Ho Chi Minh City Infrastructure Investment Joint Stock Company (stock code: CII, HoSE) has recently released a report on the results of its 10th bond conversion share issuance.

On November 3rd, CII issued 511,400 shares for the conversion of 5,114 CII42013 bonds. The conversion ratio was 1:100, meaning 1 bond was converted into 100 shares. These are common shares, freely transferable.

The share transfer is expected to take place in November 2025. Following the conversion, CII will increase its outstanding shares to 625.45 million units, equivalent to a charter capital of VND 6,254.5 billion.

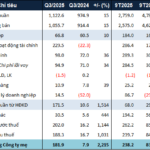

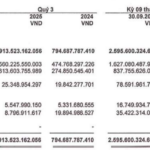

In terms of business performance, in the first 9 months of 2025, CII generated a net revenue of over VND 2,141 billion, a 6% decrease compared to the same period last year. The key segment, traffic fee collection, remained relatively stable, accounting for approximately 88% of the revenue. Real estate, construction, and infrastructure maintenance activities saw revenue declines of 67% and 21%, respectively.

Financial revenue also decreased by 38% to over VND 583 billion, due to the absence of a VND 430 billion gain from the revaluation of the investment in the associate company, Nam Bay Bay Investment Corporation, recorded in the same period last year.

Additionally, CII incurred an other loss of VND 84 billion from increased contract violation penalties and over VND 13 billion in expenses from suspended projects.

Despite cost-cutting measures, CII’s after-tax profit dropped by 55% to VND 241 billion. The profit after tax attributable to the parent company’s shareholders decreased by 78% compared to the first 9 months of 2024, reaching nearly VND 58 billion.

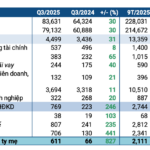

Q3 Profits Surge on Financial Revenue, Yet Hoa Binh Trails Behind After 9 Months

Despite a significant surge in profits during the third quarter, the nine-month business results of Hoa Binh Construction Group JSC (UPCoM: HBC) still reflect a decline in both revenue and profitability year-on-year.

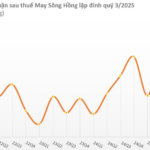

Oil Prices Stabilize, Petrolimex Profits Surge Ninefold Year-on-Year

Petrolimex (HOSE: PLX), Vietnam’s leading petroleum conglomerate, has released its Q3/2025 consolidated financial report, showcasing a robust recovery compared to the same period last year. This significant turnaround is primarily attributed to the more stable global oil price trends observed during Q3/2025.