|

Vietnam’s VN-Index Performance from Early

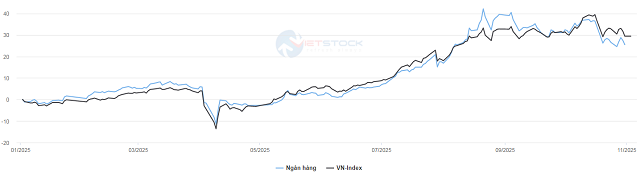

Vietnam’s stock market experienced a month of significant volatility, marked by dramatic highs and lows. In the first half of October, investor sentiment soared as FTSE Russell upgraded Vietnam’s market status from “Frontier” to “Secondary Emerging,” propelling the VN-Index to a historic peak of 1,766.85 points on October 16. However, the index plummeted by over 35 points on October 17 and lost an additional 94 points on October 20 due to profit-taking pressure at the peak. By the end of October, the VN-Index closed at 1,639.65 points, down 1.3% from September’s end.

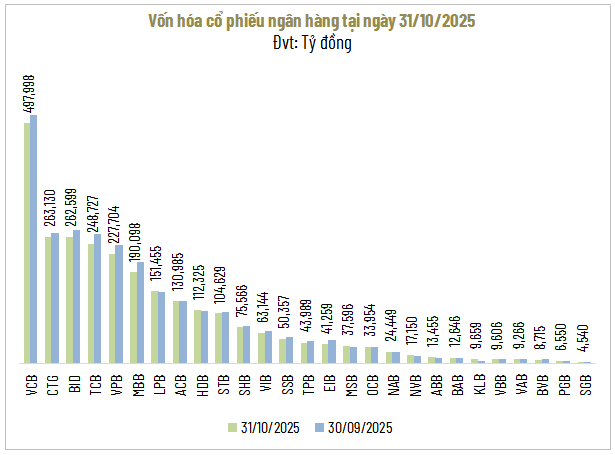

Notably, the banking sector index—a key market influencer—continued its decline, falling 4.3% to 976.77 points, marking its second consecutive month of weakness. Banking Sector Market Cap Sheds Over 108 Trillion VND As of October 31, the banking sector’s total market capitalization stood at 2.7 trillion VND, down 108 trillion VND (3.9%) from September’s end, marking the second straight month of decline.

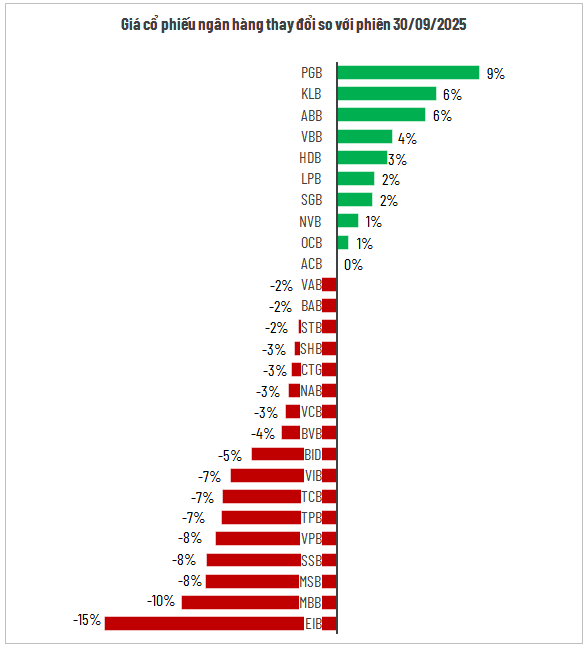

This decline stemmed from negative stock price movements. State-owned banks saw uniform drops: VCB and CTG lost 3%, while BID shed 5% in market cap. Private banks fared worse, with EIB and MBB both losing over 10%. Conversely, a few stocks posted modest gains, led by PGB (+9%), and KLB and ABB (both +6%).

