Consumers purchasing beer products – Illustrative image

|

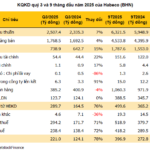

According to data from VietstockFinance, the total revenue of 14 beer companies in Q3/2025 decreased by 6% year-on-year to over VND 12,200 billion. However, net profit surged by 35% to more than VND 1,800 billion. This was primarily due to lower input costs, significantly reducing the cost of goods sold. As a result, the average gross margin for the industry rose to nearly 29%, far exceeding the 24.6% recorded in the same period last year, becoming the main driver of double-digit profit growth.

The profit improvement was widespread, with 10 out of 14 companies reporting higher profits, one company turning from loss to profit, two companies experiencing profit declines, and only one company continuing to report a loss.

|

Sabeco strengthens its industry leadership

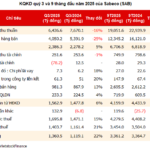

In the overall industry picture, Saigon Beer – Alcohol – Beverage Corporation (Sabeco, HOSE: SAB) remains the absolute leader. In Q3/2025, Sabeco reported a net profit of nearly VND 1,361 billion, up 22% year-on-year, more than three times the combined profit of all other beer companies.

Notably, benefiting from the industry-wide decline in input costs, Sabeco’s gross margin soared to over 37%—the second-highest level in its history, just below the peak of over 45% set more than a decade ago.

This impressive result, in addition to operational factors, was amplified by the financial impact of the M&A deal with Saigon – Binh Tay Beer Corporation (Sabibeco, UPCoM: SBB). After increasing its ownership to 65% in early 2025, Sabeco consolidated Sabibeco’s financial results, contributing nearly VND 133 billion in other income (compared to a loss in the same period) and VND 78 billion in financial expense reversals following the completion of the fair value allocation from this M&A transaction. This strategic move allowed Sabeco to leverage business consolidation to optimize profits amid slowing organic revenue growth.

In the first nine months of the year, Sabeco achieved revenue of VND 19,052 billion, down 17% year-on-year, while net profit remained flat at VND 3,361 billion. The company has fulfilled 43% of its annual revenue target and 71% of its profit goal.

| Sabeco’s 9-month business results over the years |

Sagota Beer’s owner transforms post-M&A

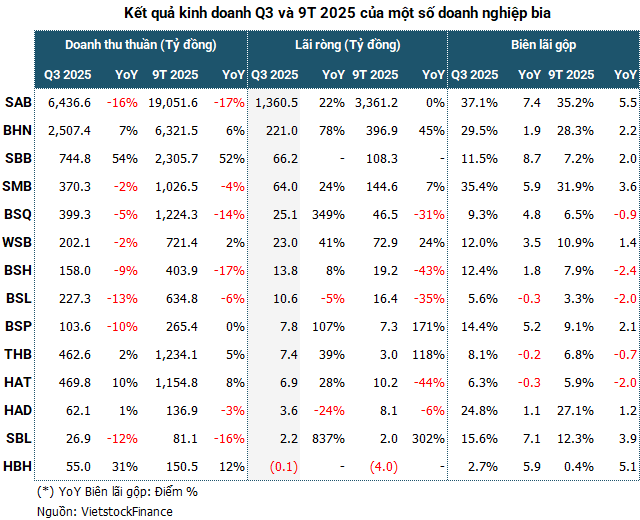

The story of Sabibeco (SBB), owner of the Sagota beer brand, is a prime example of how fortunes can change after an acquisition by Sabeco. After five years of consecutive losses, becoming a subsidiary of Sabeco has led to a remarkable turnaround for SBB.

In Q3, SBB reported a net profit of over VND 66 billion, a complete reversal from the nearly VND 10 billion loss in the same period last year. Revenue increased by 54% to nearly VND 745 billion, with 90% coming from orders from Sabeco. By leveraging its parent company’s distribution network, SBB quickly resolved its sales challenges, boosting its gross margin from 2.5% to 11.5%.

For the first nine months, SBB achieved a net profit of over VND 108 billion, exceeding its full-year profit target by 19%. Accumulated losses also decreased sharply from over VND 90 billion to below VND 26 billion, marking a significant turning point post-merger.

| SBB’s business results from 2019 to 9M2025 |

Habeco regains momentum after years of decline

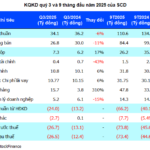

While Sabeco dominates the Southern market, the “Northern giant”, Hanoi Beer – Alcohol – Beverage Joint Stock Corporation (Habeco, HOSE: BHN), has also shown a strong resurgence, with key business indicators returning to pre-COVID-19 pandemic levels.

In Q3/2025, Habeco’s revenue reached over VND 2,507 billion, up 7% year-on-year, while net profit surged by 78% to VND 221 billion—the highest levels since early 2021. Gross margin reached 29.5%, a significant improvement from the 20-25% range in previous years.

