Smart Investment Trends with “Cash Flow” Real Estate

Vietnam’s real estate market is witnessing a shift in investor decision-making. Instead of solely focusing on price appreciation, more investors are seeking properties that can generate rental income or serve practical use—a trend known as “cash flow investing.”

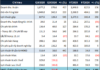

According to the latest report from Batdongsan.com.vn, in the first 10 months of 2025, 83% of surveyed participants were aged 18 to 44, and 65% earned between 15 to 50 million VND per month. This demographic highly values properties that meet real living or rental needs, rather than speculative investments. This trend is evident as transactions in central areas slow down, while interest in expanded Ho Chi Minh City regions (former Binh Duong) and neighboring areas like Dong Nai is rising. The Q3/2025 report from Batdongsan.com.vn notes, “Cash flow is moving away from the city center and spreading to suburban areas.” Investors now prioritize properties with reasonable prices, strong rental potential, and well-connected infrastructure.

In essence, real estate selection criteria now revolve around three key factors: convenient location, affordable pricing, and practical usage potential. Newly merged areas into HCMC (former Binh Duong) or neighboring regions like Dong Nai are emerging as attractive destinations due to their growth potential and lower initial investment costs.

Safe Investment Opportunities Starting from 750 Million VND

Instead of investing in future projects with legal risks or price volatility, buyers can opt for completed properties like The Habitat Binh Duong. With an attractive payment plan from the developer, buyers only need to pay 30% upfront, approximately 750 million VND, to own a unit and start renting it out. The remaining amount can be paid by 2027.

The Habitat Binh Duong Phase 3 is the only residential project located at the gateway of VSIP 1 Industrial Park.

The project is situated at the entrance of VSIP 1 Industrial Park—Binh Duong’s first industrial park, established in 1996 with a 500-hectare area. Developed to Singapore standards, it aims to be a modern, green, and environmentally friendly industrial zone. The Habitat Binh Duong Phase III is developed by VSIP Sembcorp Gateway, a joint venture between VSIP (Vietnam), Sembcorp Properties (Singapore), and MC Development Asia (Japan). These internationally renowned brands ensure Singapore-quality construction, transparent legal processes, and sustainable investment value for buyers.

After nearly 30 years of development, VSIP 1 is now home to tens of thousands of professionals, engineers, and senior personnel, creating a stable, long-term rental demand. This existing tenant pool is a significant advantage for surrounding projects like The Habitat Binh Duong, ensuring high occupancy rates and steady rental income.

High Profit Potential with Infrastructure Waves

The region’s transportation infrastructure is rapidly improving. Notable projects include the expansion of QL13 to 60 meters and the HCMC Ring Road 3, which passes through satellite districts (former Binh Duong, Dong Nai, and Long An) and is expected to open fully by mid-2026. Binh Hoa Ward (former Thu Dau Mot City) is strategically located to benefit directly from these key infrastructure developments, boosting The Habitat Binh Duong’s price appreciation potential.

50-meter infinity pool

Coupled with a modern, convenient lifestyle, the project is within a 2km radius of Aeon Mall, Song Be Golf Course, and Becamex International Hospital, making it an attractive choice for both homeowners and renters. The project features over 4,000 sqm of amenities, including a 50-meter infinity pool, children’s pool, gym, sauna, yoga area, meditation garden, and BBQ area, meeting all criteria for a high-quality lifestyle.

Project Information

Managed by: Savills Vietnam

Address: Street No. 3, VSIP 1, Binh Hoa Ward, Ho Chi Minh City

Facing a 10-Year Ban: The Consequences of Backing Out of Land Auctions

The Vietnam Association of Realtors (VARS) has proposed stringent penalties for bidders who intentionally manipulate auctions and then default on their deposits. Under the new guidelines, offenders could face a ban from participating in auctions for a period ranging from 2 to 10 years, depending on the severity of their violation.

Critical Alert from VARS to All Condominium Buyers

According to the Vietnam Association of Realtors (VARS), lending interest rates are trending upward, while promotional periods remain temporary. Once loans transition to floating rates, if the general interest rate rises, debt repayment pressures will intensify significantly. Many borrowers find themselves in a situation where “they haven’t paid any principal yet, but the interest has already doubled.”

Revitalized Vacation Real Estate: Is Now the Time to Invest and Ride the Wave?

The luxury real estate market is showing clear signs of recovery, leaving many investors wondering if now is the right time to invest.