Liquidity Contracts

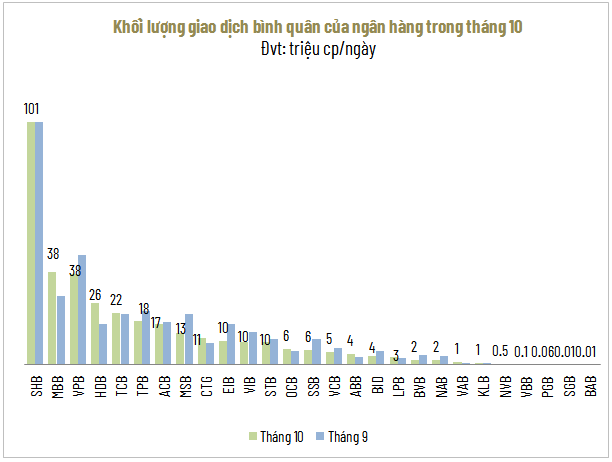

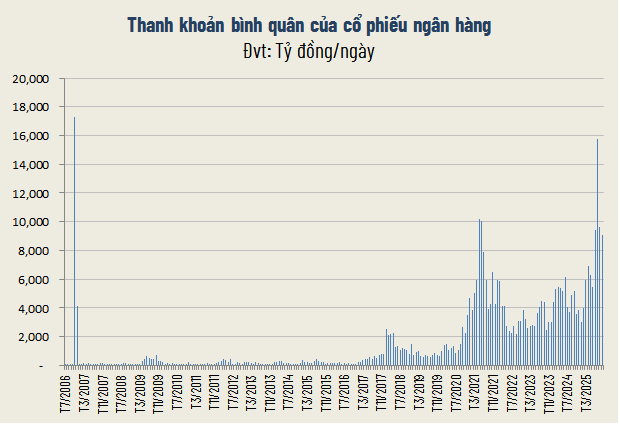

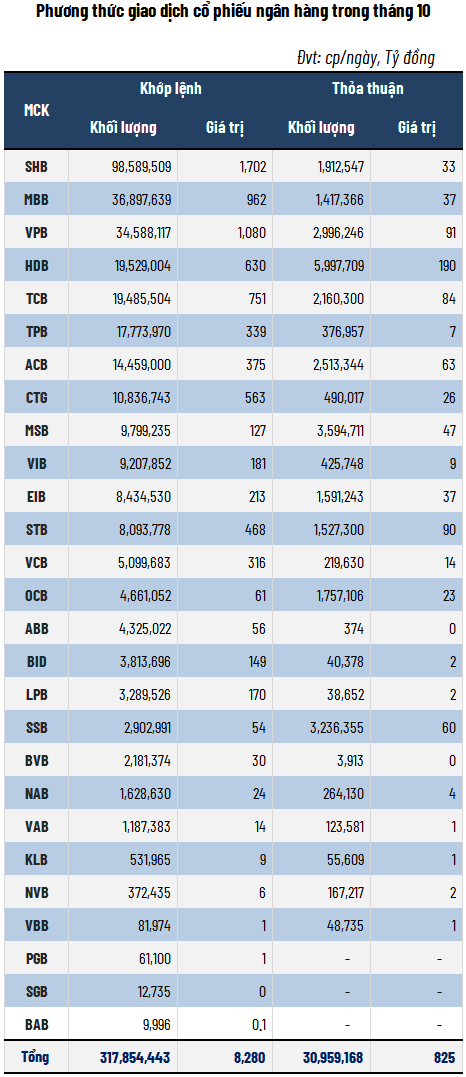

Alongside price declines, banking stock liquidity shrank significantly. In October, average trading volume fell over 20% to 349 million shares/session, while average trading value dropped 6% to 9.105 trillion VND/session—still the fourth-highest level since July 2021.

Stocks with notable liquidity increases included VAB (+89%), VBB (+59%), PGB (+55%), HDB (+51%), NVB (+41%), and MBB (+34%). In contrast, BVB (-48%), NAB (-46%), SSB (-42%), and EIB (-41%) saw the sharpest liquidity declines. SHB maintained its lead with an average 101 million shares/session, nearly flat from September, while BAB remained the least liquid, trading under 10,000 shares/day (down 25%).

