product value and meet stringent import standards. Simultaneously, traceability, sustainability certifications, and food safety compliance are becoming mandatory for maintaining export competitiveness.

Analysts predict that global surimi prices will remain stable or slightly increase by the end of 2025, supported by well-managed raw material supplies and sustained consumer demand. By 2026, the market is expected to grow sustainably at 5–7% annually, with Asia remaining central and Europe and the U.S. expanding in the value-added product segment.

However, Vietnamese enterprises face intensifying competition from regional suppliers, fluctuating logistics costs, and technical barriers.

To navigate these challenges, Vietnamese companies must adopt proactive strategies, including securing raw material sources, investing in value-added products, diversifying markets, and expanding distribution channels. Expanding into high-growth markets like Malaysia and the EU, or leveraging CPTPP tariff benefits, offers a viable path forward.

Aquaculture Experts Predict 2025 Seafood Exports Unlikely to Hit $11 Billion Target

Despite Vietnam’s seafood exports surpassing $8 billion in the first nine months of the year, marking a nearly 16% increase compared to the same period last year and fueling optimism for a promising year, VASEP experts assert that achieving the $11 billion target by 2025 remains a significant challenge.

U.S. Urged to Objectively Review Seafood Trade by Vietnam’s Minister of Industry and Trade

On September 15th, Vietnam’s Minister of Industry and Trade, Nguyen Hong Dien, sent a letter to U.S. Secretary of Commerce Howard Lutnick. In the letter, Minister Dien urged the U.S. to reconsider its decision to deny equivalency status to 12 Vietnamese seafood harvesting methods. He emphasized that this decision could significantly disrupt bilateral trade and jeopardize the livelihoods of hundreds of thousands of Vietnamese fishermen and workers.

“Racing” Against Countervailing Duties, Seafood Exports Surge by Over 17%

The seafood industry’s export performance in the first seven months of 2025 has been impressive, reaching 6.22 billion USD, a substantial 17.2% increase compared to the same period last year. However, this success hides a frantic race against time for many exporters, who rushed to expedite orders to the US before the implementation of new retaliatory tariffs on August 1, 2025, as announced by the US in early July 2025.