FPT Securities Corporation (FPTS, Stock Code: FTS, HoSE) has submitted an official notice to the State Securities Commission of Vietnam (SSC), Ho Chi Minh City Stock Exchange (HoSE), and Hong Ha Garment Joint Stock Company (Stock Code: MSH, HoSE) regarding a related insider’s stock transaction.

Accordingly, FPTS has registered to sell nearly 1.2 million shares of MSH for proprietary trading purposes. The transaction is scheduled to take place from November 6, 2025, to December 5, 2025, via order matching and/or negotiated trading methods.

Illustrative image

If the transaction is successful, FPTS’s ownership in MSH will decrease from nearly 13.2 million shares to 12 million shares, reducing its stake from 11.728% to 10.665% of Hong Ha Garment’s capital.

Previously, FPTS had registered to sell approximately 1.2 million MSH shares between August 18, 2025, and September 16, 2025. However, the transaction was unsuccessful due to unfavorable market prices.

Following the failed transaction, FPTS retained its ownership of nearly 13.2 million shares, maintaining an 11.728% stake in Hong Ha Garment.

Regarding Hong Ha Garment’s business performance, the company’s Q3/2025 consolidated financial report shows net revenue of over VND 1,646.7 billion, a 5.8% decrease compared to the same period last year. After deducting the cost of goods sold, gross profit reached over VND 349.7 billion, up 31.7%.

During the period, financial activities generated nearly VND 56.8 billion in revenue, a 31.1% increase year-on-year. Conversely, financial expenses decreased from VND 33.3 billion to over VND 22 billion.

Selling expenses rose by 5.5% to over VND 45.7 billion, while management expenses increased by 38.1% to nearly VND 83.6 billion.

As a result, after tax and fee deductions, Hong Ha Garment reported a net profit of over VND 200.7 billion, a 54.2% increase compared to Q3/2024.

For the first nine months of 2025, Hong Ha Garment recorded net revenue of nearly VND 4,149.7 billion, up 7.7% year-on-year, with post-tax profit reaching nearly VND 467.9 billion, a 73.6% increase.

As of September 30, 2025, the company’s total assets increased by 9.7% since the beginning of the year to nearly VND 4,960.4 billion, while total liabilities rose by VND 12.8 billion to nearly VND 2,480.5 billion.

Zoo Revenue Surges After Tax Debt Scrutiny

After a challenging period, Saigon Zoo and Botanical Gardens is making a remarkable recovery. On average, the zoo welcomes over 5,500 visitors daily. Its cumulative revenue for the first nine months of this year reached nearly 122 billion VND, marking a 13% increase compared to the same period last year.

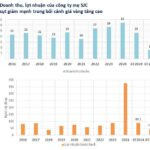

SJC Gold Company Reports 67% Revenue Drop in 6M2025, Profits Plummet to VND 37 Billion After Record-Breaking 2024

In the first half of 2025, SJC’s parent company reported a net revenue of nearly 8 trillion VND, a 67% decline compared to the same period in 2024. Pre-tax profit stood at 45.6 billion VND, reflecting a 48% decrease year-over-year. Net profit after tax amounted to 37 billion VND.

Bùi Cao Nhật Quân’s Debt to Novaland Reaches Nearly Hundred Billion VND

Novaland is currently owed VND 76 billion by Mr. Bui Cao Nhat Quan, the son of Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors. This receivable has been reflected in Novaland’s financial reports since 2020. In the recently released Q3 financial report, the debt was reclassified from long-term to short-term.