On October 28, 2025, Sari Murni Abadi (SMA) announced its acquisition of Vietnam’s Bibica from PAN Group, marking a significant shift in ownership.

PAN Group (HOSE: PAN) has finalized the sale of Bibica Corporation (HOSE: BBC) to Sari Murni Abadi (SMA), a leading Indonesian consumer goods conglomerate. This transaction signifies PAN’s exit from Bibica after eight years, while enabling SMA to establish a strong foothold in Vietnam’s confectionery market.

According to official statements, Indonesia’s Sari Murni Abadi (SMA), owner of the Momogi snack brand, has successfully acquired Bibica Corporation from PAN Group. The financial details of the deal remain undisclosed.

Bibica stands as one of Vietnam’s most established confectionery manufacturers, boasting a distribution network of over 100,000 retail points and production facilities in Long An and Hanoi.

SMA representatives stated that the acquisition aligns with the company’s global expansion strategy and reinforces its position in the fast-moving consumer goods (FMCG) sector. “Through this partnership with Bibica Vietnam, we anticipate significant enhancements in cross-border production and distribution efficiency,” said Servin, SMA’s Chief Financial Officer, in an official statement on November 3.

He emphasized that the deal will diversify SMA’s product portfolio, expanding from snacks to biscuits and other confectionery items, while optimizing supply chains and bolstering research and development capabilities.

PAN Group’s acquisition of Bibica followed years of competition with Lotte for control. In the final public tender offer in 2022, PAN Group invested an estimated VND 524 billion to increase its ownership stake to 98.3%, resolving shareholder disputes and fully integrating Bibica into PAN’s ecosystem.

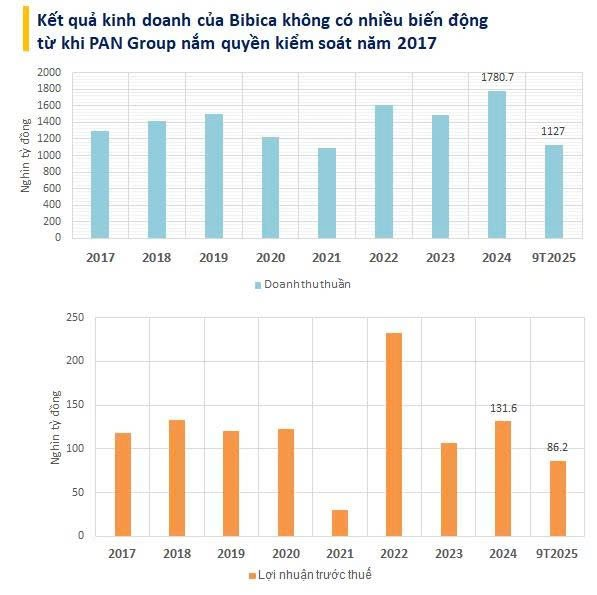

Bibica’s Financial Performance Since 2017

During PAN Group’s tenure, Bibica’s financial performance remained relatively stable. In 2024, the company reported net revenue of VND 1,780.7 billion and pre-tax profit of VND 131.6 billion. For the first nine months of 2025, Bibica achieved VND 1,127 billion in revenue and VND 86.2 billion in pre-tax profit.

PAN Group’s decision to divest from Bibica was premeditated. On November 3, PAN’s Board of Directors approved the establishment of Bibica Capital, a wholly-owned subsidiary specializing in finance.

Bibica Capital has a registered capital of nearly VND 1,650 billion, funded entirely by PAN’s 18.4 million BBC shares. These shares were valued at VND 89,237 per share, based on the 30-day average trading price as of October 30, totaling over VND 1,640 billion. The creation of this new entity facilitated the divestment and transfer of Bibica to the Indonesian partner.