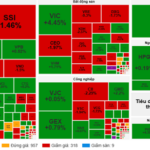

Last week’s market dynamics revealed a dominant selling pressure, interspersed with technical rebounds that failed to sustain upward momentum. Selling pressure concentrated on overheated sectors such as real estate, securities, banking, and retail. Meanwhile, green returned to long-accumulated sectors with strong fundamentals, including technology, telecommunications, seafood, chemicals, insurance, industrial zones, and textiles.

By the end of the week, the VN-Index dropped by 2.59% to 1,639 points. Liquidity significantly decreased, with trading volume on HoSE falling by 26% compared to the previous week. Investors showed caution, though bottom-fishing activities were observed in fundamentally strong stocks adjusting to April-May price levels.

Foreign investors continued their 15th consecutive week of net selling, though the scale decreased from the previous week, with a net value of 2,722 billion VND on HoSE. FPT (+1,928 billion VND), VPB (+250 billion VND), and HDB (+238 billion VND) were the top net-bought stocks. Conversely, MBB (-1,276 billion VND), SSI (-1,006 billion VND), and ACB (-836 billion VND) faced the heaviest net selling pressure.

The VN-Index closed its third consecutive week of decline, continuing its adjustment trend after peaking around 1,800 points.

Market sentiment remains cautious, with investors selectively focusing on companies with positive Q3 earnings or deeply discounted valuations. Analysts suggest this could signal portfolio restructuring amid heightened short-term risks.

According to Vietcombank Securities (VCBS), the VN-Index’s strong 30-point decline on the final trading day indicates prevailing caution. The market may need more time to absorb current supply pressures.

Amid volatility, VCBS advises investors to prioritize risk management, closely monitor market movements, and review portfolios to cut losing positions. Maintaining purchasing power and stability will help capitalize on recovery opportunities for portfolio restructuring and short-term gains.

BIDV Securities (BSC) experts note persistent short-term risks and unclear trends due to high volatility and declining liquidity. The 1,620-1,625 point range has provided strong support since August. VN-Index needs to narrow its trading range to establish a firmer price foundation.

Nhat Viet Securities (VFS) analysts highlight weak demand at higher price levels and declining liquidity, emphasizing the need for accumulation in both short and medium terms. In November, investors should focus on cyclical sectors, particularly those benefiting from monetary easing and retail trends.

Institutional demand remains stable, supporting market balance during adjustments. Favorable macroeconomic conditions, including anticipated Fed rate cuts, are expected to lower interest rates and stabilize Vietnam’s exchange rate.

Short-term risks arise from the post-Q3 earnings “information vacuum.” The VN-Index may enter a deeper correction or accumulation phase, creating attractive discount opportunities for returning capital.

With the sideways trend intact, investors should maintain 50-80% stock exposure, avoiding premature actions until clear signals emerge. VFS outlines two November scenarios:

Scenario 1 (30% likelihood): VN-Index bottoms and rebounds toward 1,800 points. Scenario 2 (70% likelihood): Increased selling pressure tests 1,600-point support. Investors should reduce exposure and await rebounds from deeper support around 1,532 points.

Two Scenarios for Vietnam’s Stock Market in November 2025

According to VFS, the short-term sideways trend remains intact. Investors are advised to maintain stock allocations between 50-80% of their portfolios and refrain from premature actions until clear signals emerge.

Market Pulse 03/11: Red Wave Sweeps Across, VN-Index Plunges Over 22 Points

At the close of trading, the VN-Index dropped 22.65 points (-1.38%), settling at 1,617 points, while the HNX-Index fell 6.67 points (-2.51%), closing at 259.18 points. Market breadth was overwhelmingly negative, with 468 decliners outpacing 229 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 4 advanced, and 3 remained unchanged.

Expert Insights: VN-Index May Dip Below 1,600 Points, Opening Opportunities for Select Stocks in a “New Cycle”

According to experts, this is the phase where investors should prioritize preserving their positions and preparing for the next cycle, rather than chasing short-term gains. The equity allocation within portfolios should ideally remain around 50%.