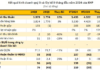

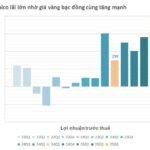

Vimico (Vietnam Minerals Corporation, stock code: KSV) has released its Q3 2025 financial report, showcasing a remarkable performance. The company recorded a revenue of nearly VND 3,868 billion and a post-tax profit of VND 594 billion, marking a 26.1% and 148% increase, respectively, compared to the same period in 2024.

For the first nine months of 2025, Vimico’s cumulative revenue reached VND 10,851 billion, a 13% growth year-on-year. The significant improvement in profit margins led to a 74% surge in post-tax profit, totaling nearly VND 1,368 billion, far exceeding the VND 788 billion recorded in the same period of 2024.

Vimico attributes this impressive profit growth to the substantial increase in both sales volume and average selling prices of its core products.

Among its flagship products, gold took the lead with a selling price of VND 2.47 billion per kilogram (up by VND 741 million per kilogram) and a sales volume increase of 136 kilograms. Silver followed suit, with a selling price of VND 22.7 million per kilogram (up by VND 5.3 million per kilogram) and a sales volume increase of 266 kilograms, among others.

Additionally, both copper sheets and zinc ingots experienced growth in both selling prices and sales volumes, contributing significantly to the company’s overall profit.

Gold, a flagship product of Vimico, achieved a selling price of VND 2.47 billion per kilogram (up by VND 741 million per kilogram) with a sales volume increase of 136 kilograms. Illustrative photo

As of September 30, Vimico held VND 5.5 billion in cash and VND 447 billion in non-term bank deposits, a 29% increase from the beginning of the year. Additionally, the company had VND 136 billion in term deposits. In total, Vimico holds nearly VND 590 billion in cash and deposits.

The company earned VND 3.5 billion in interest from its bank deposits in the first nine months, averaging VND 390 million per month.

Furthermore, Vimico recorded a foreign exchange gain of nearly VND 588 million from currency trading and settlements, a 192% increase compared to the same period last year.

Vimico, a subsidiary of the Vietnam National Coal and Mineral Industries Group (Vinacomin), is a leading domestic enterprise in the exploration, processing, and production of non-ferrous and precious metals, including copper, zinc, lead, gold, and silver.

Currently, Vimico is also managing and operating the Dong Pao mine, the largest rare earth mine in the country.

For 2025, the company plans to produce 60,716 tons of copper ore, 30,000 tons of copper cathode, 173,681 tons of iron ore, 806 kilograms of gold, and 2,751 kilograms of silver, among other targets.

On the stock market, KSV shares are trading at VND 163,000 per share, up 12% in the past month and over 53% since the beginning of 2025.

Bùi Cao Nhật Quân’s Debt to Novaland Reaches Nearly Hundred Billion VND

Novaland is currently owed VND 76 billion by Mr. Bui Cao Nhat Quan, the son of Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors. This receivable has been reflected in Novaland’s financial reports since 2020. In the recently released Q3 financial report, the debt was reclassified from long-term to short-term.

Unveiling the Lender Behind Cuong ‘Do La’s Company’s Billion-Dollar Loan

Quoc Cuong Gia Lai JSC has secured significant financial support through loans from key individuals closely associated with the company. Specifically, the company borrowed 507 billion VND from Ms. Lai Thi Hoang Yen, the daughter of QCG’s Chairman, Mr. Lai The Ha. Additionally, Mr. Lau Duc Duy, the brother-in-law of Mr. Nguyen Quoc Cuong (known as Cuong ‘do la’) and the CEO of QCG, provided a loan exceeding 527 billion VND.

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-218x150.png)

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-150x150.png)

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-100x70.png)