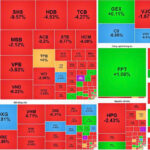

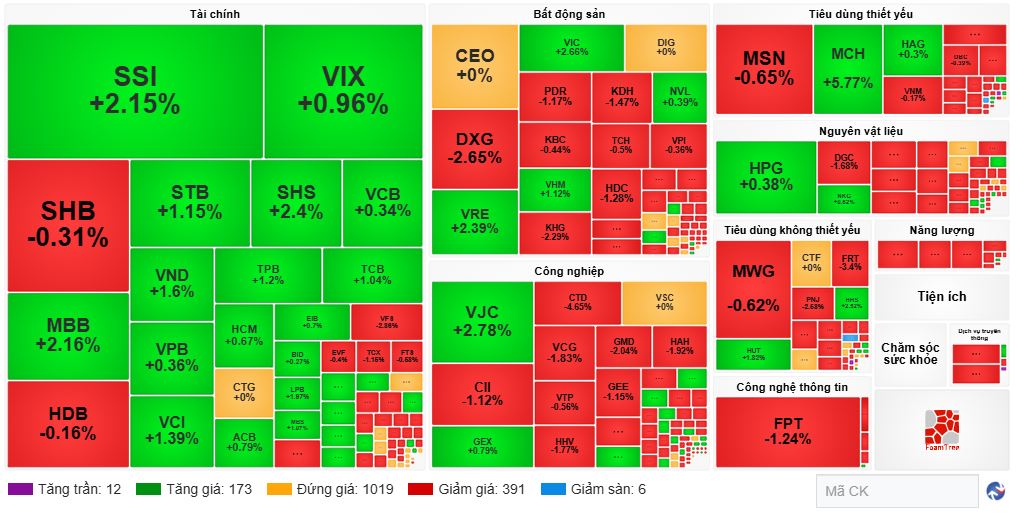

Today’s session concluded with a remarkable surge in green and purple across various sectors, notably in securities stocks. The real estate sector mirrored this trend.

Afternoon trading saw a significant influx of capital, particularly towards the session’s close. Total liquidity exceeded 37.6 trillion VND across all three exchanges.

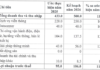

Foreign investors net bought over 1 trillion VND. VIX saw net purchases of 326 billion VND, VPB attracted nearly 165 billion VND, and MSN garnered almost 150 billion VND.

| Top 10 Stocks with Strongest Foreign Net Buying/Selling |

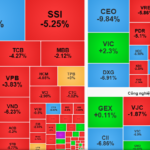

1:50 PM: Securities Stocks Hit Ceiling Prices

As the afternoon session began, negativity dissipated, and green returned across financial and real estate stocks. Securities stocks stood out with widespread purple.

By 1:55 PM, the VN-Index rose over 20 points, and the HNX-Index gained nearly 5 points.

SSI, SHS, VND, VIX, and VCI all surged to their ceiling prices. Banks also performed well, with widespread green. In real estate, CEO, KDH, DXG, PDR, and DIG joined the upward trend, alongside Vingroup stocks contributing positively to the index.

Source: VietstockFinance

|

Morning Session: Sellers Dominate, Foreign Capital a Bright Spot

The market briefly regained green mid-session, but positivity was short-lived. By midday, the VN-Index closed at 1,612 points, down nearly 4.5 points. The HNX-Index fell over 2 points to 257.07.

Divergence in the financial sector and pressure from other sectors led to the index’s decline below the reference level before the lunch break. VIC, MCH, and VJC maintained green. However, many sectors fell, with telecommunications, essential retail, non-essential retail, and energy sectors seeing the sharpest declines.

By the end of the morning, several stocks hit their floor prices, including CTD, TAL, TDP, NAG, and 7 others. Market breadth favored sellers, with nearly 500 gainers versus over 150 decliners.

VIC remained a key support, lifting the VN-Index by nearly 7 points and the VN30-Index by over 7.1 points.

Foreign investors net bought over 420 billion VND, primarily in VIX. Recently, they’ve leaned towards net selling, but selling pressure has eased, with occasional net buying sessions. The market’s valuation near 1,600 on the VN-Index seems more appealing to foreign capital.

| Foreign Net Buying/Selling Trends (as of the morning session, 04/11/2025) |

10:30 AM: Financial Sector and Vingroup Drive Index

The financial sector regained momentum, driving the VN-Index higher. By 10:30 AM, the VN-Index rose nearly 8 points to 1,624.8. VIC was a major driver.

