During the morning trading session on November 4th, shares of MCH, belonging to Masan Consumer Holdings—a subsidiary of Masan Group—continued their strong upward trend, reaching a historic high of VND 181,900 per share, surpassing previous records set in late 2024.

In just three months, MCH’s market price has nearly doubled, with its market capitalization hitting approximately VND 191 trillion.

Founded in 2000, Masan Consumer is renowned for its portfolio of food and seasoning brands, including Chin-su, Omachi instant noodles, Kokomi, Nam Ngư, and the energy drink 247.

Mr. Nguyễn Đăng Quang, Chairman of Masan Group, has hailed Masan Consumer as the “crown jewel” of the conglomerate.

According to Forbes’ real-time rankings, as of November 3rd, Mr. Quang’s net worth stands at USD 1.1 billion.

Masan Consumer is currently one of the largest companies by market capitalization on the UPCoM exchange, surpassing even established names like Vinamilk, PV Gas, GVR, ACB, STB, and its parent company, Masan Group. The company is planning to list on the HoSE, which could qualify it for inclusion in key indices.

During an online investor meeting in late October, Mr. Micheal Hung Nguyen, Deputy CEO of Masan Group, stated that while no official timeline has been set for the transfer of MCH shares to HoSE, the company’s market cap makes it a strong candidate for the VN30 index upon listing.

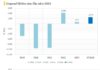

In Q3, Masan Consumer reported revenue of over VND 7.5 trillion, a 6% year-on-year decline but a 20% increase from the previous quarter, driven by sales recovery following anti-counterfeiting efforts and tax policy changes in Q2. Nine-month revenue for 2025 reached VND 21 trillion, fulfilling 63.5% of the annual target.

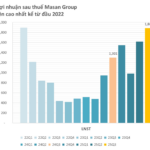

Net profit in Q3 dropped sharply by 19% year-on-year to VND 1.9 trillion, attributed to weaker gross margins and a 66% decline in net financial income. Nine-month net profit for 2025 stood at VND 4.7 trillion, achieving 63.8% of the annual goal.

Masan Leadership: MCH Confident in Q4 Recovery, Accelerating IPO Timeline

Masan’s leadership expresses confidence in MCH’s recovery starting from Q4, emphasizing that listing MCH on HOSE remains their top priority at present.

WinMart Expands Reach, Bringing Modern Retail to Over 100 Million Vietnamese Consumers

Vietnam’s retail market, valued at over $309 billion, is entering its fastest growth phase in the region, with modern retail channels projected to reach 35% by 2030. Amidst fierce competition from global giants, WinMart stands out as a formidable domestic player, rapidly expanding to secure a strong foothold for Vietnamese businesses.

Masan Surges with 43% Q3 Profit Growth, Achieves Over 90% of Annual Target

Masan Group Corporation (HOSE: MSN) has announced its consolidated financial report for Q3/2025, revealing a remarkable post-tax profit of nearly VND 1,866 billion, marking a 43% surge compared to the same period last year. This outstanding performance positions Masan to achieve over 90% of its annual profit target within just nine months.