For the first nine months, Habeco’s net profit was nearly VND 369 billion, up 45% and exceeding 87% of its annual target. This is also the highest profit in five years, surpassing the full-year results of 2024 and 2023. This impressive comeback is particularly notable given the prolonged period of deep business decline due to economic challenges and strict alcohol regulations.

| Habeco’s business results from 2016 to 9M2025 |

Ripple effect within the ecosystem

Positive business results were not limited to parent companies but extended to subsidiaries. Most companies within Sabeco’s ecosystem reported profit improvements. Several subsidiaries saw triple-digit growth in Q3, including Saigon Beer – Bac Lieu (SBL) with an 857% increase in net profit to over VND 2.2 billion; Saigon Beer – Quang Ngai (BSQ) with a 349% increase to VND 25 billion; and Saigon Beer – Phu Tho (BSP) with a 107% increase to VND 7.8 billion. The only exception was Saigon Beer – Song Lam (BSL), which saw a 5% profit decline.

In contrast, Habeco’s subsidiaries showed more varied performance. The growth group included Hanoi Beer Trading (HAT) and Hanoi Beer – Thanh Hoa (THB), with profit increases of 28% and 39%, respectively. Meanwhile, Hanoi Beer – Hai Duong (HAD) saw a 24% profit decline, and Habeco – Hai Phong (HBH) was the only company in the industry to report a loss, though the loss narrowed compared to the same period last year.

Signs of recovery and upcoming challenges

Despite positive results, the beer industry still faces several macroeconomic factors impacting its long-term outlook. Data from Euromonitor shows that beer consumption in Vietnam declined for two consecutive years (2023-2024) due to stricter alcohol regulations and weak purchasing power.

However, the period 2025-2029 is expected to see a recovery, with a compound annual growth rate (CAGR) of around 5%. The postponement of the Special Consumption Tax (SCT) increase until 2027, along with economic recovery prospects, are the key factors supporting this rebound.

According to the roadmap approved by the National Assembly, the SCT on beer will increase from the current 65% to 70% in 2027 and continue to rise by 5% annually until 2031, reaching 90%. Companies are expected to adjust selling prices to offset tax costs, thereby protecting profit margins.

Overall, the health of Vietnam’s beer industry is no longer solely reflected in revenue figures. Significant differentiation is occurring, with companies possessing efficient operational capabilities and the ability to leverage M&A for margin expansion gaining a substantial advantage. Sabeco and Habeco remain the two pillars shaping the industry, dominating market share while leading operational efficiency trends.

The future of Vietnam’s beer industry will be determined not only by consumer demand but also by the ability to adapt to policies and cost control strategies—factors emerging as new competitive “weapons” across the industry.

– 10:00 05/11/2025

Sagota Brewery Rebounds Under Sabeco’s Leadership, Posts Over 100 Billion VND in 9-Month Profit

After a prolonged period of losses, Saigon Beer – Binh Tay Joint Stock Company (Sabibeco, UPCoM: SBB), the owner of the Sagota beer brand, has rebounded strongly, reporting a net profit of over 108 billion VND in the first nine months of 2025. This turnaround follows Sabeco’s successful acquisition, transforming Sabibeco from an affiliate into a subsidiary.

Northern Beer Industry Leader Revives Golden Era, Achieving Highest Profits in 5 Years

Following the post-COVID-19 slowdown, Hanoi Beer-Alcohol-Beverage Joint Stock Corporation (Habeco, HOSE: BHN) is regaining its growth momentum, with revenue, profit, and gross margins all returning to peak levels. Beyond its robust recovery in the beer segment, Habeco has also made a notable mark with nearly VND 5,000 billion in cash deposits.

Sabeco Q3 Profit Surges 22%, Gross Margin Hits Decade-High

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”c1e6c0ea-afbb-4ef7-a109-fa67b2fcaf61″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Despite”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” revenue”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” decline”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Q”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”/”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”5″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Saigon”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Beer”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Alcohol”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Bever”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”age”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Sab”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”eco”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” SAB”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reported”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” its”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” highest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” net”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” profit”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” quarters”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reaching”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” nearly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” trillion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” This”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” achievement”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” was”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” driven”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” by”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” significantly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reduced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” production”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” costs”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” gross”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” margin”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” exceeding”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” and”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” consistent”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” interest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” income”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” from”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” deposits”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” averaging”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” over”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” billion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” daily”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

Chapter Down Again: 19 Quarters Without Profit, Bankruptcy Looms

Once a shining star with its legendary “Sá xị Chương Dương” brand, the company now faces a dire financial crisis. Accumulated losses have soared to a staggering 340 billion VND, with negative equity exceeding 150 billion VND after 19 consecutive quarters of decline. To avert bankruptcy, the company has been forced to seek debt extensions from Sabeco.