According to VBMA statistics, in the corporate bond market, Q3/2025 recorded 10 public bond issuances totaling VND 20,380 billion, accounting for 15.8% of the total issuance value. Additionally, 119 private placements were issued, totaling VND 108,939 billion, representing 84.2% of the market.

The market size relative to GDP at the end of Q3/2025 decreased by 0.5 percentage points compared to the previous quarter, settling at 10.2%.

Source: HNX, VBMA

Outstanding corporate bond debt at the end of Q3/2025 increased by 6% compared to the end of 2024, reaching VND 1,270 trillion, equivalent to 7.4% of the total credit debt of the economy. The corporate bond market size has remained relatively stable since the end of 2023, fluctuating around VND 1,200 trillion.

In Q3/2025, the banking sector led with the highest issuance value at VND 90,777 billion, accounting for 70.2%. Real estate followed with VND 27,778 billion, or 21.5% of the total.

Despite a decline in issuance value compared to the same period in 2024, overall corporate bond issuance activity since the beginning of the year has improved by 27% in value compared to last year.

Approximately 53% of corporate bonds issued in Q3/2025 had terms ranging from 1 to 3 years, with an average issuance interest rate of 7.18% per annum. The average issuance rate increased by 0.49% compared to the previous quarter and by 0.58% compared to the same period in 2024, primarily due to higher rates in the banking sector.

The value of bonds repurchased before maturity in the quarter reached VND 93,295 billion, a 32.5% increase compared to the same period in 2024. Bonds maturing in the last three months of 2025 total VND 48,080 billion, with real estate bonds accounting for VND 18,331 billion (38%) and banking bonds at VND 13,781 billion (29%).

The value of bonds with delayed principal and interest payments in Q3/2025 was VND 1,668 billion, an 80% decrease compared to Q2/2025. Of this amount, VND 639 billion has been settled.

In the secondary market, the trading value of privately placed bonds reached VND 392,080 billion, averaging VND 6,126 billion per day, a 15% increase compared to Q2. Real estate and banking bonds dominated trading, accounting for 38.6% and 36.6%, respectively.

In the government bond market, the State Treasury (KBNN) conducted 54 auctions in Q3/2025, with a total bidding value of VND 154,000 billion. The successful bidding value exceeded VND 54,299 billion, achieving a 35.3% success rate.

The total successful bidding value in the first three quarters equaled 51.1% of the annual plan (VND 500,000 billion).

During Q3, the 10-year term accounted for 87.2% of the successful bidding value, totaling over VND 47,336 billion. The 5-year, 15-year, and 30-year terms secured VND 1,900 billion, VND 4,004 billion, and VND 1,059 billion, respectively. The 7-year and 20-year terms received no bids, and the 3-year term was not offered by KBNN.

The average issuance term in Q3 was 10.58 years, with an average interest rate of 3.37%, both higher than in Q2.

Large-Cap Stocks Plunge in Unison

The stock market kicked off the week in the red, with large-cap stocks universally declining, dragging the VN-Index down to the 1,617-point mark.

Notable Real Estate M&A Deals in Q3 2025

In Q3/2025, the real estate M&A market witnessed several notable transactions, including Vinaconex’s sale of the Cát Bà Amatina project, Hodeco’s withdrawal from the Đại Dương tourism complex, and DIC Corp’s transfer of the Lam Hạ Center Point project. These deals highlight the dynamic nature of Vietnam’s property sector during this period.

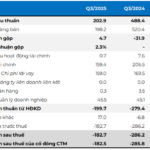

MBB: Surging Prices Yet Remains a Long-Term Attractive Investment (Part 2)

Military Commercial Joint Stock Bank (HOSE: MBB) consistently demonstrates strong operational efficiency and profitability, ranking among the top performers in the banking sector. Current valuation metrics indicate that MBB shares are attractively priced, presenting a compelling opportunity for long-term investment.