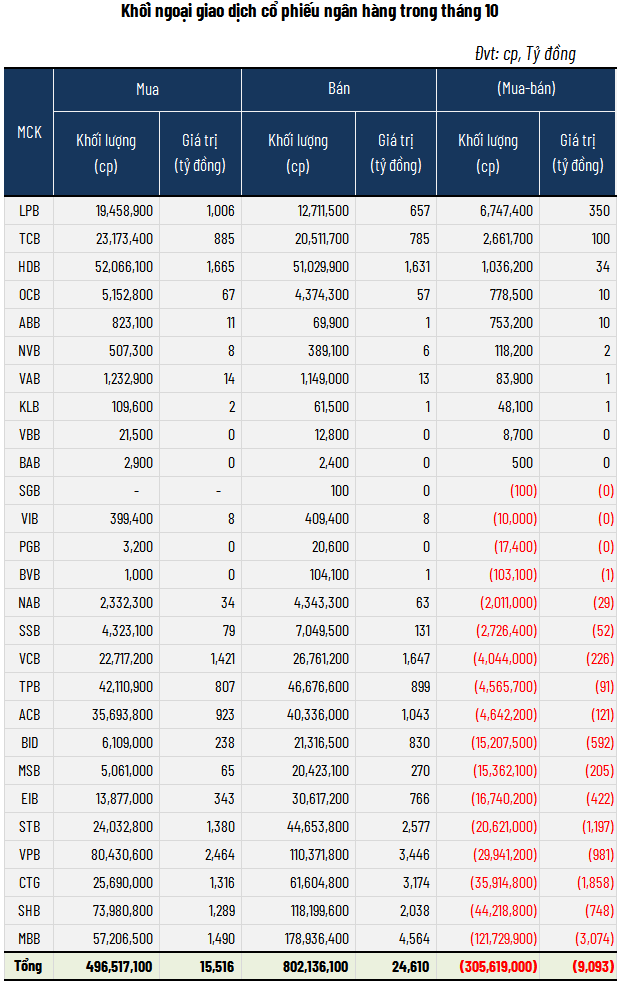

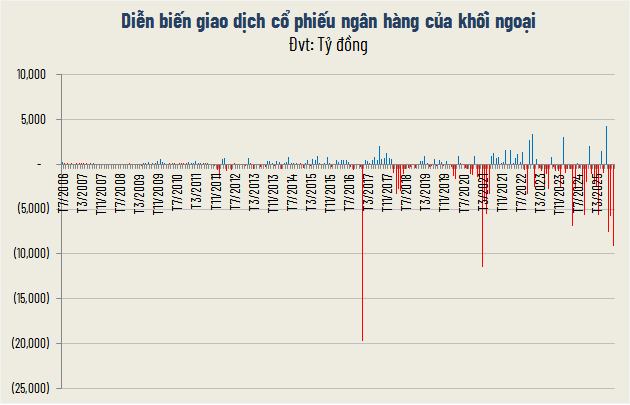

Foreign Investors’ Strongest Net Selling in Years

Foreign investors extended their net selling streak for the third consecutive month. In October, they offloaded nearly 306 million banking shares, totaling 9.093 trillion VND—the highest since April 2021.

The most heavily sold stocks were MBB, CTG, and STB, totaling over 6.1 trillion VND. Conversely, TCB and LPB were the rare net buys, each attracting over 100 billion VND. – 19:00 04/11/2025 |

Top Vietnamese Brokerage Firms Invest $38 Million in Local Stocks: Which Shares Are They Targeting?

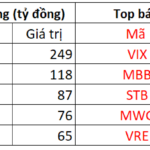

Proprietary trading desks at Vietnamese securities firms have collectively net purchased VND 886 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) during the specified period.

Foreign Investors Reduce Net Selling, Counter-Trend with Hundreds of Billions Invested in Two Blue-Chip Stocks in Session 3/11

Foreign investors continued to be a drag on the market, with a net sell-off of VND 185 billion. However, the selling pressure has significantly eased compared to previous sessions.