According to the latest market report from the Vietnam Association of Realtors (VARS), after a prolonged period of low rates, savings interest rates at many banks have been quietly rising for short-term deposits, leading to an upward trend in lending rates. Despite the State Bank of Vietnam maintaining its supportive liquidity policy and showing no signs of monetary tightening by not resuming money absorption through treasury bills since June, the interest rate landscape is under significant pressure.

The resurgence of inflationary pressures, coupled with the cautious approach of major central banks worldwide, has narrowed the scope for maintaining low interest rates. In this context, the real estate market, heavily reliant on credit, faces a critical test for its recovery and growth.

Historically, when interest rates rise sharply, the most immediate and noticeable impact is a decline in market liquidity. Homebuyers, especially those relying on loans, will reassess their financial plans. Meanwhile, real estate investors become more cautious about expanding their portfolios, as the expected returns may struggle to offset the increased capital costs.

The real estate market is heavily dependent on credit policies.

Simultaneously, real estate developers face a dual risk: rising financial costs coupled with declining demand, leading to slower cash flow cycles and a reduction in new supply. As supply decreases and transactions stall, price levels struggle to maintain the growth momentum seen in previous periods.

Given its heavy reliance on debt leverage, real estate is the investment channel most directly and profoundly affected by interest rate fluctuations. In the past, Vietnam’s market experienced a severe downturn from 2011 to 2013, when lending rates exceeded 18-20% per annum. Many businesses and investors were forced to sell assets at a loss, causing a prolonged market freeze and a 30-40% drop in property prices, even in central areas.

VARS attributes part of the issue to an investment mindset reliant on short-term loans, while real estate projects and assets have long investment cycles. When capital costs rise abruptly, cash flows are disrupted, and liquidity risks become almost inevitable.

Additional pressure comes from subsidized home loans. In recent years, to stimulate the market, many developers and commercial banks have launched home loan packages with preferential rates as low as 5.5% per annum, or even interest-free periods with principal grace periods of up to 5 years. These policies have enabled a large number of individuals and investors to access affordable capital for real estate ownership.

However, the preferential period is temporary. When transitioning to floating rates, if overall interest rates rise, debt repayment pressures intensify. Many borrowers find themselves in situations where “they haven’t repaid any principal, but the interest has already doubled.” With low market liquidity, selling assets to cut losses becomes challenging, and the risk of bad debts may re-emerge in the credit system.

Real estate companies face dual risks when interest rates rise. On one hand, they bear higher financial costs for project loans. On the other hand, market demand weakens as buyers struggle to access home loans.

Meanwhile, corporate bond issuance remains sluggish. New issuances are cautious, while high maturing volumes force many companies to manage cash flows by selling land reserves, delaying construction timelines, or negotiating extended payment terms with contractors and banks.

Particularly, with most supply consisting of future projects, the disruption of advance payments from buyers exacerbates financial pressures. As credit costs rise and alternative funding channels remain underdeveloped, many projects risk suspension or delays, impacting buyer and secondary investor confidence.

Not only do prolonged high interest rates affect ongoing projects, but they also weaken the ability to expand land banks and launch new projects. Banks typically raise rates during market downturns due to perceived higher risks. Consequently, many companies opt for a “wait-and-see” approach rather than expanding investments, especially amid rising land and construction costs. This could lead to a significant medium-term decline in housing supply.

Another consequence of rising interest rates is the indirect impact on public investment and infrastructure costs. Higher material, labor, and land clearance costs slow the progress of key transportation projects.

This directly affects price expectations in areas previously projected to benefit from infrastructure development, leaving many secondary investors in a difficult position.

Despite these challenges, the long-term outlook for Vietnam’s real estate market remains positive, driven by strong housing demand and urbanization. As the economy grows, segments like residential, industrial real estate, office rentals, and retail will maintain stable demand.

VARS advises that, in the current phase, homebuyers should take advantage of still-low interest rates and recovering supply. However, loan usage should be kept at safe levels, not exceeding 50% of asset value, to mitigate risks from potential rate reversals. Buyers should also prioritize projects from reputable developers with strong financial capabilities, ensuring legal compliance and construction timelines, especially for future housing products.

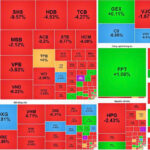

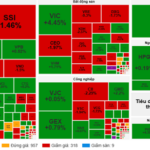

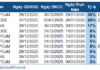

Large-Cap Stocks Plunge in Unison

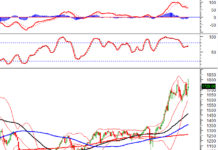

The stock market kicked off the week in the red, with large-cap stocks universally declining, dragging the VN-Index down to the 1,617-point mark.

Market Pulse 03/11: Red Wave Sweeps Across, VN-Index Plunges Over 22 Points

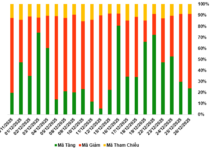

At the close of trading, the VN-Index dropped 22.65 points (-1.38%), settling at 1,617 points, while the HNX-Index fell 6.67 points (-2.51%), closing at 259.18 points. Market breadth was overwhelmingly negative, with 468 decliners outpacing 229 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 4 advanced, and 3 remained unchanged.