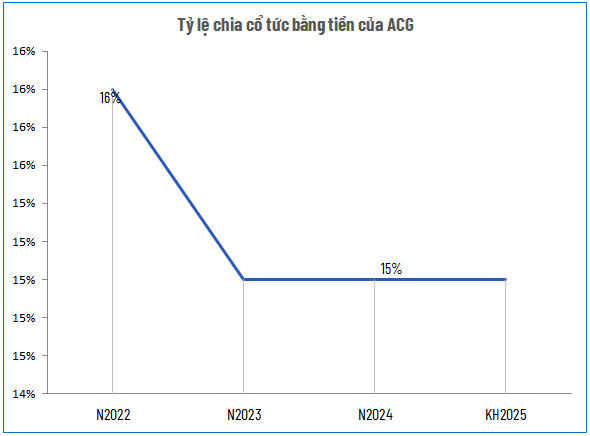

With over 150 million shares outstanding, ACG will allocate approximately VND 196 billion for this dividend payment. The disbursement is scheduled to commence on November 25th.

Source: VietstockFinance

|

For 2025, the company has set a target of VND 4,047 billion in net revenue and VND 450 billion in post-tax profit, marking a 2% and 7% increase respectively compared to 2024. Additionally, ACG has committed to a minimum dividend payout ratio of 15%, either in cash or stock. Consequently, ACG is expected to execute one more dividend distribution to fulfill its annual plan.

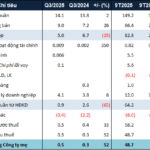

| ACG’s Financial Performance Over the Years |

Over the past three years (2022-2024), ACG has consistently paid cash dividends. In 2022, the company recorded a record profit of VND 616 billion and distributed a 16% dividend—the highest in three years. In the subsequent two years, the dividend rate stabilized at 15% as profits remained around VND 400 billion.

| ACG’s 9-Month Financial Performance Over the Years |

In the first nine months of 2025, the company led by Mr. Lê Đức Nghĩa achieved net revenue of VND 2,940 billion and a net profit of VND 358 billion, representing a 6% and 9% increase year-on-year, respectively. This performance equates to 73% and 80% of the annual targets.

Source: VietstockFinance

|

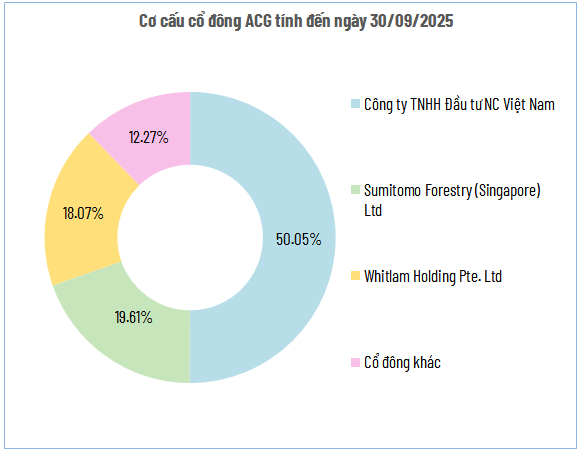

As of September 30, 2025, NC Vietnam Investment LLC is the largest shareholder, holding over 50% of the capital, and is expected to receive approximately VND 98 billion in dividends. The other major shareholders, Sumitomo Forestry and Whitlam Holding, hold nearly 20% and over 18% of the capital, respectively, and are set to receive more than VND 38 billion and VND 35 billion in dividends.

– 13:00 05/11/2025

Veteran Leader Kang Moon Kyung Steps Down from Mirae Asset’s Board of Directors

Following the extraordinary 2/2025 shareholders’ meeting on November 4th, Mirae Asset Securities (Vietnam) Joint Stock Company announced significant changes to its Board of Directors.

Novaland-Affiliated Leaders Fail to Fully Offload Registered NVL Shares

Diamond Properties has successfully offloaded over 1.1 million NVL shares, representing 52.2% of the total registered shares initially planned for sale, following an adjustment to their trading strategy.