With a 3% gain, VIC was the top contributor on the HOSE, adding over 5 points to the VN-Index. VHM followed with 1.3 points, and VRE contributed 0.3 points.

Banking and securities stocks rose 1-2%, sustaining the index’s upward trend. SSI, VIX, VND, VCI, and HCM performed well. Notable banking stocks included MBB, STB, TPB, EIB, VPB, and TCB.

In other sectors, large-cap stocks like HPG, MCH, and VJC saw solid gains.

Telecommunications stocks faced heavy selling pressure, with VGI, FOX, CTR, TTN, MFS, and VTK all in the red.

Source: VietstockFinance

|

Opening: Selling Pressure Dominates Early

After recent declines, the VN-Index approached 1,600 points. Market sentiment remained cautious. The 04/11 session opened with indices hovering around the reference level.

By 9:25 AM, sellers dominated, with 280 decliners versus 155 gainers. Red prevailed across most sectors, particularly real estate and non-essential consumer goods.

As sentiment stabilized, the financial sector turned positive. SSI, SHS, and MBB rose over 1%. VIX rebounded slightly after recent declines.

In essential consumer goods, MCH surged nearly 6%. MSN was a key driver for this sector.

Real estate was supported by Vingroup stocks, with VIC and VHM in the green. Most of the sector remained red.

– 14:55 04/11/2025

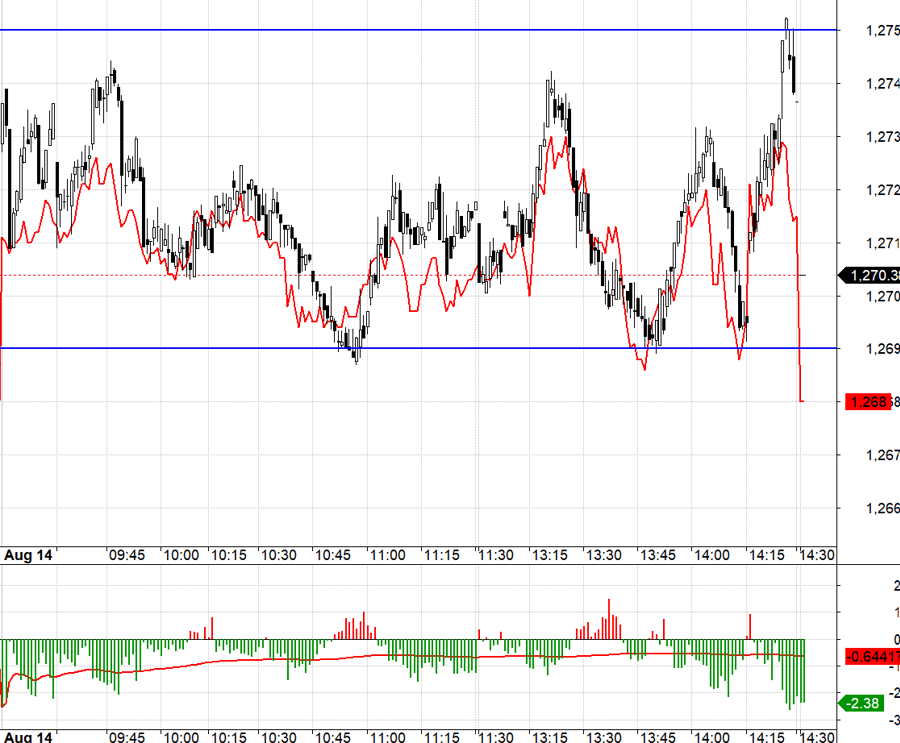

Vietstock Daily 05/11/2025: A Powerful Comeback

The VN-Index staged a robust comeback, bolstered by trading volumes surpassing the 20-day average, reaffirming the August 2025 support level’s resilience. Sustained upward momentum paired with stable liquidity in upcoming sessions is crucial to cementing the recovery trend. However, heightened volatility remains a risk, as the MACD indicator lingers below zero and trails significantly behind the Signal line.

Top Vietnamese Brokerage Firms Invest $38 Million in Local Stocks: Which Shares Are They Targeting?

Proprietary trading desks at Vietnamese securities firms have collectively net purchased VND 886 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) during the specified period.